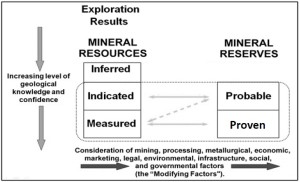

One of the first things we normally look at when examining a resource estimate is how much of the resource is classified as Measured or Indicated (“M+I”) compared to the Inferred tonnage. It is important to understand the uncertainty in the estimate and how much the Inferred proportion contributes. Having said that, I think we tend to focus less on the split between the Measured and Indicated tonnages.

Inferred resources have a role

We are all aware of the regulatory limitations imposed by Inferred resources in mining studies. They are speculative in nature and hence cannot be used in the economic models for pre-feasibility and feasibility studies. However Inferred resource can be used for production planing in a Preliminary Economic Assessment (“PEA”).

Inferred resources are so speculative that one cannot legally add them to the Measure and Indicated tonnages in a resource statement (although that is what everyone does). I don’t really understand the concern with a mineral resource statement if it includes a row that adds M+I tonnage with Inferred tonnes, as long as everything is transparent.

When a PEA mining schedule is developed, the three resource classifications can be combined into a single tonnage value. However in the resource statement the M+I+I cannot be totaled. A bit contradictory.

Are Measured resources important?

It appears to me that companies are more interested in what resource tonnage meets the M+I threshold but are not as concerned about the tonnage split between Measured and Indicated. It seems that M+I are largely being viewed the same. Since both Measured and Indicated resources can be used in a feasibility economic analysis, does it matter if the tonnage is 100% Measured (Proven) or 100% Indicated (Probable)?

The NI 43-101 and CIM guidelines provide definitions for Measured and Indicated resources but do not specify any different treatment like they do for the Inferred resources.

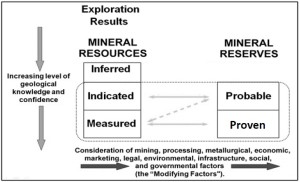

Relationship between Mineral Reserves and Mineral Resources (CIM Definition Standards).

Payback Period and Measured Resource

In my past experience with feasibility studies, some people applied a rule-of-thumb that the majority of the tonnage mined during the payback period must consist of Measure resource (i.e. Proven reserve).

The goal was to reduce project risk by ensuring the production tonnage providing the capital recovery is based on the resource with the highest certainty.

Generally I do not see this requirement used often, although I am not aware of what everyone is doing in every study. I realize there is a cost, and possibly a significant cost, to convert Indicated resource to Measured so there may be some hesitation in this approach. Hence it seems to be simpler for everyone to view the Measured and Indicated tonnages the same way.

Conclusion

NI 43-101 specifies how the Inferred resource can and cannot be utilized. Is it a matter of time before the regulators start specifying how Measured and Indicated resources must be used? There is some potential merit to this idea, however adding more regulation (and cost) to an already burdened industry would not be helpful.

Perhaps in the interest of transparency, feasibility studies should add two new rows to the bottom of the production schedule. These rows would show how the annual processing tonnages are split between Proven and Probable reserves. This enables one to can get a sense of the resource risk in the early years of the project. Given the mining software available today, it isn’t hard to provide this additional detail.

Note: If you would like to get notified when new blogs are posted, then sign up on the KJK mailing list on the website. Otherwise I post notices on LinkedIn, so follow me at: https://www.linkedin.com/in/kenkuchling/.

In the past there would be binders with detailed calculations and backup for the different parts of the study. Typically there was a binder for the Executive Summary and separate sections (i.e. binders) for Geology, Mining, Processing, Infrastructure, Capital Cost, Operating Cost, Environmental, Project Execution, and Economic Analysis, etc.

In the past there would be binders with detailed calculations and backup for the different parts of the study. Typically there was a binder for the Executive Summary and separate sections (i.e. binders) for Geology, Mining, Processing, Infrastructure, Capital Cost, Operating Cost, Environmental, Project Execution, and Economic Analysis, etc. The original intent of the 43-101 Technical Report was for it to be a summary document, only about 80-150 pages in length. The intent was to simplify all the technical work for the benefit of non-technical investors. Currently I have noticed that in many cases the 43-101 report is now the entire feasibility study document.

The original intent of the 43-101 Technical Report was for it to be a summary document, only about 80-150 pages in length. The intent was to simplify all the technical work for the benefit of non-technical investors. Currently I have noticed that in many cases the 43-101 report is now the entire feasibility study document. My recommendation is that, where budgets permit, mining companies return to the days of preparing the comprehensive feasibility study document. It’s the right thing to do.

My recommendation is that, where budgets permit, mining companies return to the days of preparing the comprehensive feasibility study document. It’s the right thing to do.

If any mining industry credibility has been lost, re-establishing it should be important. One way to start doing this is to focus on creating the type of reports that best serve the needs of the industry stakeholders.

If any mining industry credibility has been lost, re-establishing it should be important. One way to start doing this is to focus on creating the type of reports that best serve the needs of the industry stakeholders.

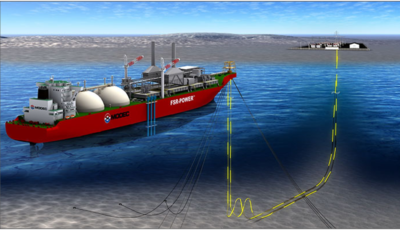

The technology consists of a floating LNG (liquefied natural gas) turbine power plant combined with high capacity seawater desalinization capabilities. MODEC is offering the FSRWP® (Floating Storage Regasification Water-Desalination & Power-Generation) system.

The technology consists of a floating LNG (liquefied natural gas) turbine power plant combined with high capacity seawater desalinization capabilities. MODEC is offering the FSRWP® (Floating Storage Regasification Water-Desalination & Power-Generation) system. From a green mining perspective, the FSRWP produces clean power with the highest thermal efficiency and lowest carbon foot-print.

From a green mining perspective, the FSRWP produces clean power with the highest thermal efficiency and lowest carbon foot-print. Currently there are three mooring options for the floating system that should fit most any tidewater situation.

Currently there are three mooring options for the floating system that should fit most any tidewater situation. The bottom line is that if your mining project is near shore, and has both water supply and power issues, take a look at the FSRWP technology. One might say it is greener technology by using LNG (rather than coal, heavy fuel oil, or diesel) to generate power. At the same time it avoids competition with locals for access to fresh water.

The bottom line is that if your mining project is near shore, and has both water supply and power issues, take a look at the FSRWP technology. One might say it is greener technology by using LNG (rather than coal, heavy fuel oil, or diesel) to generate power. At the same time it avoids competition with locals for access to fresh water.

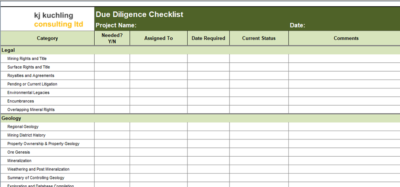

Mining companies are always on the hunt for new projects to grow their cashflows. They would all like to find the “perfect” project; one with ideal conditions and great attributes.

Mining companies are always on the hunt for new projects to grow their cashflows. They would all like to find the “perfect” project; one with ideal conditions and great attributes. Now take an honest look at some recent (or past) projects that you have been involved with. How many of the perfect attributes listed above would be represented? It would be surprising to see them all checked off. Unfortunately that means certain flaws (risks) must be accepted when developing a project.

Now take an honest look at some recent (or past) projects that you have been involved with. How many of the perfect attributes listed above would be represented? It would be surprising to see them all checked off. Unfortunately that means certain flaws (risks) must be accepted when developing a project. The bottom line is that management understandably have a difficult task in making go/no-go decisions. Financial institutions have similar dilemmas when deciding on whether or not to finance a project.

The bottom line is that management understandably have a difficult task in making go/no-go decisions. Financial institutions have similar dilemmas when deciding on whether or not to finance a project.

You a create your own checklist but if you would like a copy of mine just email me at KJKLTD@rogers.com and let me know a bit about how you plan to use it (for my own curiosity). Specify if you would prefer the Excel or PDF versions.

You a create your own checklist but if you would like a copy of mine just email me at KJKLTD@rogers.com and let me know a bit about how you plan to use it (for my own curiosity). Specify if you would prefer the Excel or PDF versions. Mining due diligence exercises can be interesting and great learning experiences, even for senior people that have seen it all. However they can also be mentally taxing due to the volumes of information that one must find, review, and comprehend, all in a short period of time.

Mining due diligence exercises can be interesting and great learning experiences, even for senior people that have seen it all. However they can also be mentally taxing due to the volumes of information that one must find, review, and comprehend, all in a short period of time.

Its the right thing to do

Its the right thing to do The company gets a chance to learn about potential employees and also gets productive service from them.

The company gets a chance to learn about potential employees and also gets productive service from them.

His topic is interesting and relevant to today’s mining industry. Paul raised many thoughtful points supported by data. He gave me permission to share his information.

His topic is interesting and relevant to today’s mining industry. Paul raised many thoughtful points supported by data. He gave me permission to share his information. I agree with many of the points raised by Paul in his study. The mining industry has some credibility issues based on recent performance and therefore understanding the causes and then repairing that credibility will be important for the future.

I agree with many of the points raised by Paul in his study. The mining industry has some credibility issues based on recent performance and therefore understanding the causes and then repairing that credibility will be important for the future.

Tailings dam stability is so important that in some jurisdictions regulators may be requiring that mining companies have third party independent review boards or third party audits done on their tailings dams. The feeling is that, although a reputable consultant may be doing the dam design, there is still a need for some outside oversight.

Tailings dam stability is so important that in some jurisdictions regulators may be requiring that mining companies have third party independent review boards or third party audits done on their tailings dams. The feeling is that, although a reputable consultant may be doing the dam design, there is still a need for some outside oversight. Nowadays most small companies do not develop their own in-house resource estimates. The task is generally awarded to an independent QP.

Nowadays most small companies do not develop their own in-house resource estimates. The task is generally awarded to an independent QP.

One downside to a third party review is the added cost to the owner.

One downside to a third party review is the added cost to the owner.

The term Theory of Constraints may be common to some. However that concept is different than what is being discussed in the book. The TOC essentially relies on managing a constraint or eliminating it, and then addressing the next constraint in sequence.

The term Theory of Constraints may be common to some. However that concept is different than what is being discussed in the book. The TOC essentially relies on managing a constraint or eliminating it, and then addressing the next constraint in sequence.