Typically gold mines consist of either a heap leach (HL) operation or a CIL type plant. There are a few projects that operate (or are considering) concurrent heap leach and CIL operations. Ultimately the mineral resource distribution determines if it makes economic sense to have both. This blog discusses this concept based on past experience.

A CIL operation has higher capital and operating costs than a heap leach. However that higher cost is offset by achieving improved gold recovery, perhaps 20-30% higher. At higher gold prices or head grades, the economic benefit from improved CIL recovery can exceed the additional cost incurred to achieve that recovery.

Some background

Several years ago I was VP Engineering for a Vancouver based junior miner (Oromin Expl) who had a gold project in Senegal. We were in the doldrums of Stage 3 of the Lassonde Curve (read this blog to learn what I mean) having completed our advanced studies. Our timeline was as follows.

Initially in August 2009 we completed a Pre-Feasibility Study for a standalone CIL operation. Subsequently in June 2010 we completed a Feasibility Study. The technical aspects of Stage 2 were done and we were entering Stage 3. Now what do we do? Build or wait for a sale?

The property’s next door neighbor was the Teranga Sabodala operation. It made sense for Teranga to acquire our project to increase their long term reserves. It also made sense for a third party to acquire both of us. The Feasibility Study also made the economic case to go it alone and build a mine.

While waiting for various third-party due diligences to be completed, the company continue to do exploration drilling. There were still a lot of untested showings on the property and geologists need to stay busy.

While waiting for various third-party due diligences to be completed, the company continue to do exploration drilling. There were still a lot of untested showings on the property and geologists need to stay busy.

Two years later in 2013 we completed an update to the CIL Feasibility Study based on an updated resource model. Concurrently our geologists had identified seven lower grade deposits that were not considered in the Feasibility Study.

These deposits had gold grades in the range of 0.5 to 0.7 g/t compared to 2.0 g/t for the deposits in the CIL Feasibility Study. We therefore decided to also complete a Heap Leach PEA in 2013, looking solely on the lower grade deposits.

These HL deposits were 2-8 km from the proposed CIL plant so their ore could be shipped to the CIL plant if it made economic sense. Test work had indicated that heap leach recoveries could be in the range of 70% versus >90% with a CIL circuit. The gold price at that time was about $ 1,100/oz.

Ultimately our project was acquired by Teranga in the middle of 2013.

Where should the ore go?

With regards to the Heap Leach PEA, we did not wish to complicate the Feasibility Study by adding a new feed supply to that plant from mixed CIL/HL pits. The heap leach project was therefore considered as a separate satellite operation.

With regards to the Heap Leach PEA, we did not wish to complicate the Feasibility Study by adding a new feed supply to that plant from mixed CIL/HL pits. The heap leach project was therefore considered as a separate satellite operation.

The assumption was that all of the low grade pit ore would go only to the heap leach facility. However, in the back of our minds we knew that perhaps higher grade portions of those deposits might warrant trucking to the CIL plant.

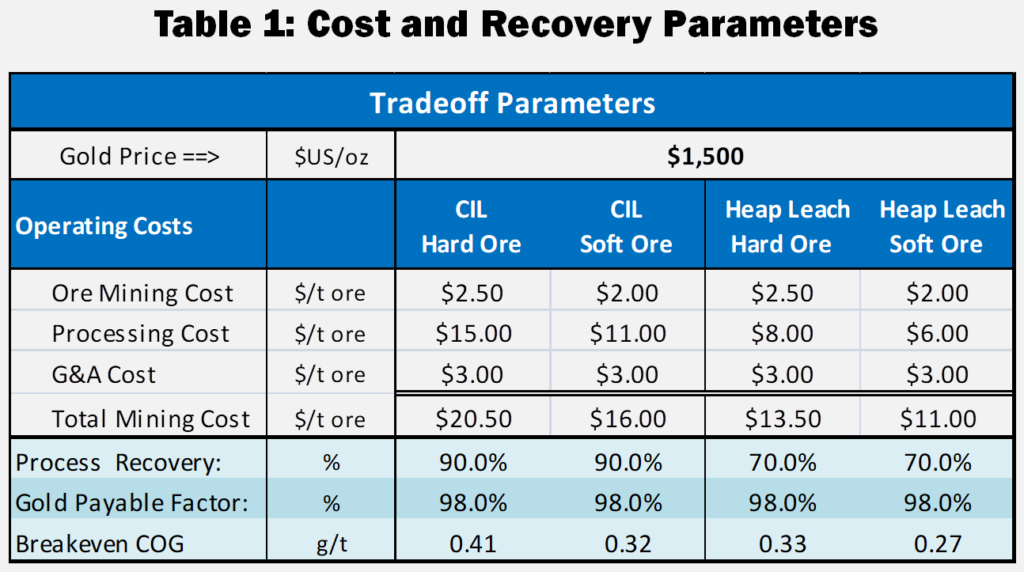

For internal purposes, we started to look at some destination trade-off analyses. We considered both hard (fresh rock) and soft ore (saprolite) separately. CIL operating costs associated with soft ore would be lower than for hard ore. Blasting wasn’t required and less grinding energy is needed. The CIL plant throughput rate could be 30-50% higher with soft ore than with hard ore, depending on the blend.

I have updated and simplified the trade-off analysis for this blog. Table 1 provides the costs and recoveries used herein, including increasing the gold price to $1500/oz.

I have updated and simplified the trade-off analysis for this blog. Table 1 provides the costs and recoveries used herein, including increasing the gold price to $1500/oz.

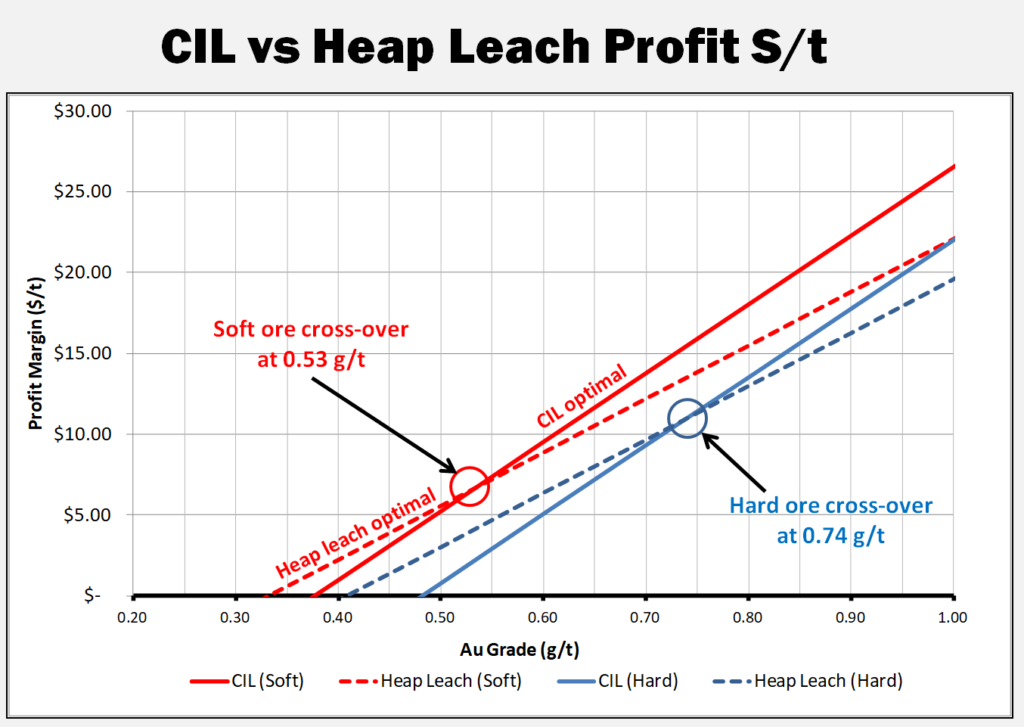

The graph shows the profit per tonne for CIL versus HL processing methods for different head grades.

The cross-over point is the head grade where profit is better for CIL than Heap Leach. For soft ore, this cross-over point is 0.53 g/t. For hard ore, this cross over point is at 0.74 g/t.

The cross-over point will be contingent on the gold price used, so a series of sensitivity analyses were run.

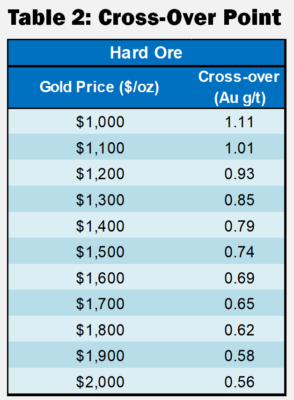

The typical result, for hard ore, is shown in Table 2. As the gold price increases, the HL to CIL cross-over grade decreases.

These cross-over points described in Table 2 are relevant only for the costs shown in Table 1 and will be different for each project.

These cross-over points described in Table 2 are relevant only for the costs shown in Table 1 and will be different for each project.

Conclusion

Mining is akin to petroleum E & P, except that there is more data and more analysis before drilling the first hole, followed by more data and more analysis before embarking on the development and everything is shaped by probabilities and economics. And the main thing is always to be able to justify the development concept, without resorting to “this is normally what we do ….” Bravo ! Good article