There are not many things that are novel to me after having worked in the mining industry for almost 40 years. However recently I came across a mining technology that I had heard very little about. It’s actually not something new, but it has never been mentioned as a materials handling option on any project that I am aware of.

That innovative technology is vertical conveying. Not long ago I read about a vertical conveyor being used at the Fresnillo underground mine, hoisting 200 tph up from a depth of 400 metres and had a capital cost of $12.7 million.

I was aware of steep angle conveyors being used in process plants. However they tended to be of limited height and have idlers and hardware along their entire length. Vertical conveyors are different from that.

After doing a bit of research, I discovered that vertical conveyors have been used since the 1970’s. Their application was mainly in civil projects; for example in subway construction where one must elevate rock from the excavation level up to street level. The mining industry is taking vertical conveyors to the next level.

I have never personally worked with vertical conveyors. Therefore I am providing this discussion based on vendor information. My goal is to create awareness to readers so that they might consider its application for their own projects.

How vertical conveying works

The background information on vertical conveying was provided to me by FKC-Lake Shore, a construction contractor that installs these systems. FKC itself does not fabricate the conveyor hardware. A link to their website is here.

The background information on vertical conveying was provided to me by FKC-Lake Shore, a construction contractor that installs these systems. FKC itself does not fabricate the conveyor hardware. A link to their website is here.

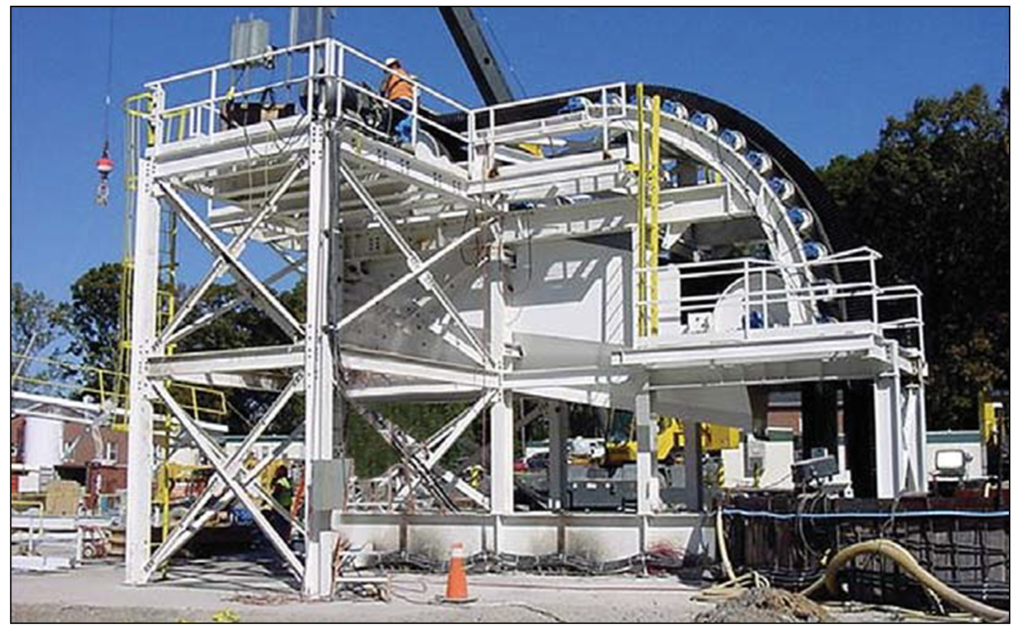

The head station and tail station assemblies are installed at the top and bottom of a shaft. The conveyor belt simply hangs in the shaft between these two points. There is no need for internal guides or hardware down the shaft. The conveyor belting relies on embedded steel cables for tensile strength and pockets (or cells) to carry the material.

The Pocketlift conveyor system is based on the Flexowell technology. This has been advanced for deep underground applications with a theoretical lift height of 700 metres in one stage. The power transfer is achieved by two steel cord belts that are connected with rigid cross bars. The ore is fed into rubber pockets, which are bolted onto the cross bars. The standard Pocketlift can reaches capacities up to 1,500 m3/h and lift heights up to 700 m, while new generations of the technology may achieve capacities up to 4,000 m3/h.

The FLEXOWELL®-conveyor system is capable of running both horizontally and vertically, or any angle in between. These conveyors consist of FLEXOWELL®-conveyor belts comprised of 3 components: (i) Cross-rigid belt with steel cord reinforcement; (ii) Corrugated rubber sidewalls; (iii) transverse cleats to prevent material from sliding backwards. They can handle lump sizes varying from powdery material up to 400 mm (16 inch). Material can be raised over 500 metres with reported capacities up to 6,000 tph.

The FLEXOWELL®-conveyor system is capable of running both horizontally and vertically, or any angle in between. These conveyors consist of FLEXOWELL®-conveyor belts comprised of 3 components: (i) Cross-rigid belt with steel cord reinforcement; (ii) Corrugated rubber sidewalls; (iii) transverse cleats to prevent material from sliding backwards. They can handle lump sizes varying from powdery material up to 400 mm (16 inch). Material can be raised over 500 metres with reported capacities up to 6,000 tph.

The benefits of vertical conveying

Vendors have evaluated the use of vertical conveying against the use of a conventional vertical shaft hoisting. They report the economic benefits for vertical conveying will be in both capital and operating costs.

Vendors have evaluated the use of vertical conveying against the use of a conventional vertical shaft hoisting. They report the economic benefits for vertical conveying will be in both capital and operating costs.

Reduced initial capital cost due to:

-

Smaller shaft excavation diameter,

-

Reduced cost of structural supports vs a typical shaft headframe,

-

Structural supports are necessary only in the loading and unloading zones and no support structures in the shaft itself since the belt hangs free.

Lower operating costs due to:

-

Significantly reduced power consumption and peak power demand,

-

Lower overall maintenance costs,

-

No shaft inspections required,

-

The belt is replaced every 8 – 10 years.

Conclusion

The vendors indicate the conveying system should be able to achieve heights of 700 metres. This may facilitate the use of internal shafts (winzes) to hoist ore from even greater depths in an expanding underground mine. It may be worth a look at your mine.

The vendors indicate the conveying system should be able to achieve heights of 700 metres. This may facilitate the use of internal shafts (winzes) to hoist ore from even greater depths in an expanding underground mine. It may be worth a look at your mine.

Based on my own career, mining has definitely provided me with a chance to travel the world. It will also help anyone overcome their fear of travel. One will also learn that both international and domestic travel can be as equally rewarding. There is nothing wrong with learning more about your own country.

Based on my own career, mining has definitely provided me with a chance to travel the world. It will also help anyone overcome their fear of travel. One will also learn that both international and domestic travel can be as equally rewarding. There is nothing wrong with learning more about your own country.

Business travel has always been one of the best parts of my mining career. I can remember the details about a lot of the travel that I did. Unfortunately the project details themselves will blur with those of other projects.

Business travel has always been one of the best parts of my mining career. I can remember the details about a lot of the travel that I did. Unfortunately the project details themselves will blur with those of other projects.

While waiting for various third-party due diligences to be completed, the company continue to do exploration drilling. There were still a lot of untested showings on the property and geologists need to stay busy.

While waiting for various third-party due diligences to be completed, the company continue to do exploration drilling. There were still a lot of untested showings on the property and geologists need to stay busy. With regards to the Heap Leach PEA, we did not wish to complicate the Feasibility Study by adding a new feed supply to that plant from mixed CIL/HL pits. The heap leach project was therefore considered as a separate satellite operation.

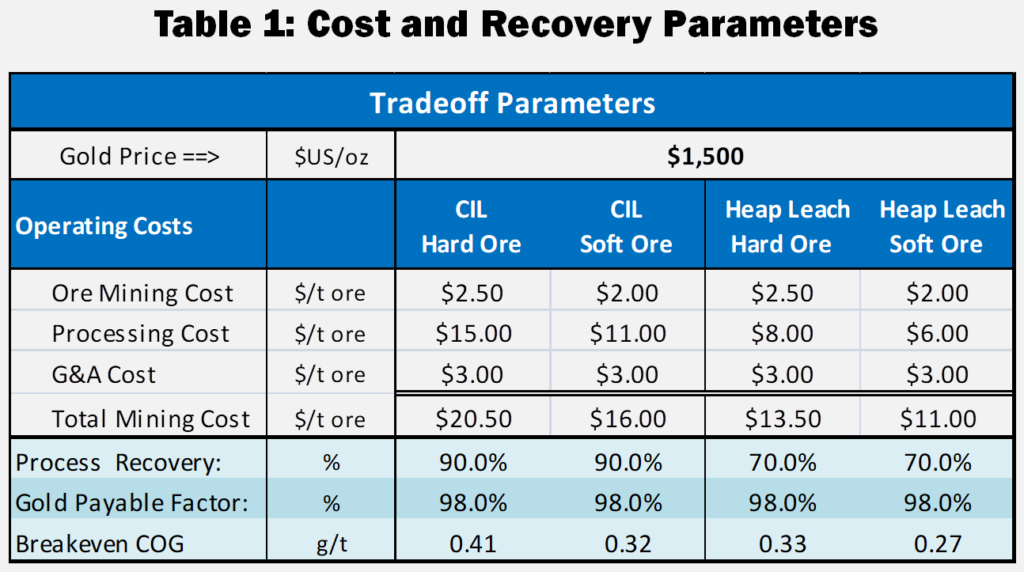

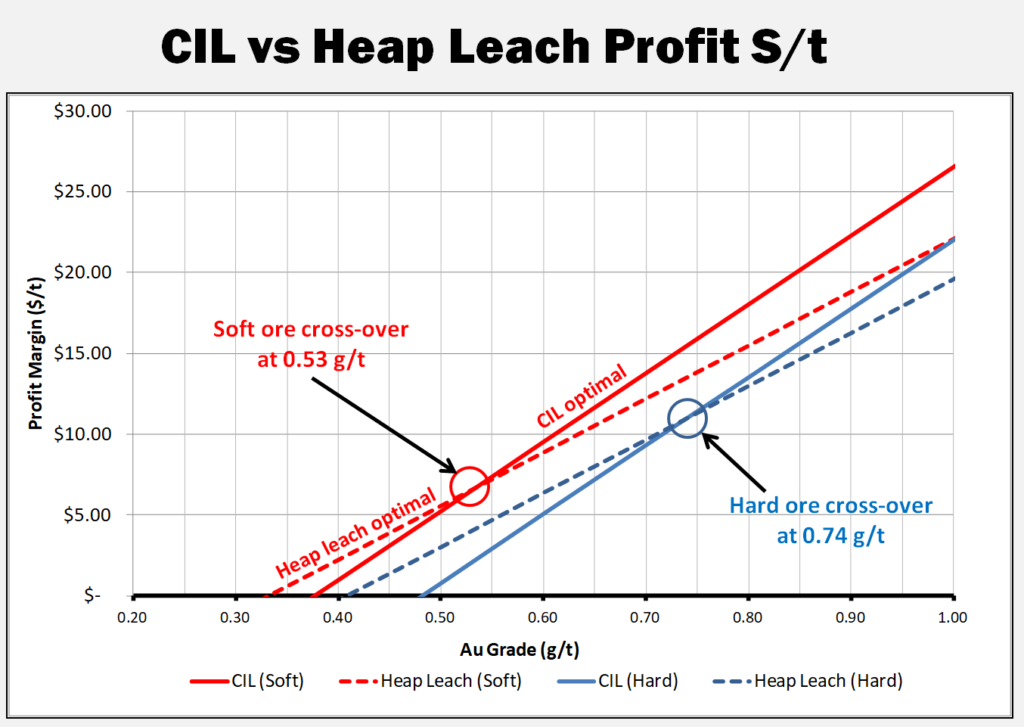

With regards to the Heap Leach PEA, we did not wish to complicate the Feasibility Study by adding a new feed supply to that plant from mixed CIL/HL pits. The heap leach project was therefore considered as a separate satellite operation. I have updated and simplified the trade-off analysis for this blog. Table 1 provides the costs and recoveries used herein, including increasing the gold price to $1500/oz.

I have updated and simplified the trade-off analysis for this blog. Table 1 provides the costs and recoveries used herein, including increasing the gold price to $1500/oz. These cross-over points described in Table 2 are relevant only for the costs shown in Table 1 and will be different for each project.

These cross-over points described in Table 2 are relevant only for the costs shown in Table 1 and will be different for each project.

Normally I don’t write about mining stock markets, preferring instead to focus on technical matters. However I have seen some recent discussions on Twitter about stock price trends. For every stock there are a wide range of price expectations. Ultimately some of the expectations and realizations can be linked back to the Lassonde Curve.

Normally I don’t write about mining stock markets, preferring instead to focus on technical matters. However I have seen some recent discussions on Twitter about stock price trends. For every stock there are a wide range of price expectations. Ultimately some of the expectations and realizations can be linked back to the Lassonde Curve.

Stage 5 is the start-up and commercial production period, possibly nerve-racking for some investors. This is where the rubber hits the road. The stock price can fall if milled grades, operating costs, or production rates are not as expected.

Stage 5 is the start-up and commercial production period, possibly nerve-racking for some investors. This is where the rubber hits the road. The stock price can fall if milled grades, operating costs, or production rates are not as expected. Some corporate presentations will highlight the Lassonde Curve, particularly when they are rising in Stage 1. You are less likely to see the curve presented when they are rolling along in Stages 2 or 3.

Some corporate presentations will highlight the Lassonde Curve, particularly when they are rising in Stage 1. You are less likely to see the curve presented when they are rolling along in Stages 2 or 3.

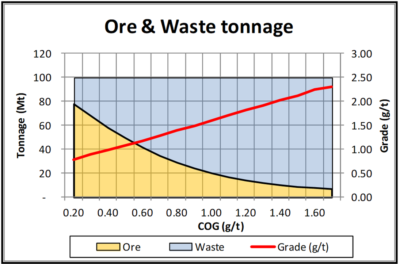

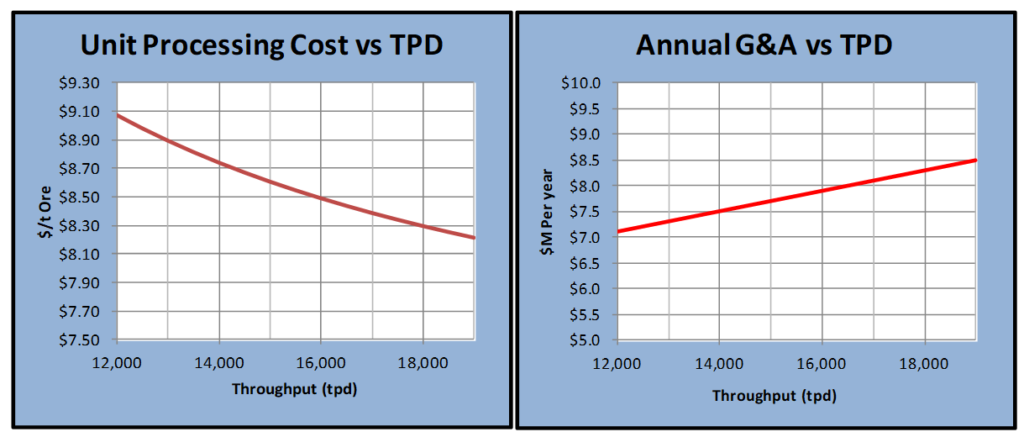

I had a grade tonnage curve, including the tonnes of ore and waste, for a designed pit. This data is shown graphically on the right. Essentially the mineable reserve is 62 Mt @ 0.94 g/t Pd with a strip ratio of 0.6 at a breakeven cutoff grade of 0.35 g/t. It’s a large tonnage, low strip ratio, and low grade deposit. The total pit tonnage is 100 Mt of combined ore and waste.

I had a grade tonnage curve, including the tonnes of ore and waste, for a designed pit. This data is shown graphically on the right. Essentially the mineable reserve is 62 Mt @ 0.94 g/t Pd with a strip ratio of 0.6 at a breakeven cutoff grade of 0.35 g/t. It’s a large tonnage, low strip ratio, and low grade deposit. The total pit tonnage is 100 Mt of combined ore and waste.

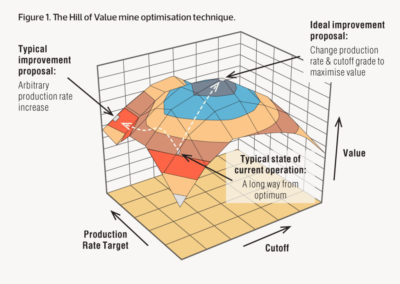

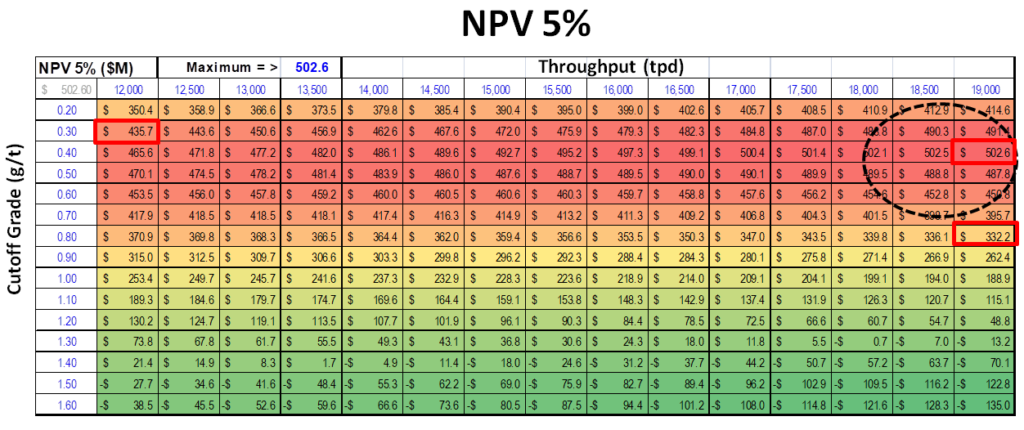

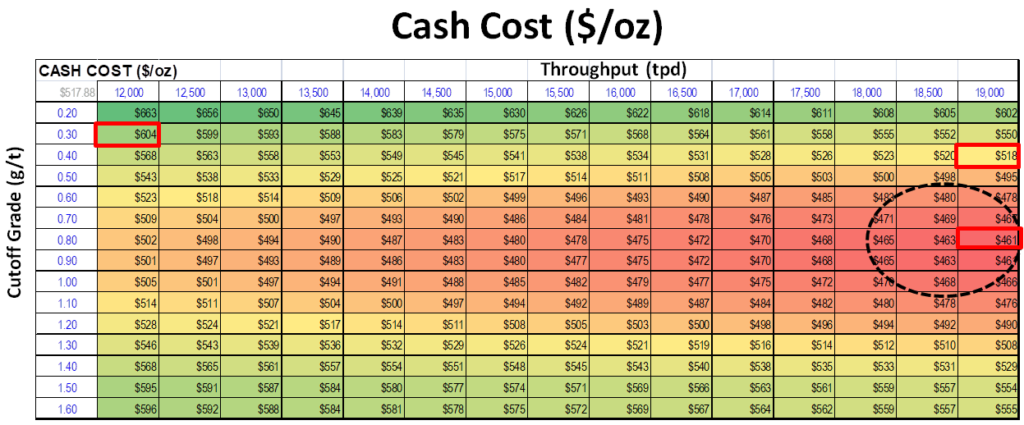

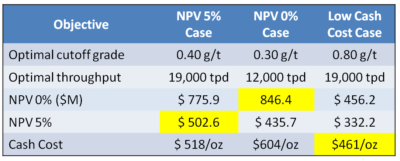

The Hill of Value is an interesting optimization concept to apply to a project. In the example I have provided, the optimal project varies depending on what the financial objective is. I don’t know if this would be the case with all projects, however I suspect so.

The Hill of Value is an interesting optimization concept to apply to a project. In the example I have provided, the optimal project varies depending on what the financial objective is. I don’t know if this would be the case with all projects, however I suspect so.

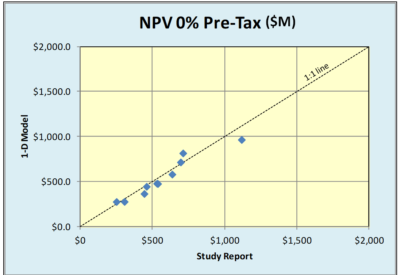

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model.

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model. There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

Perhaps with technology, like Zoom, one can replicate the personal feel of a trade show booth. One can still have back and forth conversations with investors rather than just doing lecture style webinars.

Perhaps with technology, like Zoom, one can replicate the personal feel of a trade show booth. One can still have back and forth conversations with investors rather than just doing lecture style webinars. Management teams should introduce more than just the CEO or COO. Include VP’s of geology, engineering, corporate development, from time to time. Don’t hesitate to let the public meet more of your team. Trade show booths are often manned by different team members.

Management teams should introduce more than just the CEO or COO. Include VP’s of geology, engineering, corporate development, from time to time. Don’t hesitate to let the public meet more of your team. Trade show booths are often manned by different team members. Better communication with investors can increase confidence in a management team. Although some investors may not enjoy technical discussions, I think there is a subset that will find them very helpful and interesting. There will likely be an audience out there.

Better communication with investors can increase confidence in a management team. Although some investors may not enjoy technical discussions, I think there is a subset that will find them very helpful and interesting. There will likely be an audience out there. As an aside, if you are using Zoom make sure the host has configured the right settings. There are instances where anonymous participants can suddenly share their own computer screen, i.e. with questionable videos, to the group. It’s been referred to as “zoom bombing”.

As an aside, if you are using Zoom make sure the host has configured the right settings. There are instances where anonymous participants can suddenly share their own computer screen, i.e. with questionable videos, to the group. It’s been referred to as “zoom bombing”.

The number of independent mining consultants is increasing daily as more people reach retirement age or are made redundant.

The number of independent mining consultants is increasing daily as more people reach retirement age or are made redundant. GLG (

GLG ( Digbee (

Digbee (

We often see junior mining companies benchmarking themselves against others. Sometimes corporate presentations provide graphs of enterprise value per gold ounce to demonstrate that a company might be undervalued.

We often see junior mining companies benchmarking themselves against others. Sometimes corporate presentations provide graphs of enterprise value per gold ounce to demonstrate that a company might be undervalued. Lenders may have observers at site monitoring both construction progress and cash expenditures. Shareholders and analysts are watching for news releases that update the capital spending. Their concern is well founded due to several significant cost over-run instances.

Lenders may have observers at site monitoring both construction progress and cash expenditures. Shareholders and analysts are watching for news releases that update the capital spending. Their concern is well founded due to several significant cost over-run instances. It would be a good thing if the mining industry (or other concerned parties) work together to create open source project databases. These would incorporate summary information and cost information for global mining projects. The information is already out there, it just needs to be compiled.

It would be a good thing if the mining industry (or other concerned parties) work together to create open source project databases. These would incorporate summary information and cost information for global mining projects. The information is already out there, it just needs to be compiled. Benchmarking can be a great tool when done correctly. Benchmarking capital costs might bring more transparency to the project development process. It may help convince nervous investors that the proposed costs are reasonable.

Benchmarking can be a great tool when done correctly. Benchmarking capital costs might bring more transparency to the project development process. It may help convince nervous investors that the proposed costs are reasonable.

Reading it further, it was apparent that their study consultant, Ausenco, was being paid in company stock in lieu of cash. The arrangement included an initial financing of $750k with a further $375k to follow once the pre-feasibility study was 75% complete. Upon completion of the study another share payment was due.

Reading it further, it was apparent that their study consultant, Ausenco, was being paid in company stock in lieu of cash. The arrangement included an initial financing of $750k with a further $375k to follow once the pre-feasibility study was 75% complete. Upon completion of the study another share payment was due. I have never been in a situation where I was consulting with company shares as my compensation. Neither have I ever managed a study where outside consultants were being paid in shares. However I can see the possibility of interesting dynamics at play.

I have never been in a situation where I was consulting with company shares as my compensation. Neither have I ever managed a study where outside consultants were being paid in shares. However I can see the possibility of interesting dynamics at play. Regarding the first item “impartiality”, in the past there have been questions raised about the impartiality of engineering firms. I first recall reading this claim many years ago in a public response to a mining EIA application. Unfortunately I cannot find the exact source now.

Regarding the first item “impartiality”, in the past there have been questions raised about the impartiality of engineering firms. I first recall reading this claim many years ago in a public response to a mining EIA application. Unfortunately I cannot find the exact source now. It would be interesting to know how many consulting firms would be willing to accept compensation solely in shares. Stock prices move up and down and the outcome of the study itself can have an impact on share performance.

It would be interesting to know how many consulting firms would be willing to accept compensation solely in shares. Stock prices move up and down and the outcome of the study itself can have an impact on share performance.