A few years ago I posted an article about how I use a simple (one-dimensional) financial model to help me take a very quick look at mining projects. The link to that blog is here. I use this simple 1D model with clients that are looking at potential acquisitions or joint venture opportunities at early stages. In many instances the problem is that there is only a resource estimate but no engineering study or production schedule available.

By referring to my model as a 1D model, I imply that I don’t use a mine production schedule across the page like a conventional cashflow model would.

The 1D model simply uses life-of-mine reserves, life-of-mine revenues, operating costs, and capital costs. It’s essentially all done in a single column. The 1D model also incorporates a very rudimentary tax calculation to ballpark an after-tax NPV.

The 1D model does not calculate payback period or IRR but focuses solely on NPV. NPV, for me, is the driver of the enterprise value of a project or a company. A project with a $100M NPV has that value regardless of whether the IRR is 15% or 30%.

How accurate is a 1D model?

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model.

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model.

It takes about 10 minutes to find the relevant data in the technical report and insert the numbers. Interestingly it is typically easy to find the data in reports authored by certain consultants. In other reports one must dig deeper to get the data and sometimes even can’t find it.

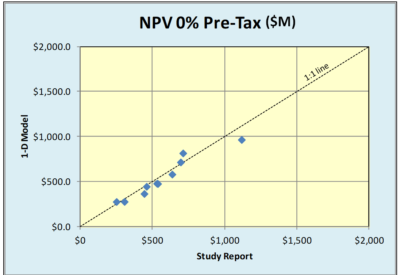

The results of the comparison are show in the scatter plots. The bottom x-axis is the 43-101 report NPV and the y-axis is the 1D model result. The 1:1 correlation line is shown on the plots.

There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

Where the 1D model can run into difficulty is when a project has a production expansion after a few years. The 1D model logic assumes a uniform annual production rate for the life of mine reserve.

Another thing that hampers the 1D model is when a project uses low grade stockpiling to boost head grades early in the mine life. The 1D model assumes a uniform life-of-mine production reserve grade profile.

Nevertheless even with these limitations, the NPV results are reasonably representative. Staged plant expansions and high grading are usually modifications to an NPV and generally do not make or break a project.

Conclusion

Linkedin brought me to your profile and thus your website. Enjoyed learning.

Hi Ken,

can you share me with the 1D cashflow model in excel format please?

I am new and learning in this industry.

thank you

I don’t share my ID model since it is a bit more complex and one needs to understand how I input the logic. However it wouldn’t take someone long to build their own model, which is important in understanding the logic of the calculations. I always recommend building you own model instead of using someone else’s.