Geological colleagues have often joked that engineers are a pessimistic lot; they are never technically satisfied. The engineers will fire back that geologists are an overly optimistic lot; every speck of mineralization makes them ecstatic. Together they make a great team since each cancels the other out.

In my opinion engineers are often pessimistic. This is mainly because they have been trained to be that way. Throughout my own engineering career I have been called upon many times to focus on the downsides, i.e. what can happen that we don’t want to happen.

It starts early and continues on

This pessimism training started early in my career while working as a geotechnical engineer. Geotechnical engineers were always looking at failure modes and the potential causes of failure when assessing factors of safety.

This pessimism training started early in my career while working as a geotechnical engineer. Geotechnical engineers were always looking at failure modes and the potential causes of failure when assessing factors of safety.

Slope failure could be due to the water table, excess pore pressures, seismic or blast vibrations, liquefaction, unknown weak layers, overly steepen slopes, or operating error. As part of our job we had to come up with our list of negatives and consider them all. The more pessimistic view you had, the better job you did.

This training continued through the other stages of a career. The focus on negatives continues in mine planning and costing.

For example, there are 8,760 hours in a year, but how many productive hours will each piece of equipment provide? There will delays due to weather conditions, planned maintenance, unplanned breakdowns, inter-equipment delays, operator efficiency, and other unforeseen events. The more pessimistic a view of equipment productivity, the larger the required fleet. Geotechnical engineers would call this the factor of safety.

In the more recent past, I have been involved in numerous due diligences. Some of these were done for major mining companies looking at acquisitions. Others were on behalf of JV partners, project financiers, and juniors looking at acquisitions.

When undertaking a due diligence, particularly for a major company or financier, we are not hired to tell them how great the project is. We are hired to look for fatal flaws, identify poorly based design assumptions or errors and omissions in the technical work. We are mainly looking for negatives or red flags.

When undertaking a due diligence, particularly for a major company or financier, we are not hired to tell them how great the project is. We are hired to look for fatal flaws, identify poorly based design assumptions or errors and omissions in the technical work. We are mainly looking for negatives or red flags.

Often we get asked to participate in a Risk Analysis or SWOT analysis (Strengths-Weaknesses-Opportunities-Threats) where we are tasked with identifying strengths and weaknesses in a project.

Typically at the end of these SWOT exercises, one will see many pages of project risks with few pages of opportunities.

The opportunities will usually consist of the following cliches (feel free to use them in your own risk session); metal prices may be higher than predicted; operating costs will be lower than estimated; dilution will be better than estimated; and grind size optimization will improve process recoveries.

The project’s risk list will be long and have a broad range. The longer the list of risks, the smarter the review team appears to be.

Investing isn’t easy

After decades of the training described above, it becomes a challenge for me to invest in junior miners. My skewed view of projects carries over into my investing approach, whereby I tend to see the negatives in a project fairly quickly. These may consist of overly optimistic design assumptions or key technical aspects not understood in sufficient depth.

Most 43-101 technical reports provide a lot of technical detail; however some of them will still leave me wanting more. Most times some red flags will appear when first reviewing these reports. Some of the red flags may be relatively inconsequential or can be mitigated. However the fact that they exist can create concern. I don’t know if management knows they exists or knows how they can mitigate them.

It has been my experience that digging in a data room or speaking with the engineering consultants can reveal issues not identifiable in a 43-101 report. Possibly some of these issues were mentioned or glossed over in the report, but you won’t understand the full extent of the issues until digging deeper.

It has been my experience that digging in a data room or speaking with the engineering consultants can reveal issues not identifiable in a 43-101 report. Possibly some of these issues were mentioned or glossed over in the report, but you won’t understand the full extent of the issues until digging deeper.

43-101 reports generally tell you what was done, but not why it was done. The fact I cannot dig into the data room or speak with the technical experts is what has me on the fence. What facts might I be missing?

Statistics show that few deposits or advanced projects become real mines. However every advanced study will say that this will be an operating mine. Many projects have positive feasibility studies but these studies are still sitting on the shelf. Is the project owner a tough bargainer or do potential acquirers / financiers see something from their due diligence review that we are not aware of? You don’t get to see these third party reviews unless you have access to the data room.

My hesitance in investing in some companies unfortunately can be penalizing. I may end up sitting on the sidelines while watching the rising stock price. Junior mining investors tend to be a positive bunch, when combined with good promotion can result in investors piling into a stock.

My hesitance in investing in some companies unfortunately can be penalizing. I may end up sitting on the sidelines while watching the rising stock price. Junior mining investors tend to be a positive bunch, when combined with good promotion can result in investors piling into a stock.

Possibly I would benefit by putting my negatives aside and instead ask whether anyone else sees these negatives. If they don’t, then it might be worth taking a chance, albeit making sure to bail out at the right time.

Often newsletter writers will recommend that you “Do your own due diligence”. Undertaking a deep dive in a company takes time. In addition I’m not sure one can even do a proper due diligence without accessing a data room or the consulting team. In my opinion speaking with the engineering consultants that did the study is the best way to figure things out. That’s one reason why “hostile” due diligences can be difficult, while “friendly” DD’s allow access to a lot more information.

Conclusion

Sometimes studies that I have been involved with have undergone third party due diligence. Most times one can predict ahead of time which issues will be raised in the review. One knows how their engineers are going to think and what they are going to highlight as concerns.

Most times the issue is something we couldn’t fully address given the level of study. We might have been forced to make best guess assumptions to move forward. The review engineers will have their opinions about what assumptions they would have used. Typically the common comment is that our assumption is too optimistic and their assumption would have been more conservative or realistic (in their view).

Most times the issue is something we couldn’t fully address given the level of study. We might have been forced to make best guess assumptions to move forward. The review engineers will have their opinions about what assumptions they would have used. Typically the common comment is that our assumption is too optimistic and their assumption would have been more conservative or realistic (in their view).

Ultimately if the roles were reversed and I were reviewing the project I may have had the same comments. After all, the third party reviewers aren’t being hired to say everything is perfect with a project.

The odd time one hears that our assumption was too pessimistic. You usually hear this comment when the reviewing consultant wants to do the next study for the client. They would be a much more optimistic and accommodating team.

To close off this rambling blog, the next time you feel that your engineers are too negative just remember that they are trained to be that way. If you want more positivity, hang out with a geologist (or hire a new grad).

The background information on vertical conveying was provided to me by FKC-Lake Shore, a construction contractor that installs these systems. FKC itself does not fabricate the conveyor hardware. A link to their website is

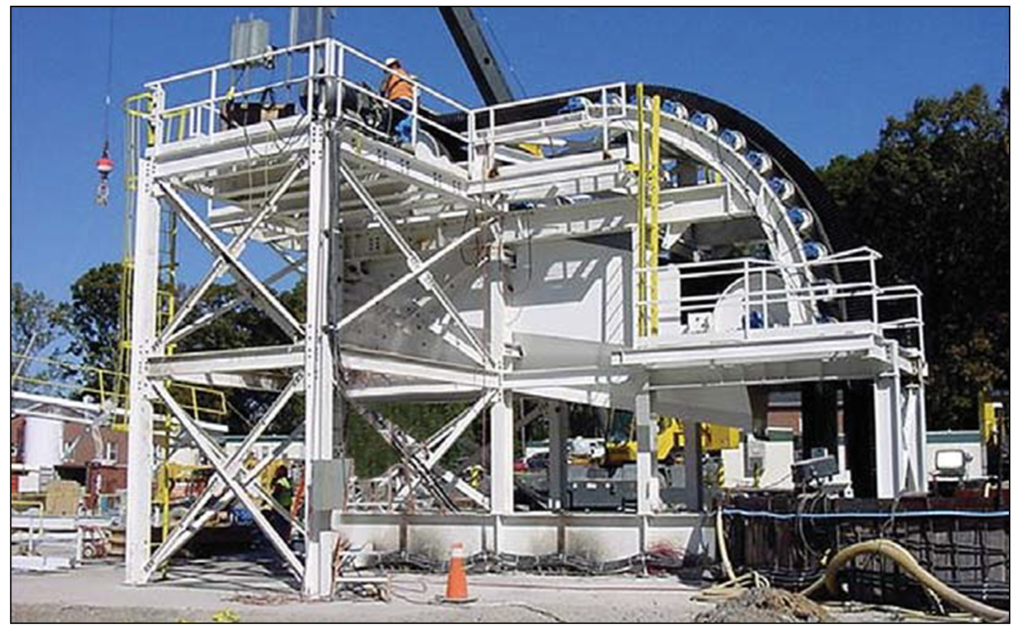

The background information on vertical conveying was provided to me by FKC-Lake Shore, a construction contractor that installs these systems. FKC itself does not fabricate the conveyor hardware. A link to their website is  The FLEXOWELL®-conveyor system is capable of running both horizontally and vertically, or any angle in between. These conveyors consist of FLEXOWELL®-conveyor belts comprised of 3 components: (i) Cross-rigid belt with steel cord reinforcement; (ii) Corrugated rubber sidewalls; (iii) transverse cleats to prevent material from sliding backwards. They can handle lump sizes varying from powdery material up to 400 mm (16 inch). Material can be raised over 500 metres with reported capacities up to 6,000 tph.

The FLEXOWELL®-conveyor system is capable of running both horizontally and vertically, or any angle in between. These conveyors consist of FLEXOWELL®-conveyor belts comprised of 3 components: (i) Cross-rigid belt with steel cord reinforcement; (ii) Corrugated rubber sidewalls; (iii) transverse cleats to prevent material from sliding backwards. They can handle lump sizes varying from powdery material up to 400 mm (16 inch). Material can be raised over 500 metres with reported capacities up to 6,000 tph. Vendors have evaluated the use of vertical conveying against the use of a conventional vertical shaft hoisting. They report the economic benefits for vertical conveying will be in both capital and operating costs.

Vendors have evaluated the use of vertical conveying against the use of a conventional vertical shaft hoisting. They report the economic benefits for vertical conveying will be in both capital and operating costs. The vendors indicate the conveying system should be able to achieve heights of 700 metres. This may facilitate the use of internal shafts (winzes) to hoist ore from even greater depths in an expanding underground mine. It may be worth a look at your mine.

The vendors indicate the conveying system should be able to achieve heights of 700 metres. This may facilitate the use of internal shafts (winzes) to hoist ore from even greater depths in an expanding underground mine. It may be worth a look at your mine.

Based on my own career, mining has definitely provided me with a chance to travel the world. It will also help anyone overcome their fear of travel. One will also learn that both international and domestic travel can be as equally rewarding. There is nothing wrong with learning more about your own country.

Based on my own career, mining has definitely provided me with a chance to travel the world. It will also help anyone overcome their fear of travel. One will also learn that both international and domestic travel can be as equally rewarding. There is nothing wrong with learning more about your own country.

Business travel has always been one of the best parts of my mining career. I can remember the details about a lot of the travel that I did. Unfortunately the project details themselves will blur with those of other projects.

Business travel has always been one of the best parts of my mining career. I can remember the details about a lot of the travel that I did. Unfortunately the project details themselves will blur with those of other projects.

While waiting for various third-party due diligences to be completed, the company continue to do exploration drilling. There were still a lot of untested showings on the property and geologists need to stay busy.

While waiting for various third-party due diligences to be completed, the company continue to do exploration drilling. There were still a lot of untested showings on the property and geologists need to stay busy. With regards to the Heap Leach PEA, we did not wish to complicate the Feasibility Study by adding a new feed supply to that plant from mixed CIL/HL pits. The heap leach project was therefore considered as a separate satellite operation.

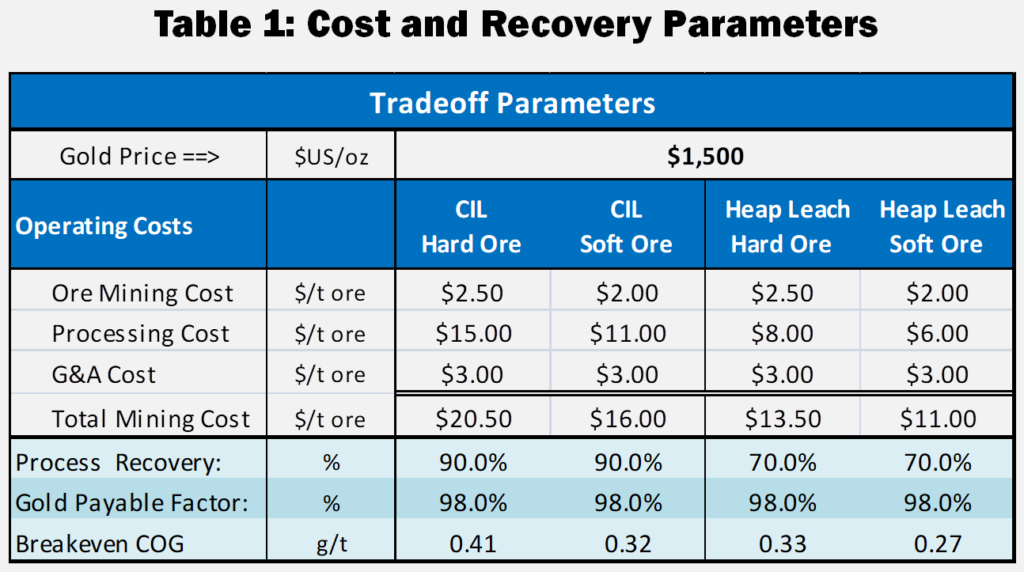

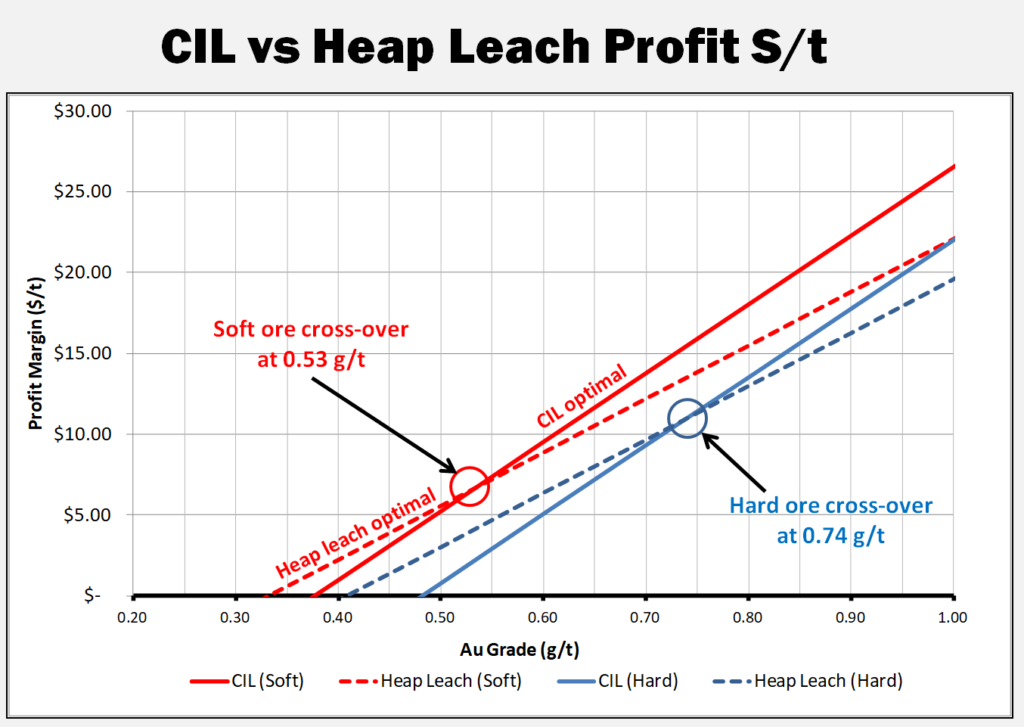

With regards to the Heap Leach PEA, we did not wish to complicate the Feasibility Study by adding a new feed supply to that plant from mixed CIL/HL pits. The heap leach project was therefore considered as a separate satellite operation. I have updated and simplified the trade-off analysis for this blog. Table 1 provides the costs and recoveries used herein, including increasing the gold price to $1500/oz.

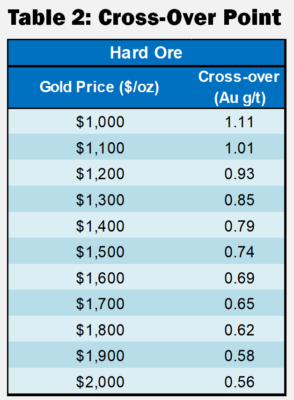

I have updated and simplified the trade-off analysis for this blog. Table 1 provides the costs and recoveries used herein, including increasing the gold price to $1500/oz. These cross-over points described in Table 2 are relevant only for the costs shown in Table 1 and will be different for each project.

These cross-over points described in Table 2 are relevant only for the costs shown in Table 1 and will be different for each project.

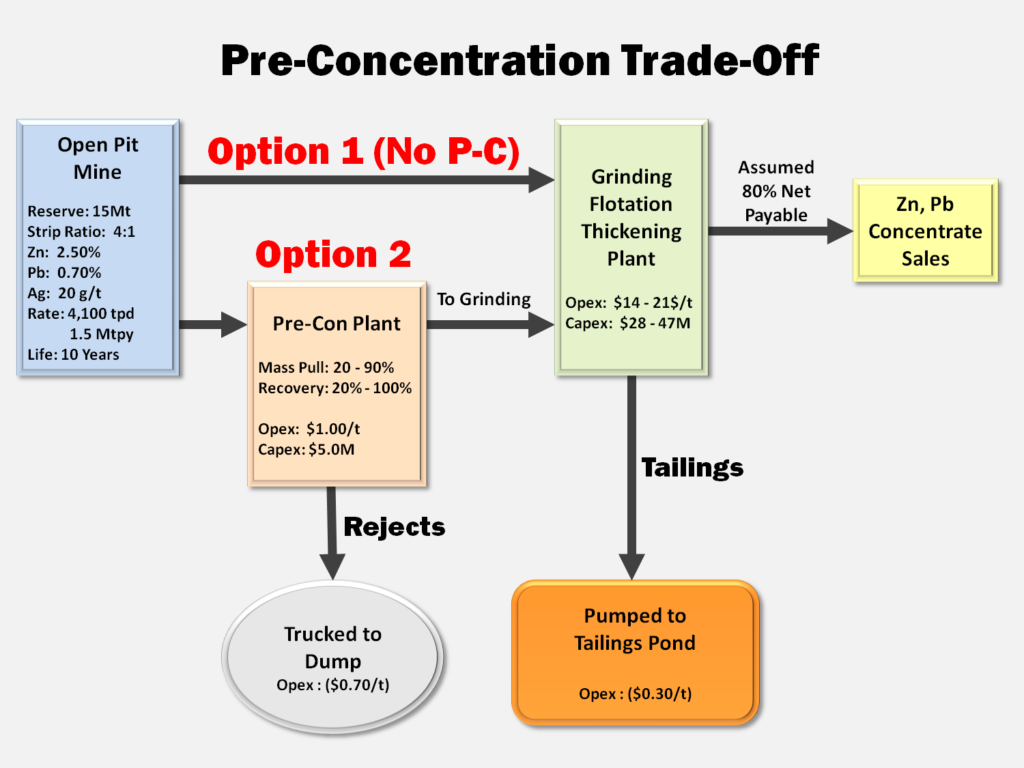

Concentrate handling systems may not differ much between model options since roughly the same amount of final concentrate is (hopefully) generated.

Concentrate handling systems may not differ much between model options since roughly the same amount of final concentrate is (hopefully) generated.

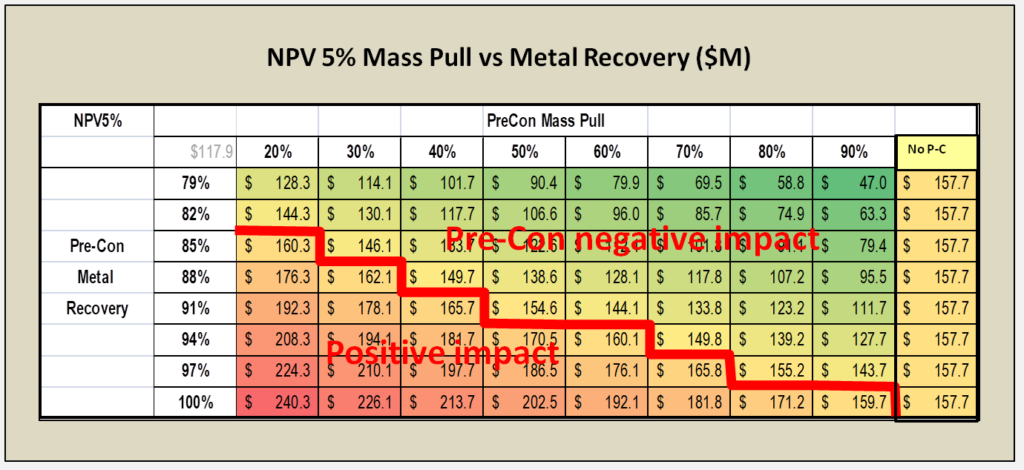

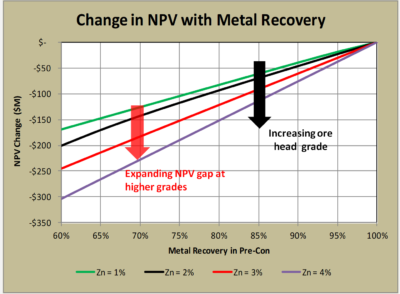

4. The head grade of the deposit also determines how economically risky pre-concentration might be. In higher grade ore bodies, the negative impact of any metal loss in pre-concentration may be offset by accepting higher cost for grinding (see chart on the right).

4. The head grade of the deposit also determines how economically risky pre-concentration might be. In higher grade ore bodies, the negative impact of any metal loss in pre-concentration may be offset by accepting higher cost for grinding (see chart on the right).

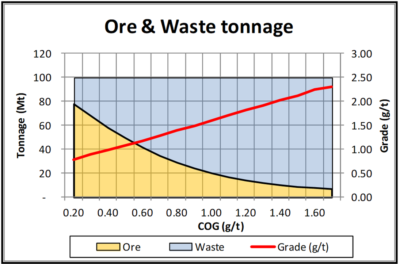

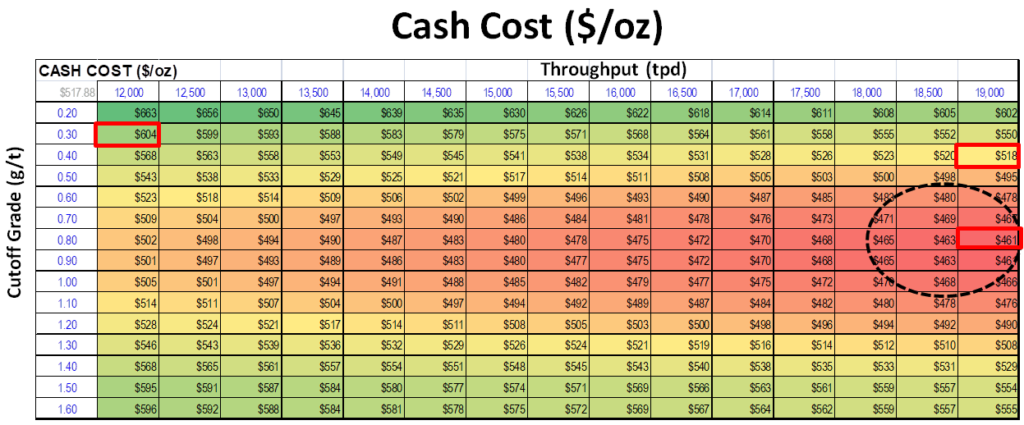

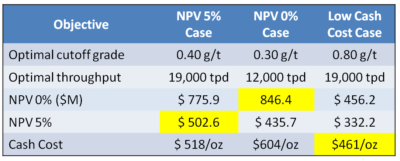

I had a grade tonnage curve, including the tonnes of ore and waste, for a designed pit. This data is shown graphically on the right. Essentially the mineable reserve is 62 Mt @ 0.94 g/t Pd with a strip ratio of 0.6 at a breakeven cutoff grade of 0.35 g/t. It’s a large tonnage, low strip ratio, and low grade deposit. The total pit tonnage is 100 Mt of combined ore and waste.

I had a grade tonnage curve, including the tonnes of ore and waste, for a designed pit. This data is shown graphically on the right. Essentially the mineable reserve is 62 Mt @ 0.94 g/t Pd with a strip ratio of 0.6 at a breakeven cutoff grade of 0.35 g/t. It’s a large tonnage, low strip ratio, and low grade deposit. The total pit tonnage is 100 Mt of combined ore and waste.

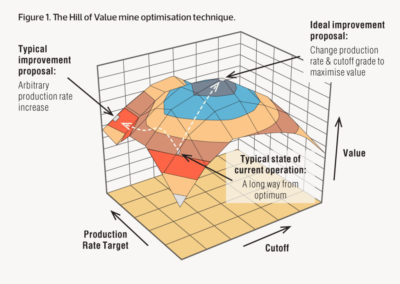

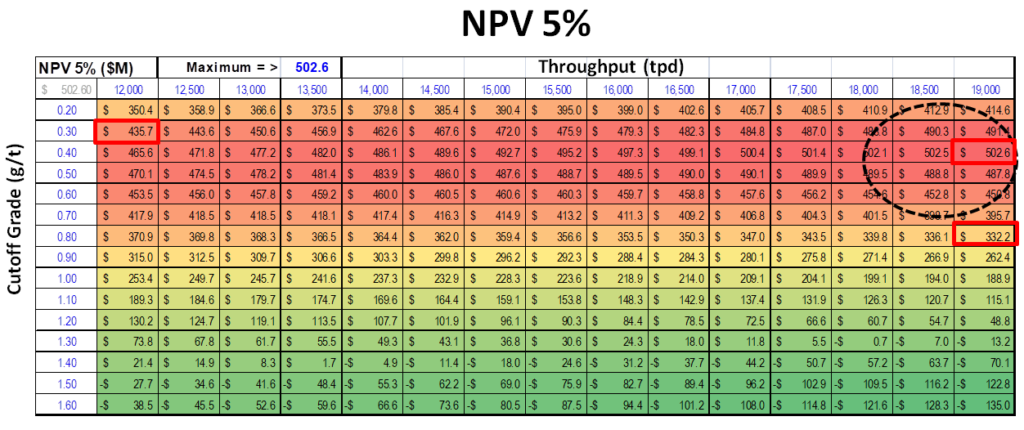

The Hill of Value is an interesting optimization concept to apply to a project. In the example I have provided, the optimal project varies depending on what the financial objective is. I don’t know if this would be the case with all projects, however I suspect so.

The Hill of Value is an interesting optimization concept to apply to a project. In the example I have provided, the optimal project varies depending on what the financial objective is. I don’t know if this would be the case with all projects, however I suspect so.

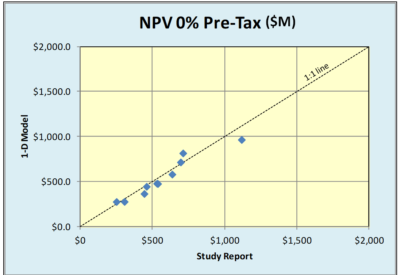

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model.

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model. There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

Perhaps with technology, like Zoom, one can replicate the personal feel of a trade show booth. One can still have back and forth conversations with investors rather than just doing lecture style webinars.

Perhaps with technology, like Zoom, one can replicate the personal feel of a trade show booth. One can still have back and forth conversations with investors rather than just doing lecture style webinars. Management teams should introduce more than just the CEO or COO. Include VP’s of geology, engineering, corporate development, from time to time. Don’t hesitate to let the public meet more of your team. Trade show booths are often manned by different team members.

Management teams should introduce more than just the CEO or COO. Include VP’s of geology, engineering, corporate development, from time to time. Don’t hesitate to let the public meet more of your team. Trade show booths are often manned by different team members. Better communication with investors can increase confidence in a management team. Although some investors may not enjoy technical discussions, I think there is a subset that will find them very helpful and interesting. There will likely be an audience out there.

Better communication with investors can increase confidence in a management team. Although some investors may not enjoy technical discussions, I think there is a subset that will find them very helpful and interesting. There will likely be an audience out there. As an aside, if you are using Zoom make sure the host has configured the right settings. There are instances where anonymous participants can suddenly share their own computer screen, i.e. with questionable videos, to the group. It’s been referred to as “zoom bombing”.

As an aside, if you are using Zoom make sure the host has configured the right settings. There are instances where anonymous participants can suddenly share their own computer screen, i.e. with questionable videos, to the group. It’s been referred to as “zoom bombing”.

The number of independent mining consultants is increasing daily as more people reach retirement age or are made redundant.

The number of independent mining consultants is increasing daily as more people reach retirement age or are made redundant. GLG (

GLG ( Digbee (

Digbee (

Reading it further, it was apparent that their study consultant, Ausenco, was being paid in company stock in lieu of cash. The arrangement included an initial financing of $750k with a further $375k to follow once the pre-feasibility study was 75% complete. Upon completion of the study another share payment was due.

Reading it further, it was apparent that their study consultant, Ausenco, was being paid in company stock in lieu of cash. The arrangement included an initial financing of $750k with a further $375k to follow once the pre-feasibility study was 75% complete. Upon completion of the study another share payment was due. I have never been in a situation where I was consulting with company shares as my compensation. Neither have I ever managed a study where outside consultants were being paid in shares. However I can see the possibility of interesting dynamics at play.

I have never been in a situation where I was consulting with company shares as my compensation. Neither have I ever managed a study where outside consultants were being paid in shares. However I can see the possibility of interesting dynamics at play. Regarding the first item “impartiality”, in the past there have been questions raised about the impartiality of engineering firms. I first recall reading this claim many years ago in a public response to a mining EIA application. Unfortunately I cannot find the exact source now.

Regarding the first item “impartiality”, in the past there have been questions raised about the impartiality of engineering firms. I first recall reading this claim many years ago in a public response to a mining EIA application. Unfortunately I cannot find the exact source now. It would be interesting to know how many consulting firms would be willing to accept compensation solely in shares. Stock prices move up and down and the outcome of the study itself can have an impact on share performance.

It would be interesting to know how many consulting firms would be willing to accept compensation solely in shares. Stock prices move up and down and the outcome of the study itself can have an impact on share performance.