In my view one thing lacking in the mining industry today is a consistent approach to quantifying and presenting the risks associated with mining projects. In a blog written in 2015 titled “Mining Cashflow Sensitivity Analyses – Be Careful” I discussed the limitations of the standard “spider graph” sensitivity analysis often seen in Section 22 of 43-101 reports.

This blog post expands on that discussion by describing a better approach. A six-year time gap between the two articles – no need to rush I guess.

This blog summarizes excerpts from an article written by a colleague that specializes in probabilistic financial analysis. That article is a result of conversations we had about the current methods of addressing risk in mining. The full article can be found at this link, however selected excerpts and graphs have been reprinted here with permission from the author.

The author is Lachlan Hughson, the Founder of 4-D Resources Advisory LLC. He has a 30-year career in the mining/metals and oil gas industry as an investment banker and a corporate executive. His website is here 4-D Resources Advisory LLC.

Excerpts from the article

Mining can be risky

“The natural resources industry, especially the finance function, tends to use a static, or single data estimate, approach to its planning, valuation and M&A models. This often fails to capture the dynamic interrelationships between the strategic, operational and financial variables of the business, especially commodity price volatility, over time.”

“A comprehensive financial model should correctly reflect the dynamic interplay of these fundamental variables over the company life and commodity price cycles. This requires enhancing the quality of key input variables and quantitatively defining how they interrelate and change depending on the strategy, operational focus and capital structure utilized by the company.”

“Given these critical limitations, a static modeling approach fundamentally reduces the decision making power of the results generated leading to unbalanced views as to the actual probabilities associated with expected outcomes. Equally, it creates an over-confident belief as to outcomes and eliminates the potential optionality of different courses of action as real options cannot be fully evaluated.”

Monte Carlo can be risky

“Fortunately, there is another financial modeling method – using Monte Carlo simulation – which generates more meaningful output data to enhance the company’s decision making process.”

Monte Carlo simulation is not new. For example @RISK has been available as an easy to use Excel add-in for decades. Crystal Ball does much the same thing.

“Dynamic, or probabilistic, modeling allows for far greater flexibility of input variables and their correlation, so they better reflect the operating reality, while generating an output which provides more insight than single data estimates of the output variable.”

“The dynamic approach gives the user an understanding of the likely output range (presented as a normal distribution here) and the probabilities associated with a particular output value. The static approach is relatively “random” as it is based on input assumptions that are often subject to biases and a poor understanding of their potential range vs. reality (i.e. +/- 10%, 20% vs. historical or projected data range).”

“In the case of a dynamic model, there is less scope for the biases (compensation, optionality, historic perspective, desire for optimal transaction outcome) that often impact the static, single data estimates modeling process. Additionally, it imposes a fiscal discipline on management as there is less scope to manipulate input data for desired outcomes (i.e. strategic misrepresentation), especially where strong correlations to historical data exist.”

“It encourages management to consider the likely range of outcomes, and probabilities and options, rather than being bound to/driven by achieving a specific outcome with no known probability. Equally, it introduces an “option” mindset to recognize and value real options as a key way to maintain/enhance company momentum over time.”

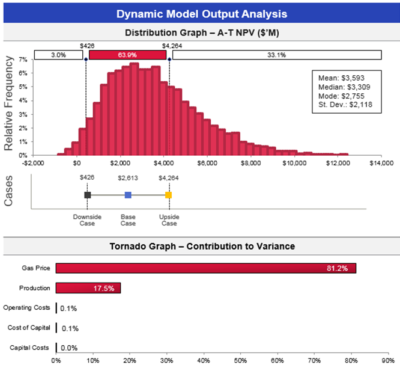

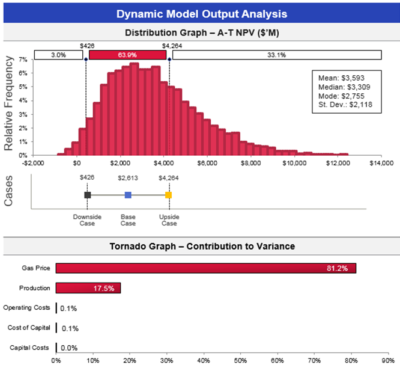

Image from the 4-D Resources article

“In the simple example (to the right), the financial model was more real-world through using input variables and correlation assumptions that reflect historical and projected reality rather than single data estimates that tend towards the most expected value.”

“Additionally, the output data provide greater insight into the variability of outcomes than the static model Downside, Base and Upside cases’ single data estimates did.”

The tornado diagram, shown below the histogram, essentially is another representation of the spider diagram information. ie.e which factors have the biggest impact.

“The dynamic data also facilitated the real option value of the asset in a manner a static model cannot. And the model took less time to build, with less internal relationships to create to make the output trustworthy, given input variables and correlation were set using the @RISK software options. This dynamic modeling approach can be used for all types of financial models.”

To read the full article, follow this link.

Conclusion

image from 4-D Resources article

Improvements are needed in the way risks are evaluated and explained to mining stakeholders. Improvements are required given increasing complexity in the risks impacting on decision making.

The probabilistic risk evaluation approach described above isn’t new and isn’t that complicated. In fact, it can be very intuitive when undertaken properly.

Probabilistic risk analysis isn’t something that should only be done within the inner sanctums of large mining companies. The approach should filter down to all mining studies and 43-101 reports.

It should ultimately become a best practice or standard part of all mining project economic analyses. The more often the approach is applied, the sooner people will become familiar (and comfortable) with it.

Mining projects can be risky, as demonstrated by the numerous ventures that have derailed. Yet recognition of this risk never seems to be brought to light beforehand.

Essentially all mining projects look the same to outsiders from a risk perspective, when in reality they are not. The mining industry should try to get better in explaining this.

Management understandably have a difficult task in making go/no-go decisions. Financial institutions have similar dilemmas when deciding on whether or not to finance a project. You can read that blog post at this link “Flawed Mining Projects – No Such Thing as Perfection“

Note: You can sign up for the KJK mailing list to get notified when new blogs are posted. Follow me on Twitter at @KJKLtd for updates.

So, you just completed your initial PEA cashflow model and the resulting NPV and IRR are a little disappointing. They are not what everyone was expecting. They don’t meet the ideal targets of an IRR greater than 30% and an NPV that is more than 2x the initial capital cost. The project could now be on life support in the eyes of some.

So, you just completed your initial PEA cashflow model and the resulting NPV and IRR are a little disappointing. They are not what everyone was expecting. They don’t meet the ideal targets of an IRR greater than 30% and an NPV that is more than 2x the initial capital cost. The project could now be on life support in the eyes of some. The discounting of cashflows in a cashflow model means that up-front revenues and costs have a bigger impact on the final economics than those far off in the future. This effect is amplified at higher discount rates.

The discounting of cashflows in a cashflow model means that up-front revenues and costs have a bigger impact on the final economics than those far off in the future. This effect is amplified at higher discount rates. ake to the cashflow model. Sometimes several of the small ones, when compounded together, will result in a significant impact. Here are some of the other cashflow model adjustments that I have seen.

ake to the cashflow model. Sometimes several of the small ones, when compounded together, will result in a significant impact. Here are some of the other cashflow model adjustments that I have seen.

Don’t let a disappointing NPV get you down. There may be a few ways to boost the NPV by applying some common practices. However, if after applying all of these adjustments, the NPV still isn’t great, something bigger may be required. That could be an entire project scope re-think.

Don’t let a disappointing NPV get you down. There may be a few ways to boost the NPV by applying some common practices. However, if after applying all of these adjustments, the NPV still isn’t great, something bigger may be required. That could be an entire project scope re-think.

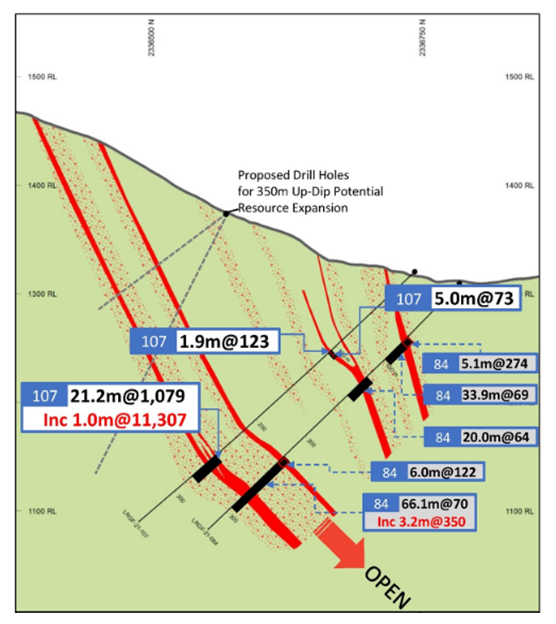

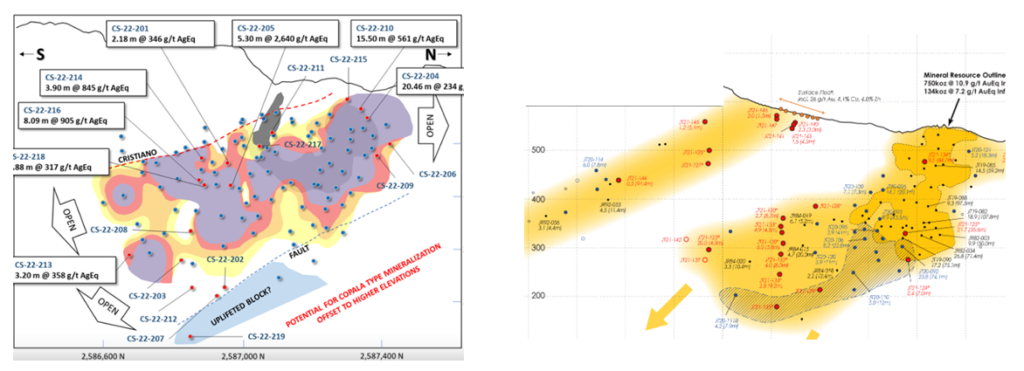

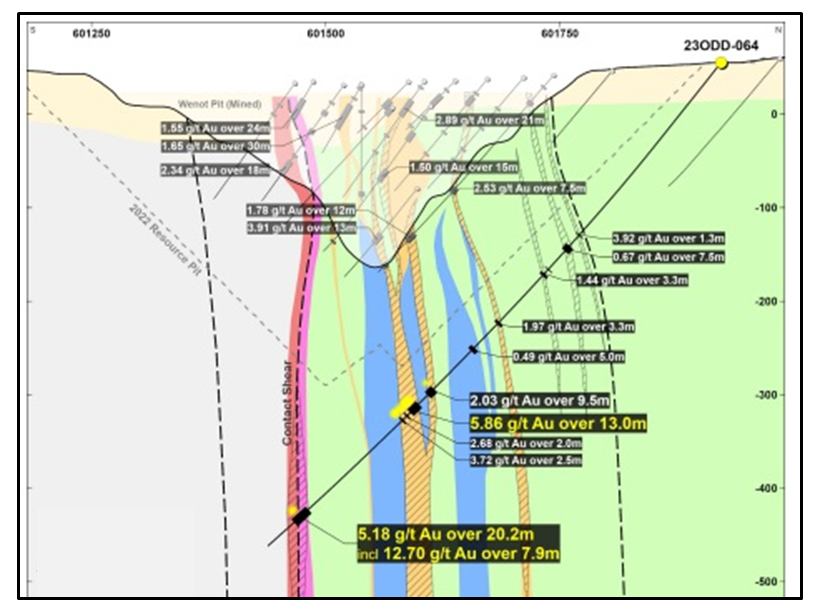

This article is about the benefit of preparing (cutting) more geological cross-sections and the value they bring.

This article is about the benefit of preparing (cutting) more geological cross-sections and the value they bring. Long sections are aligned along the long axis of the deposit. They can be vertically oriented, although sometimes they may be tilted to follow the dip angle of an ore zone.

Long sections are aligned along the long axis of the deposit. They can be vertically oriented, although sometimes they may be tilted to follow the dip angle of an ore zone. Cross-sections are generally the most popular geological sections seen in presentations. These are vertical slices aligned perpendicular to the strike of the orebody. They can show the ore zone interpretation, drill holes traces, assays, rock types, and/or color-coded resource block grades.

Cross-sections are generally the most popular geological sections seen in presentations. These are vertical slices aligned perpendicular to the strike of the orebody. They can show the ore zone interpretation, drill holes traces, assays, rock types, and/or color-coded resource block grades. When looking at cross-sections, it is always important to look at multiple cross-sections across the orebody. Too often in reports one may be presented with the widest and juiciest ore zone, as if that was typical for the entire orebody. It likely is not typical.

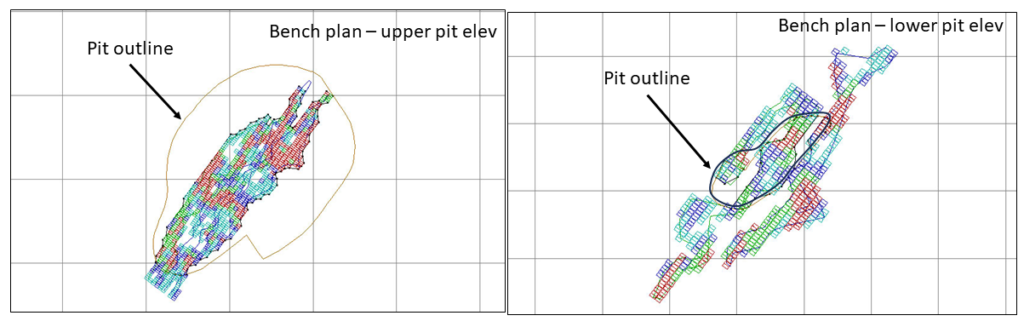

When looking at cross-sections, it is always important to look at multiple cross-sections across the orebody. Too often in reports one may be presented with the widest and juiciest ore zone, as if that was typical for the entire orebody. It likely is not typical. Bench plans (or level plans) are horizontal slices across the ore body at various elevations. In these sections one is looking down on the orebody from above.

Bench plans (or level plans) are horizontal slices across the ore body at various elevations. In these sections one is looking down on the orebody from above. 3D PDF files can be created by some of the geological software packages. They can export specific data of interest; for example topography, ore zone wireframes, underground workings, and block model information. These 3D files allows anyone to rotate an image, zoom in as needed and turn layers off and on.

3D PDF files can be created by some of the geological software packages. They can export specific data of interest; for example topography, ore zone wireframes, underground workings, and block model information. These 3D files allows anyone to rotate an image, zoom in as needed and turn layers off and on. The different types of geological sections all provide useful information. Don’t focus only on cross-sections, and don’t focus only on one typical section. Create more sections at different orientations to help everyone understand better.

The different types of geological sections all provide useful information. Don’t focus only on cross-sections, and don’t focus only on one typical section. Create more sections at different orientations to help everyone understand better.

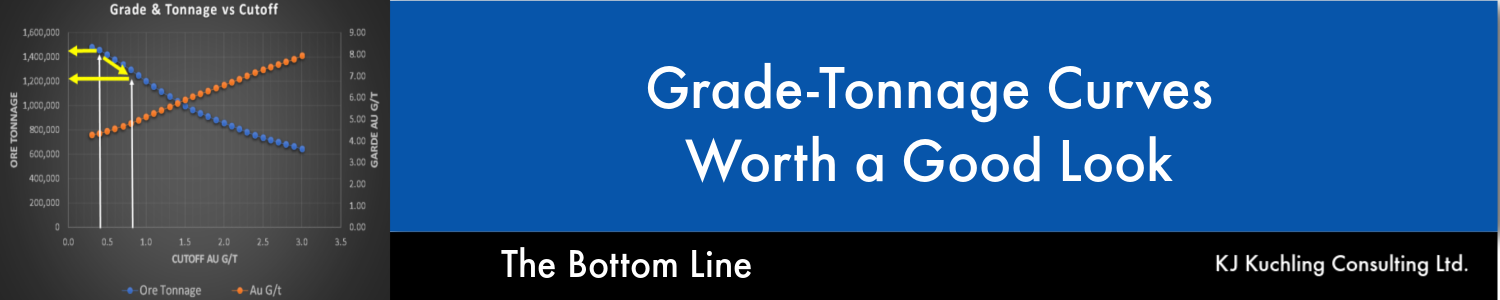

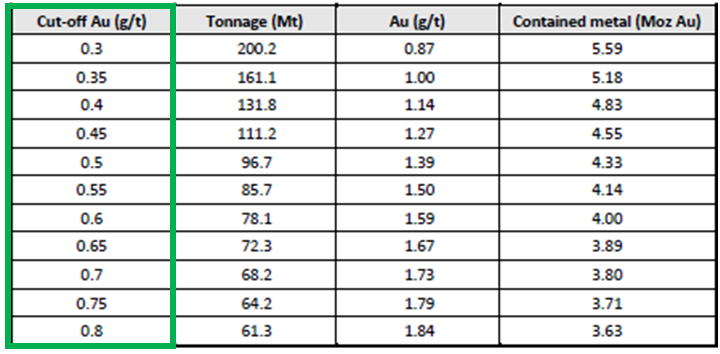

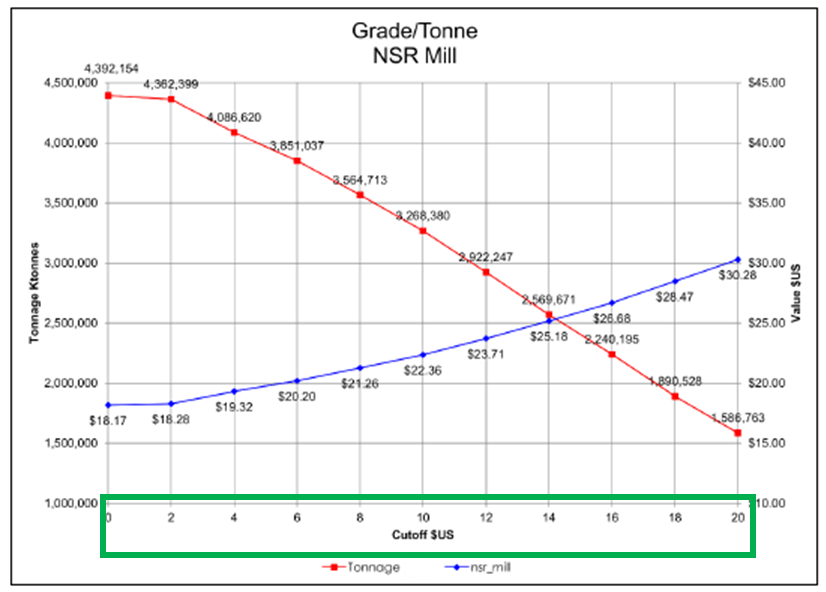

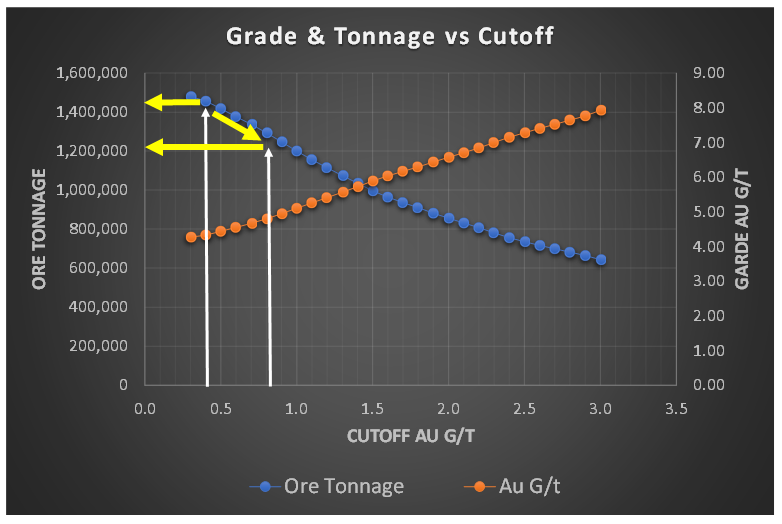

When I am undertaking a due diligence review or working on a study, very early on I like to have a look at the grade-tonnage information. This could be for the entire deposit resource, within a resource constraining shell, or in the pit design.

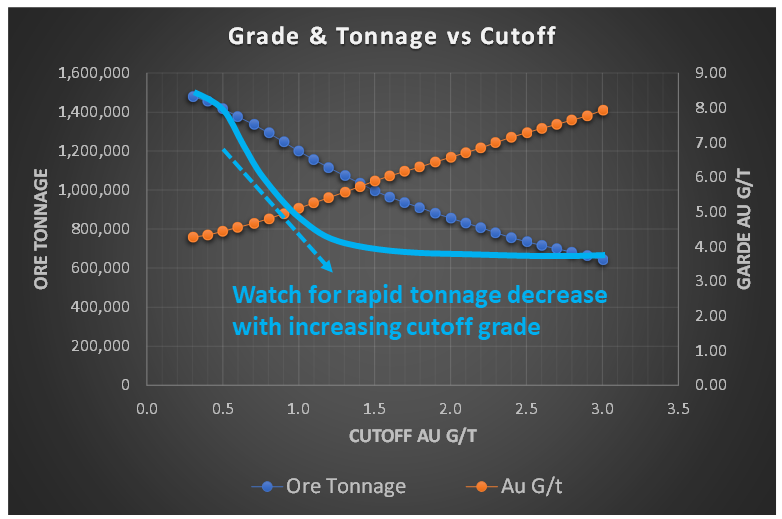

When I am undertaking a due diligence review or working on a study, very early on I like to have a look at the grade-tonnage information. This could be for the entire deposit resource, within a resource constraining shell, or in the pit design. However, if the tonnage curve profile resembled the light blue line in this image, with a concave shape, the ore tonnage is decreasing rapidly with increasing cutoff grade. This is generally not a favorable situation.

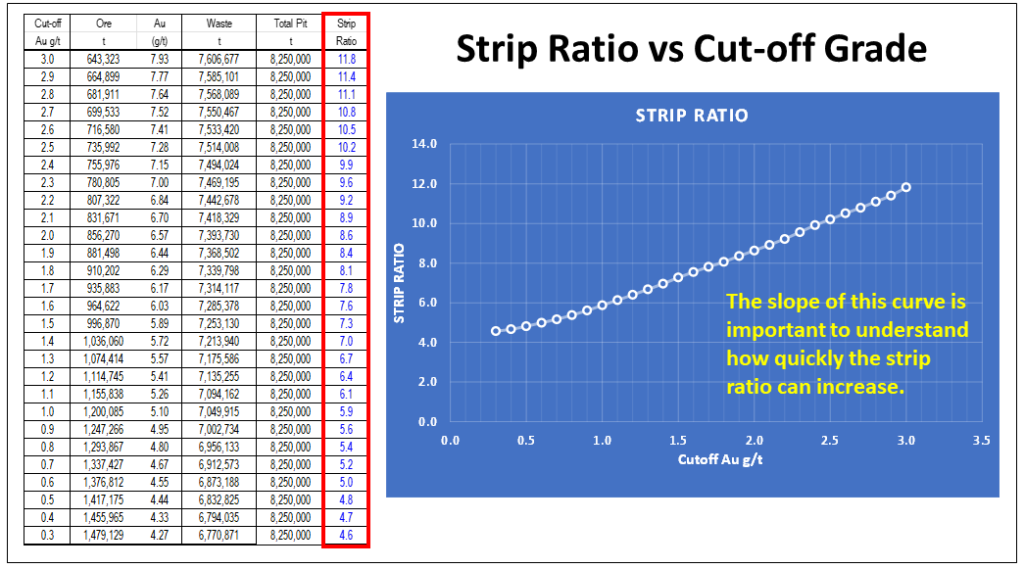

However, if the tonnage curve profile resembled the light blue line in this image, with a concave shape, the ore tonnage is decreasing rapidly with increasing cutoff grade. This is generally not a favorable situation. One complaint I have about reporting mineral resources inside a resource constraining shell is the lack of strip ratio information. This applies whether disclosing a single mineral resource estimate or variable grade-tonnage data.

One complaint I have about reporting mineral resources inside a resource constraining shell is the lack of strip ratio information. This applies whether disclosing a single mineral resource estimate or variable grade-tonnage data. Regarding mineral resources, one should be required to disclose the waste tonnage and strip ratio when reporting resources inside a constraining shell. The constraining shell and cutoff grade are both based on defined economic factors such as unit mining costs, processing cost, process recoveries, and metal prices. With respect to the mining cost component, the strip ratio is a key aspect of the total mining cost, yet it normally isn’t disclosed.

Regarding mineral resources, one should be required to disclose the waste tonnage and strip ratio when reporting resources inside a constraining shell. The constraining shell and cutoff grade are both based on defined economic factors such as unit mining costs, processing cost, process recoveries, and metal prices. With respect to the mining cost component, the strip ratio is a key aspect of the total mining cost, yet it normally isn’t disclosed. In 43-101 technical reports, the financial Chapter 22 normally presents the project sensitivities expressed in a spider diagram or a table format.

In 43-101 technical reports, the financial Chapter 22 normally presents the project sensitivities expressed in a spider diagram or a table format.

NPV One is targeting to replace the typical Excel based cashflow model with an online cloud model. It reminds me of personal income tax software, where one simply inputs the income and expense information, and then the software takes over doing all the calculations and outputting the result.

NPV One is targeting to replace the typical Excel based cashflow model with an online cloud model. It reminds me of personal income tax software, where one simply inputs the income and expense information, and then the software takes over doing all the calculations and outputting the result. Pros

Pros Like anything, nothing is perfect and NPV may have a few issues for me.

Like anything, nothing is perfect and NPV may have a few issues for me. The NPV One software is an option for those wishing to standardize or simplify their financial modelling.

The NPV One software is an option for those wishing to standardize or simplify their financial modelling.

We likely have all heard the statement that increasing pit wall angles will result in significant cost savings to the mining operation.

We likely have all heard the statement that increasing pit wall angles will result in significant cost savings to the mining operation. The results of applying the increased inter-ramp angle to each of the four pits is shown in the Bar Chart. Note that the waste reduction is not necessarily the same for each pit. It depends on the specific topography around each pit.

The results of applying the increased inter-ramp angle to each of the four pits is shown in the Bar Chart. Note that the waste reduction is not necessarily the same for each pit. It depends on the specific topography around each pit. In general one can typically see four positive outcomes from adopting steeper pit walls. They are as follows:

In general one can typically see four positive outcomes from adopting steeper pit walls. They are as follows: 4. Pit Crest Location: The steeper wall angles result in a shift in the final pit crest location. The Image shows the impact that the 5 degree steepening had on the crest location for one of the pits in this scenario.

4. Pit Crest Location: The steeper wall angles result in a shift in the final pit crest location. The Image shows the impact that the 5 degree steepening had on the crest location for one of the pits in this scenario. It is relatively easy to justify spending additional time and money on proper geotechnical investigations and geotechnical monitoring given the potential slope steepening benefits.

It is relatively easy to justify spending additional time and money on proper geotechnical investigations and geotechnical monitoring given the potential slope steepening benefits.

Overburden is a generalized termed used to describe unconsolidated material encountered at a mine. It can consist of gravels, sands, silts, and clays and combinations of each. Usually overburden is not given much focus in many mining studies. Very often, the overburden as a unit, is not adequately characterized.

Overburden is a generalized termed used to describe unconsolidated material encountered at a mine. It can consist of gravels, sands, silts, and clays and combinations of each. Usually overburden is not given much focus in many mining studies. Very often, the overburden as a unit, is not adequately characterized. These are the clays most people are familiar with, i.e. a sedimentary deposit of very fine particles that have settled in a calm body of water. Normally consolidated clays are generally not a problem, other than having a high moisture content. As such, they can be very sticky in loader buckets, truck boxes, and when feeding crushers.

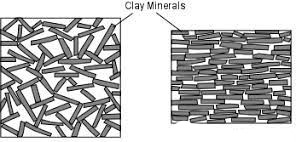

These are the clays most people are familiar with, i.e. a sedimentary deposit of very fine particles that have settled in a calm body of water. Normally consolidated clays are generally not a problem, other than having a high moisture content. As such, they can be very sticky in loader buckets, truck boxes, and when feeding crushers. Clays in general consist of very fine plate like particles, as shown in this sketch. In over-consolidated clays, these particles have been flattened and tightly compressed as in the right image. The result is that the clay may be dense, have a good cross bedding shear strength, but very low shear strength along the plates. This characteristic is analogous to the lubricating properties of graphite, which is facilitated by sliding along graphite plates.

Clays in general consist of very fine plate like particles, as shown in this sketch. In over-consolidated clays, these particles have been flattened and tightly compressed as in the right image. The result is that the clay may be dense, have a good cross bedding shear strength, but very low shear strength along the plates. This characteristic is analogous to the lubricating properties of graphite, which is facilitated by sliding along graphite plates. My experience with sensitive clays was at the former BHP bauxite mining operations along the northern coast of Suriname. There were Demerara clay channels up to 20m thick over top of many of their open pits. The bucketwheel excavators used for waste stripping would trigger the quick clay slope failures, sometimes resulting in the crawler tracks being buried and unfortunately also causing some worker fatalities.

My experience with sensitive clays was at the former BHP bauxite mining operations along the northern coast of Suriname. There were Demerara clay channels up to 20m thick over top of many of their open pits. The bucketwheel excavators used for waste stripping would trigger the quick clay slope failures, sometimes resulting in the crawler tracks being buried and unfortunately also causing some worker fatalities. I recall walking up towards a bucketwheel digging face as the machine quietly churned away. About 70 metres from the machine, we would see cracks quietly opening all around us as the ground mass was starting to initiate its flow towards the machine. Most times the bucketwheel could just sit there and dig. Instead of the machine having to advance toward the face, the face would advance towards the machine.

I recall walking up towards a bucketwheel digging face as the machine quietly churned away. About 70 metres from the machine, we would see cracks quietly opening all around us as the ground mass was starting to initiate its flow towards the machine. Most times the bucketwheel could just sit there and dig. Instead of the machine having to advance toward the face, the face would advance towards the machine. The formation of the diamond deposits in northern Canada often involved the explosive eruption of kimberlite pipes under bodies of water. The lakebed muds and expelled kimberlite by the eruption would collapse back into the crater, resulting in a mix of mud and kimberlite (yellow zones in the image). This muddy kimberlite could be soft, weak, and difficult to mine with underground methods.

The formation of the diamond deposits in northern Canada often involved the explosive eruption of kimberlite pipes under bodies of water. The lakebed muds and expelled kimberlite by the eruption would collapse back into the crater, resulting in a mix of mud and kimberlite (yellow zones in the image). This muddy kimberlite could be soft, weak, and difficult to mine with underground methods. At many tropical mining operations (west African gold projects for example) the upper bedrock has undergone weathering, resulting in the fresh rock being decomposed into saprolite. This clay-rich material can exceed 50 metres in thickness, can be fairly soft and diggable without blasting. This is an obvious mining cost benefit.

At many tropical mining operations (west African gold projects for example) the upper bedrock has undergone weathering, resulting in the fresh rock being decomposed into saprolite. This clay-rich material can exceed 50 metres in thickness, can be fairly soft and diggable without blasting. This is an obvious mining cost benefit. Compacted clay fill can also be used as a pond liner material for water retention ponds.

Compacted clay fill can also be used as a pond liner material for water retention ponds.

The DRX Drill Hole and Reporting algorithm developed by

The DRX Drill Hole and Reporting algorithm developed by

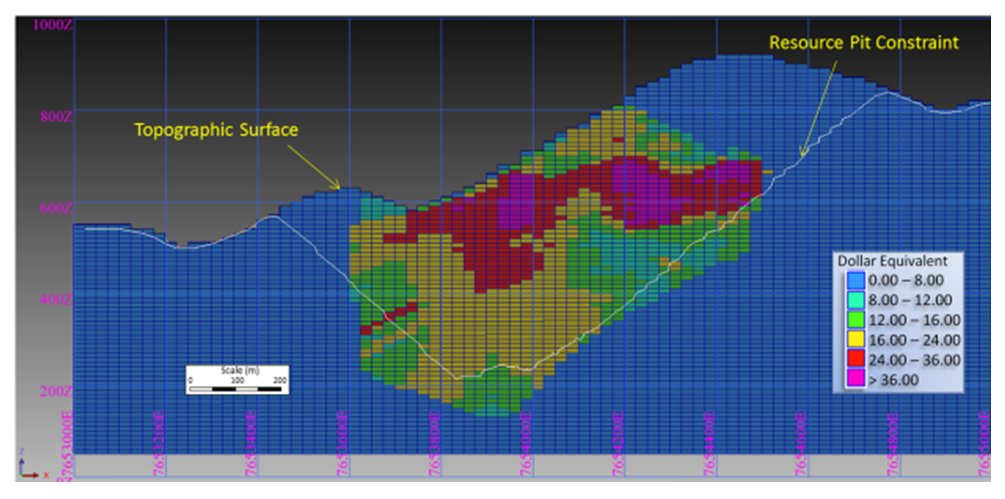

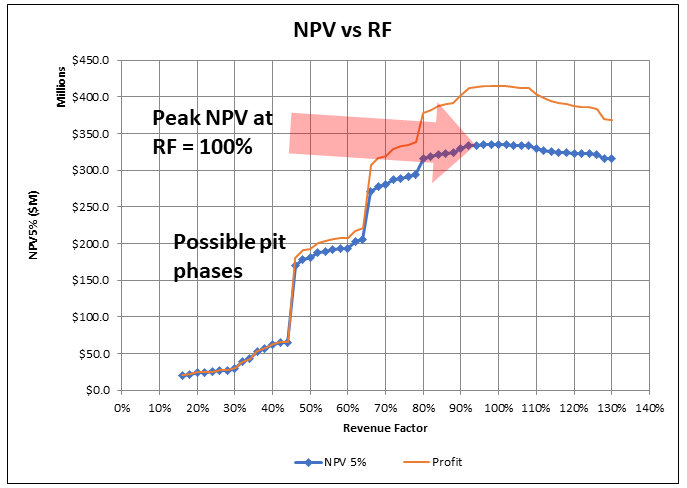

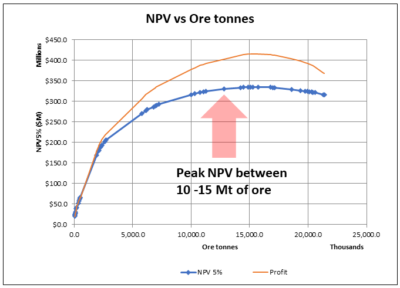

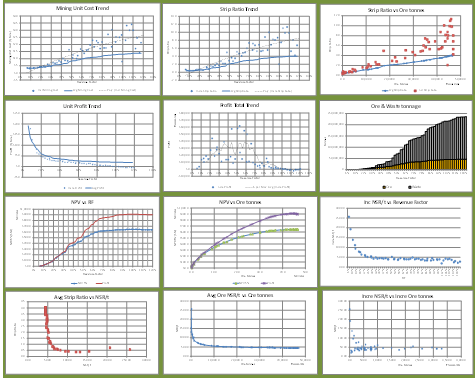

Often in 43-101 technical reports, when it comes to pit optimization, one is presented with the basic “NPV vs Revenue Factor (RF)” curve. That’s it.

Often in 43-101 technical reports, when it comes to pit optimization, one is presented with the basic “NPV vs Revenue Factor (RF)” curve. That’s it.

Pit optimization is a approximation process, as I outlined in a prior post titled “

Pit optimization is a approximation process, as I outlined in a prior post titled “

It’s always a good idea to drill down deeper into the optimization output data, even if you don’t intend to present that analysis in a final report. It will help develop an understanding of the nature of the orebody.

It’s always a good idea to drill down deeper into the optimization output data, even if you don’t intend to present that analysis in a final report. It will help develop an understanding of the nature of the orebody.

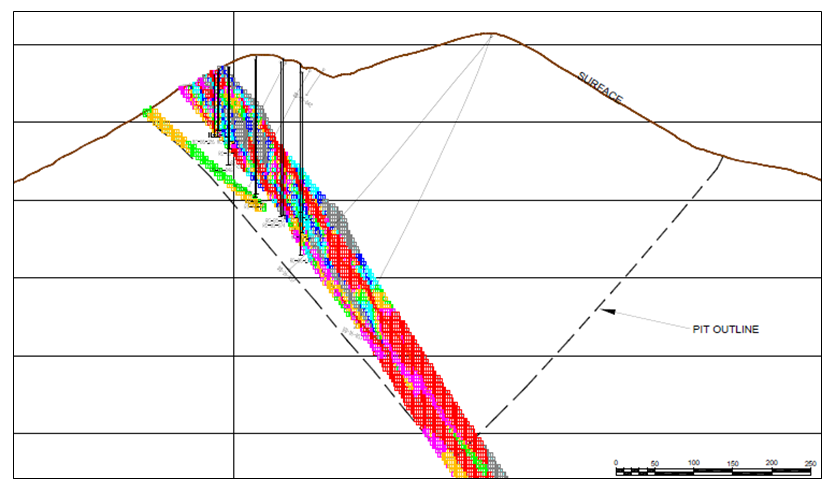

The majority of mining projects tend to consist of either open pit only or underground only operations. However there are instances where the orebody is such that eventually the mine must transition from open pit to underground. Open pit stripping ratios can reach uneconomic levels hence the need for the change in direction.

The majority of mining projects tend to consist of either open pit only or underground only operations. However there are instances where the orebody is such that eventually the mine must transition from open pit to underground. Open pit stripping ratios can reach uneconomic levels hence the need for the change in direction. There are several reasons why open pit and underground can be considered as two different projects within the same project.

There are several reasons why open pit and underground can be considered as two different projects within the same project. An underground mine that uses a backfilling method will be able to dispose of some tailings underground. Conversely moving towards a larger open pit will require a larger tailings pond, larger waste dumps and overall larger footprint. This helps make the case for underground mining, particularly where surface area is restricted or local communities are anti-open pit.

An underground mine that uses a backfilling method will be able to dispose of some tailings underground. Conversely moving towards a larger open pit will require a larger tailings pond, larger waste dumps and overall larger footprint. This helps make the case for underground mining, particularly where surface area is restricted or local communities are anti-open pit. Open pit and underground operations will require different skill sets from the perspective of supervision, technical, and operations. Underground mining can be a highly specialized skill while open pit mining is similar to earthworks construction where skilled labour is more readily available globally. Do local people want to learn underground mining skills? Do management teams have the capability and desire to manage both these mining approaches at the same time?

Open pit and underground operations will require different skill sets from the perspective of supervision, technical, and operations. Underground mining can be a highly specialized skill while open pit mining is similar to earthworks construction where skilled labour is more readily available globally. Do local people want to learn underground mining skills? Do management teams have the capability and desire to manage both these mining approaches at the same time? As you can see from the foregoing discussion, there are a multitude of factors playing off one another when examining the open pit to underground cross-over point. It can be like trying to mesh two different projects together.

As you can see from the foregoing discussion, there are a multitude of factors playing off one another when examining the open pit to underground cross-over point. It can be like trying to mesh two different projects together.