Over my career I have been involved in various types of mine studies, ranging from desktop conceptual to definitive feasibility. Each type of study has a different purpose and therefore requires a different level of input and effort, and can have hugely different costs.

I have sat in on a few junior mining management discussions regarding whether they should be doing a PEA or a Pre-Feasibility Study, or a Feasibility instead of a Pre-Feasibility Study. Everyone had their opinion on how to proceed based on their own reasoning. Ultimately there is no absolute correct answer but there likely is one path that is better than the others. It depends on the short term and long term objectives of the company, the quality and quantity of data on hand, and the funding available.

4 types of mining studies

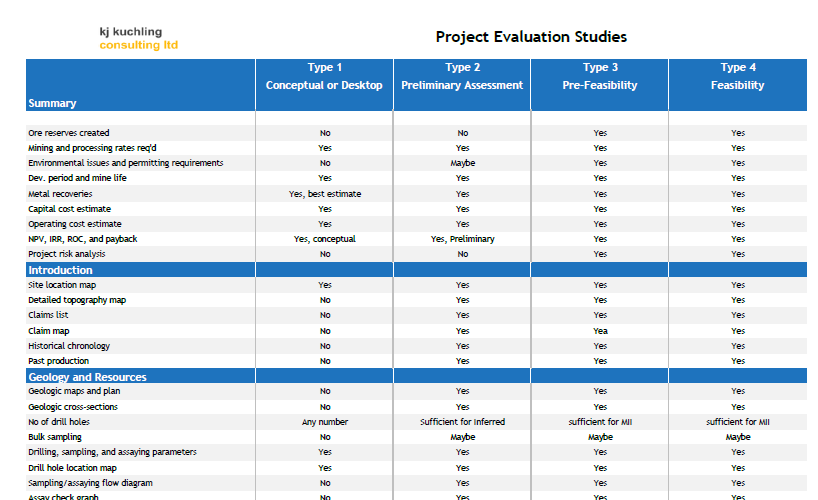

In general there are 4 basic levels of study, which are listed below. In this blog I am simply providing an overview of them. On the web there are detailed comparison tables, but anyone can contact me at KJKLTD@rogers.com for an a full copy of my table (an excerpt is shown below).

1. Desktop or Conceptual Mining Study

This would likely be an in-house study, non-43-101 compliant, and simply used to test the potential economics of the project. It lets management know where the project may go (see a previous blog at the link “Early Stage “What-if” Economic Analysis – How Useful Is It?”. I always recommend doing a desktop study, and preparing some type of small internal document to summarize it. It doesn’t take much time and is not made public so the inputs can be high level or simply guesses. This type of early stage study helps to frame the project for management and lets one test different scenarios.

2. Preliminary Economic Assessment (“PEA”)

The PEA (or scoping study) can be 43-101 compliant and present the first snapshot of the project scope, size, and potential economics to investors. Generally the resource may still be uncertain (inferred classification), capital and operating costs are approximate (+/- 40%) since not all the operational or environmental issues are known at this time. Avoid promoting the PEA as an “almost” feasibility level study.

Don’t Announce a PEA Until You Know the Outcome

I recommend not announcing the start of a PEA until you are confident in what the outcome of that PEA will be. A reasonable desktop study done beforehand will let a company know if the economics for the PEA will be favorable. I have seen situations where companies have announced the start of a PEA and then during the course of the study, things not working out economically as well as envisioned. The economics were poorer than hoped and so a lot of re-scoping of the project was required. The PEA was delayed, and shareholders & analysts negative suspicions were raised in the meantime.

The PEA can be used to evaluate different development scenarios for the project (i.e. open pit, underground, small capacity, large capacity, heap leach, CIL, etc.). However the accuracy of the PEA is limited and therefore I suggest that the PEA scenario analysis only be used to discard obvious sub-optimal cases. Scenarios that are economically within a +/-30% range of each other many be too similar to discard at this PEA stage. This is where the PFS comes into play.

3. Pre-Feasibility Study (“PFS”)

The PFS will be developed using only measured and indicated resources (no inferred resource used) so the available ore tonnage may decrease from a previous PEA study. The PFS costing accuracy will be greater than a PEA. Therefore the PFS is the proper time to evaluate the remaining mine development scenarios. Make a decision on the single path forward going into the Feasibility study.

Use the PFS to determine the FS case

More data will be required for the FS, possibly a comprehensive infill drilling program to upgrade more of the the resource classification from inferred to indicated. Many companies, especially those with smaller projects might skip the PFS stage entirely and move directly to Feasibility. I don’t disagree with this approach if the project is fairly simple and had a well defined scope at the PEA stage.

4. Feasibility Study (“FS”)

The Feasibility Study is the final stage study prior to making a production decision. The feasibility study should preferably be done on a single project scope. Try to avoid more scenario option analysis at this stage.

Smaller companies should be careful when entering the FS stage. Once the FS is complete, shareholders will be expecting a production decision. If the company only intends to sell the project with no construction intention, they have now hit a wall. What to do next?

Sometimes management feel that a FS may help sell the project.

I don’t feel that a FS is needed to attract buyers and sell a project. Many potential buyers will do their own in-house due diligence, and possibly some alternate design and economic studies. Likely information from a PFS would be sufficient to give them what they need. A well advanced Environmental-Socio Impact Assessment may provide more comfort than a completed Feasibility Study would.

Conclusion

I didn’t know that the feasibility study is the final stage before making a production decision. I thought that it would be one of the first stages. I’m glad I found this article before I tried doing anything on my own. I think I’ll hire a professional service to help me out.

You are correct, the FS is essentially the last study done. Some may refer to it as Definitive Feasibility Study or Bankable Feasibility Study, but they are all essentially the same thing.