Over the past few years I have worked in different consulting roles; as an independent consultant; as a member of a large consulting team; and as owner’s representative managing consultants. I have learned that there is a role for both the independent consultant and larger consulting firms. Read on for more in this self-serving article.

Independents have a role

A previous blog (“9. Large Consulting Firms or Small Firms – Any Difference?”) discusses where large and small consultants fit into the overall picture. Large technical teams are required where there are broader scopes of work, significant effort levels, and where multiple skills sets are needed.

Independent consultants are a different thing. They are best suited for assisting the Owner directly, either independently or as part of an overall corporate advisory team. Non-technical junior mining management teams should always have access to in-house engineering capability for brainstorming or technical direction.

Even if some of the management are technically oriented, having independent thought is valuable. The question is whether the engineer should be a cheerleader or a true independent observer.

Independent consultants will differentiate themselves from large engineering firms in several ways.

Independent consultants will differentiate themselves from large engineering firms in several ways.

-

They don’t bring a lot of extra personnel onto a job. They focus only on what is needed and can draw in other expertise when needed.

-

They can provide unbiased advice. Larger firm sometimes have business development conflicts. The independent consultant does not have the motivation to win a feasibility study or EPCM contract.

-

A company can develop a long term working relationship with an independent consultant. Everyone gets familiar with each other’s objectives and goals. Large engineering firms can be revolving doors with people moving on to other firms.

-

Independents can work efficiently at a pace of their own choosing. This can result in lower costs and faster deliverables. I know many independent consultants will work evenings and weekends to meet client targets.

-

Independents can provide long term stability since they won’t have any employee turnover. Personally I was involved for over 15 years with a mining operating in Suriname. The expat staff at the mine site experienced significant turnover. This was partly due to them being promised personal development relocations. I ended up being the only constant for the mine site. I knew the history and why things were done they way they were. I even had copies of old study reports they could no longer find in their files on site. I knew what was done previously, thereby avoiding re-inventing the wheel each time there was a new technical manager was brought in.

Consultants and Stocks Options

A point of discussion is whether the independent consultants should receive stock option compensation. I have worked under both situations.

Awarding stock options might eliminate the “independent” nature of the relationship and hence negated the ability to sign off as an independent QP. In some circumstances, the company may not require the independent consultant to be a QP since they mainly fulfill an advisory role.

Does one want independent advice, from someone who may not be a significant shareholder or option holder?

One advantage of awarding stock options is that the consultant may become more beholden to the project. They feel it is their project too, rather than simply acting as an adviser. They may have a longer term interest in being involved with the project and the company.

Conversely the company may prefer the consultant doesn’t have any direct ownership so that their advice can be viewed as being unbiased. Having a contrarian view of corporate plans is a good thing.

I feel that awarding stock options is a good way to foster long term commitment from the consultant. It can be easier for them to walk away without any such inducement.

Conclusion

I have heard from geologist colleagues that financing grass-roots exploration is still extremely difficult. That is unless company management has had past successes or is well connected to the money scene.

I have heard from geologist colleagues that financing grass-roots exploration is still extremely difficult. That is unless company management has had past successes or is well connected to the money scene. The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

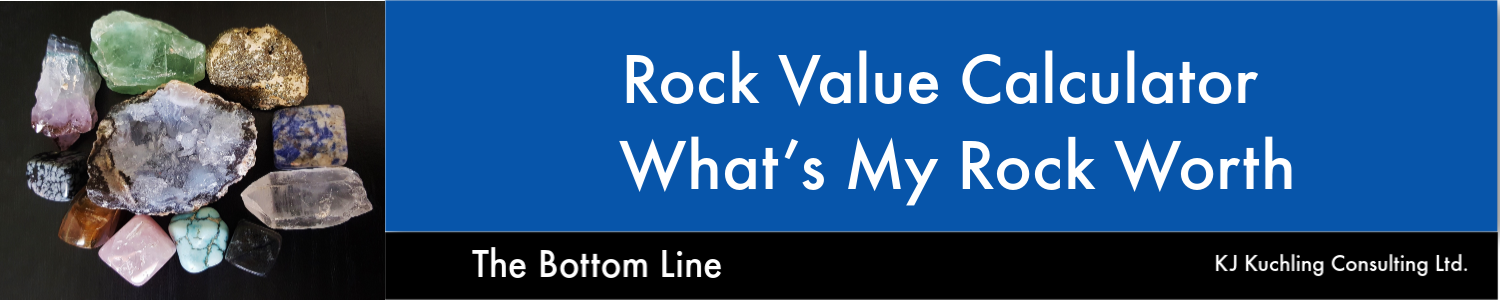

The two main nature-driven factors in the economics of a mining project are the ore grade and the ore tonnage. In simplistic terms, the ore grade will determine how much incremental profit can be generated by each tonne of rock processed.

The two main nature-driven factors in the economics of a mining project are the ore grade and the ore tonnage. In simplistic terms, the ore grade will determine how much incremental profit can be generated by each tonne of rock processed.

Gather your team around their computers and fire up screen sharing software like Teams, GoToMeeting, Skype, or Zoom. Give control of the mouse to someone who knows the site well. Here are some of the things you can do on your group tour.

Gather your team around their computers and fire up screen sharing software like Teams, GoToMeeting, Skype, or Zoom. Give control of the mouse to someone who knows the site well. Here are some of the things you can do on your group tour.

In my personal experience I find that larger consultants are best suited for managing the large scale feasibility studies. This isn’t because they necessarily provide better technical expertise. Its because they generally have the internal project management and costing systems to manage the complexities of such larger studies.

In my personal experience I find that larger consultants are best suited for managing the large scale feasibility studies. This isn’t because they necessarily provide better technical expertise. Its because they generally have the internal project management and costing systems to manage the complexities of such larger studies. For certain aspects of a feasibility study, one may get better technical expertise by subcontracting to smaller highly specialized engineering firms. However too much subcontracting may become an onerous task. Often the larger firms may be better positioned to do this.

For certain aspects of a feasibility study, one may get better technical expertise by subcontracting to smaller highly specialized engineering firms. However too much subcontracting may become an onerous task. Often the larger firms may be better positioned to do this. One of the purposes of an early stage study is to see if the project has economic merit and would therefore warrant further expenditures in the future. An early stage study is (hopefully) not used to defend a production decision. The objective of an early stage study is not necessarily to terminate a project (unless it is obviously highly uneconomic).

One of the purposes of an early stage study is to see if the project has economic merit and would therefore warrant further expenditures in the future. An early stage study is (hopefully) not used to defend a production decision. The objective of an early stage study is not necessarily to terminate a project (unless it is obviously highly uneconomic).

The bottom line is that it is important for the Study Manager and project Owner to ensure the entire technical team is on the same page and understands the type of information they are working with. The technical detail in the final study should be consistent throughout.

The bottom line is that it is important for the Study Manager and project Owner to ensure the entire technical team is on the same page and understands the type of information they are working with. The technical detail in the final study should be consistent throughout.

My recollection is that many years ago larger consulting firms would offer to do an entire study in-house. They would have the in-house team to cover almost the entire study. That approach seems to have changed and now the multi-company path is the norm.

My recollection is that many years ago larger consulting firms would offer to do an entire study in-house. They would have the in-house team to cover almost the entire study. That approach seems to have changed and now the multi-company path is the norm. The Study Manager must ensure that everyone understands what their deliverables are. Generally this is done using a “Responsibility Matrix”, but these can sometimes be too general.

The Study Manager must ensure that everyone understands what their deliverables are. Generally this is done using a “Responsibility Matrix”, but these can sometimes be too general.

Some PEA’s might be based on a large database of test work and site information while others may rely on very preliminary data and require design projections based on that data.

Some PEA’s might be based on a large database of test work and site information while others may rely on very preliminary data and require design projections based on that data. The securities commissions consider that the cautionary language an important component of the PEA Technical Report and may red-flag it if it’s not in all the right places. However this cautionary language is generally focused on the resource.

The securities commissions consider that the cautionary language an important component of the PEA Technical Report and may red-flag it if it’s not in all the right places. However this cautionary language is generally focused on the resource.