A while ago I posted an article about how one can evaluate the economic potential of a gold deposit using early-stage exploration intercepts. That article can be found at this link. Doing the same evaluation for a polymetallic deposit is a bit more challenging. There will be different metals of interest, with variable grades, prices, and process recoveries.

When disclosing polymetallic drill results, many companies will convert the multiple metal grades into a single equivalent grade. I am not a big proponent of that approach.

When disclosing polymetallic drill results, many companies will convert the multiple metal grades into a single equivalent grade. I am not a big proponent of that approach.

I prefer using the rock value, whether calculated as a recoverable “NSR dollar value per tonne” or as an “insitu value per tonne”. Either rock value is fine for my purposes.

Interestingly NI 43-101 prohibits the disclosure of insitu rock value but allows the use of metal-equivalents. In my view this is a bit counter-intuitive since the equivalent grade can be more misleading than rock value.

What can drill intercepts show

The three aspects that interest me the most when looking at early-stage drill results are:

The three aspects that interest me the most when looking at early-stage drill results are:

-

The economic value of the rock (in $/t tonne). This can either be “insitu value” (assuming 100% recovery, 100% payable) or the “NSR value” incorporating recovery and payable factors (if available). Personally, the 100% insitu value is simpler to calculate and assess.

-

The depth to the top of the economic zone, which indicates if this deposit would be a lower cost open pit mine or must be a higher cost underground mine.

-

The length of the economic intervals, which indicates whether bulk mining approaches are viable versus the need to selectively mine narrow ore zones. The economic interval lengths also give a sense for the potential tonnage size (i.e. is it a big deposit or a small one).

There are two types of early-stage exploration data that can be examined with respect to the three items of interest described above. They are (i) the drill hole assay data and (ii) the drill hole "intercepts of interest". I will show an example of each in this post using sample data from an actual exploration program.

One can examine individual drill hole assays to calculate the rock value profile along each drill hole. One can also examine the rock values for the major and minor intervals of interest reported in company news releases.

I normally like to examine both, but the intervals of interest data is publicly disclosed and more readily available. Drill hole assays are often a bit harder, if not impossible, to track down.

Economic Parameters

In a polymetallic deposit, the insitu rock value is simply the summation of value of the individual metal, based on their respective assay grades. An NSR rock value would apply an adjustment for metal recoveries and smelter payables, thereby lowering the insitu rock value somewhat. However the insitu value is fine if there is no metallurgical or process data to rely upon.

Next one must determine what insitu rock value is deemed potentially economic, i.e. the breakeven cutoff.

One can estimate a processing cost and G&A cost. In an open pit scenario, one doesn’t include the mining cost since the goal is to decide whether to send a truck to the waste dump or to the crusher. Only the processing and G&A cost musts be recovered by the ore value. In an underground mining scenario, one would include the mining cost in the cutoff calculation.

In our example, lets assume a unit processing cost of $12/t and a G&A cost of $$2/t, for a combined cost of $14/t. If we envision a metal recovery range of 75%-95%, we can assume 85% for now.

If we envision a smelter payable range of 75% to 95%, we will assume 85% for that also.

The “NSR factor” would now be 85% x 85% or 75%. Therefore, if the breakeven cost is $14/t, then one should target to mine rock with an insitu value greater than $20/tonne (i.e. $14 / 0.75). This would be the approximate ore vs waste cutoff. It is still only ballpark estimate at this early stage, but good enough for this type of review.

The “NSR factor” would now be 85% x 85% or 75%. Therefore, if the breakeven cost is $14/t, then one should target to mine rock with an insitu value greater than $20/tonne (i.e. $14 / 0.75). This would be the approximate ore vs waste cutoff. It is still only ballpark estimate at this early stage, but good enough for this type of review.

Normally it would be nice to see the average head grade (or rock value) at 3 to 4 times greater than the cutoff grade. This is not a necessity but it is a positive factor.

For example, in a gold deposit with a 0.3 g/t cutoff, one would like to see average head grades at least 0.9 to 1.2 g/t or more. If the average head grade is close to the cutoff grade, then possibly the orebody tonnage may be very sensitive to changes in cutoff. This may not be a good thing.

In our example, with a breakeven cutoff rock value of $20/t, one would like to see some ore zones with insitu values 3-4x higher, or above $60 - $80/t. We can target >$70/t rock as a "nice to have" with $20/t as the cutoff.

So far, its all pretty simple. Let’s look at some actual exploration data to see how to apply this approach.

Our example will be a polymetallic deposit containing four metals of interest; copper, gold, cobalt, and iron. One can examine a few drill holes as well as the intervals of interest.

Metal prices used in this example are Cu = $4/lb, Au = $1980/oz, Co = $15.50/lb, Fe concentrate = $100/tonne, assuming 100% recovery and 100% payable for everything.

Drill Hole Assays Examples

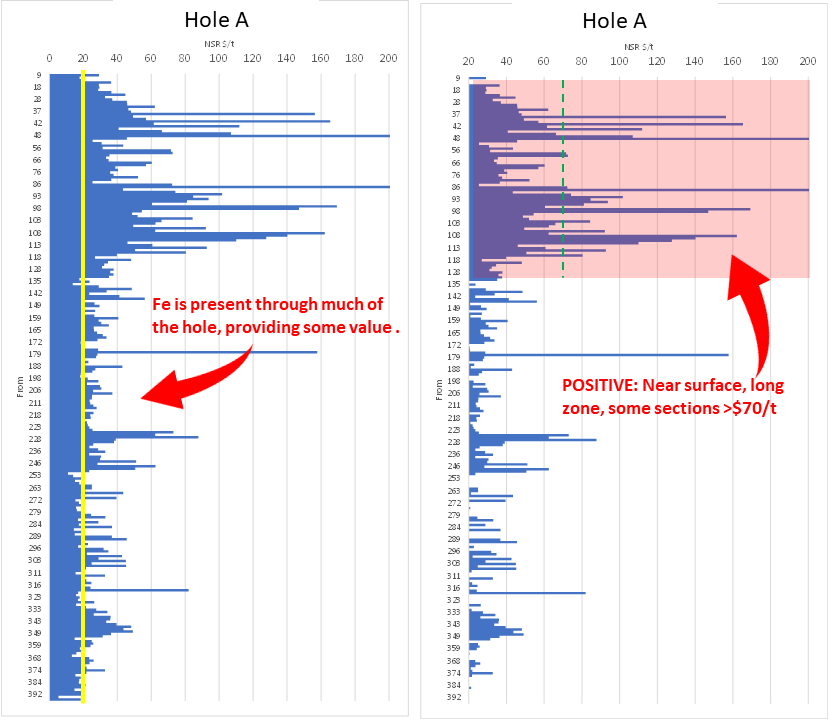

The following three graphs show down hole profiles for Drill Holes A, B, C. For each hole there are two plots. One plot shows the insitu rock values down the hole. The second plot is the same, except the x-axis minimum has been set to the breakeven cutoff value of $20/t. This is done simply to highlight the potentially economic zones.

Hole A:

Shows positive economic results with ore quality rock starting near surface and extending down to 120 metres.

While many of the assay values are between $20-$70/t there are a significant number exceeding $70/t.

This hole has good economic potential for production.

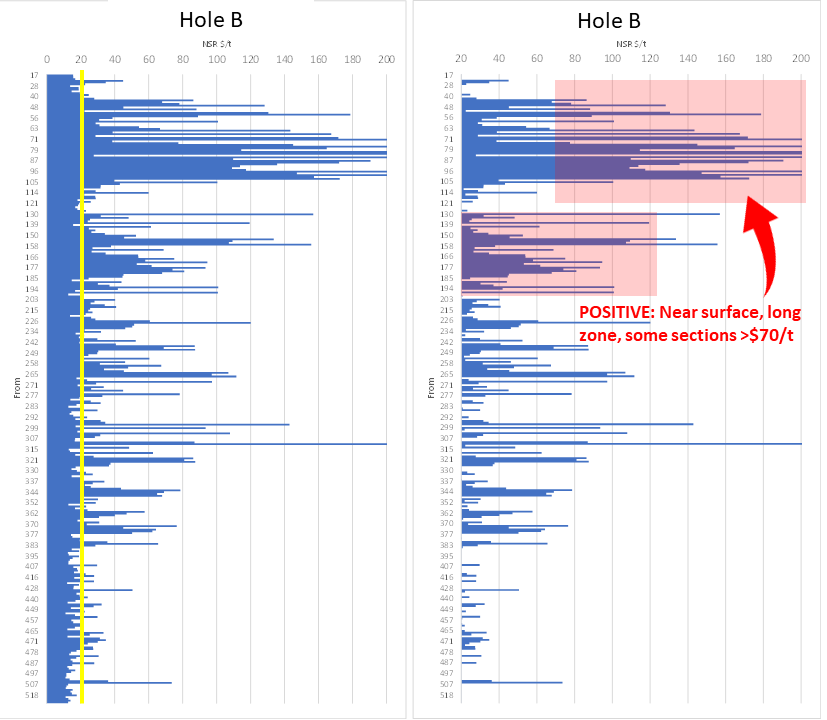

Hole B:

Shows positive economic results with economic rock starting near surface. There are multiple economic zones extending all the way down to 370 metres.

The upper part of the hole, from 40m to 100m, shows multiple assay values exceeding the $70 target.

A second potentially economic zone is seen at a depth of 130m to 190m, which is still within the open pit mining range.

This hole also has good economic potential.

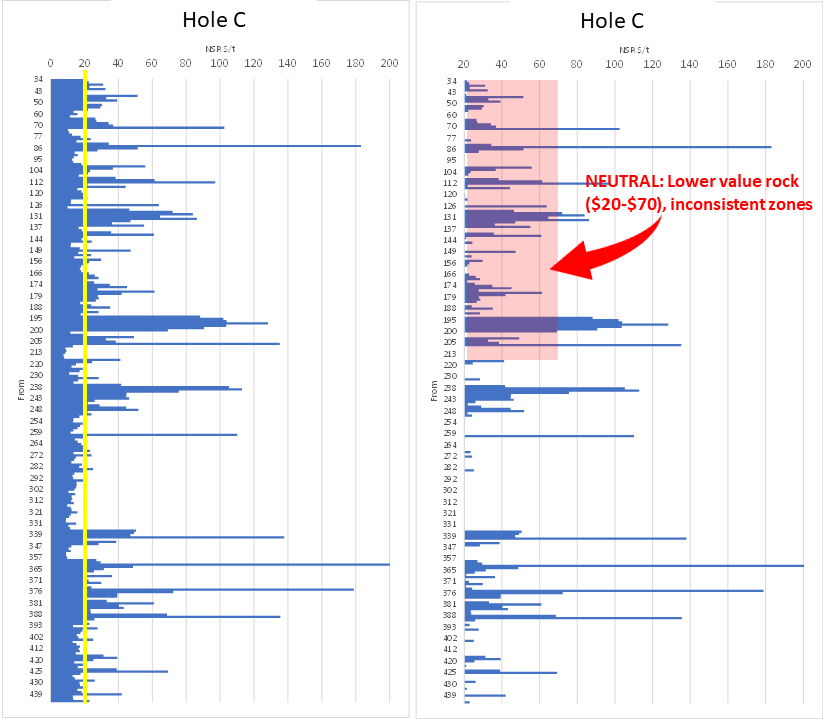

Hole C:

For comparison purposes, Hole C is neutral in that while there are multiple potentially economic zones, they have lower insitu value.

This hole doesn't have the economic consistency that was seen in Holes A and B.

Possibly this hole may be near the edge of the ore body, in which case such a profile is not unexpected.

Normally I would not spend a lot of time examining holes with little to no grade. Some may consider this as a biased view. However, every orebody has its limits, and what is occurring along the edges isn’t that critical in my view.

My objective is to understand what is happening in the core of the orebody, since that is what will dictate the overall economics. Is the core of the orebody marginal value, or does it consist of high value rock? Ultimately it will be the exploration company's task to keep drilling to define if there is sufficient tonnage of this higher value rock to justify a mine. However this shows that at least the grades are there.

Intervals of Interest Example

The next series of plots examines the insitu rock values over drill intervals typically published in a company news releases. The intervals of interest will composite the individual assays over larger widths based on the company’s technical judgement.

It is interesting to see whether the larger intervals have good economic potential. The following charts combine both major intervals with minor zones, often referred to as “including” in news releases. Both major and minor intervals can provide useful information.

Insitu Rock Value vs Depth:

This chart shows the rock values for multiple report intervals versus their depth (top) along the hole.

One can see multiple intervals at open pit depths (<250 m) with insitu values above the $20/t cutoff and above the $70/t threshold.

Within the upper 250 metres, we are seeing multiple intervals with good value. That is a positive sign.

Note that these depths are not depths from surface, but distance along the drill hole. In reality the intervals may be slightly closer to surface, depending on the hole inclination.

Insitu Rock Value vs Interval Length:

The next question to ask is whether the higher value zones are narrow or wide?

In the example here one can see some wide zones (70 to 90m) with rock values in the range of $40-70/t. These are good open pit mining widths.

There are numerous higher grade zones ($70-$200/t) in the 5m to 20m width range. These widths are still fine for open pit mining.

Some intervals are quite narrow (<5m), being a bit more difficult to mine. Since many of these are higher grade, they will tolerate some mining dilution.

Conclusion

This might be better than each company applying their own unique equivalent grade calculation to their exploration results.

This might be better than each company applying their own unique equivalent grade calculation to their exploration results.

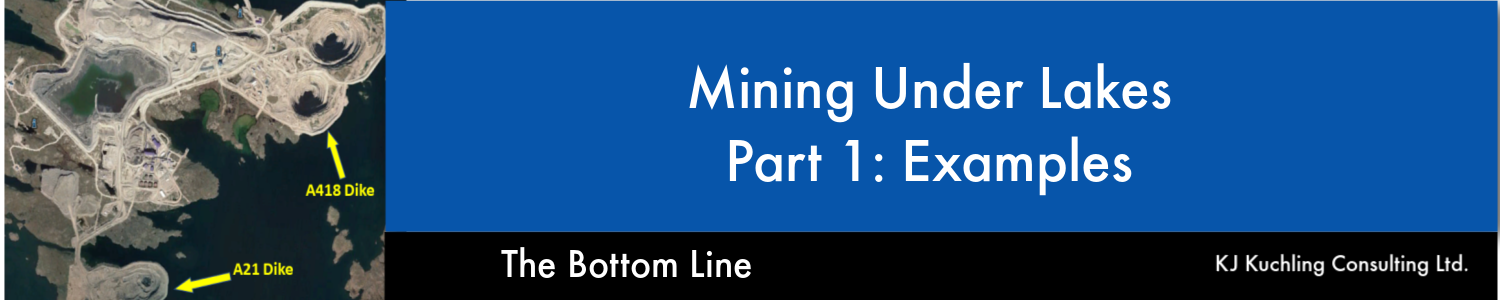

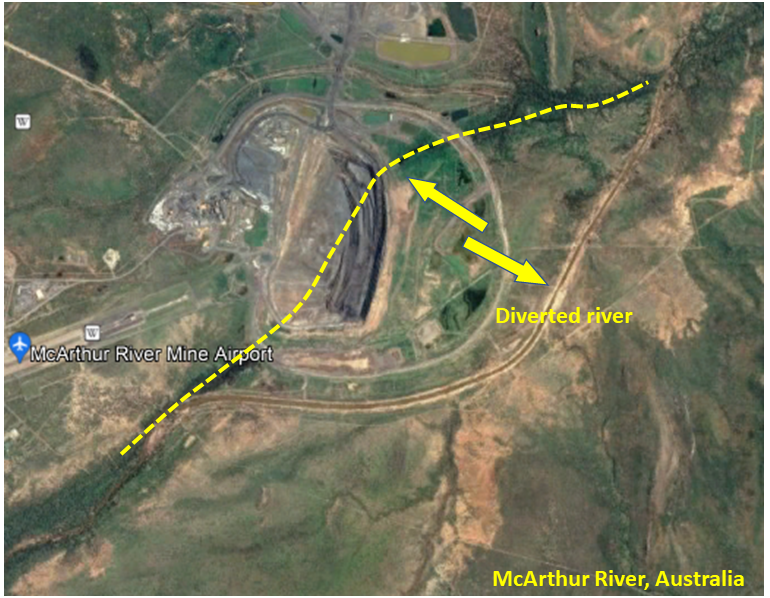

The primary question to be answered is whether one can mine safely and economically without creating significant impacts on the environment.

The primary question to be answered is whether one can mine safely and economically without creating significant impacts on the environment. Lake Turbidity: Dike construction will need to be done through the water column. Works such as dredging or dumping rock fill will create sediment plumes that can extend far beyond the dike. Is the area particularly sensitive to such turbidity disturbances, is there water current flow to carry away sediments?

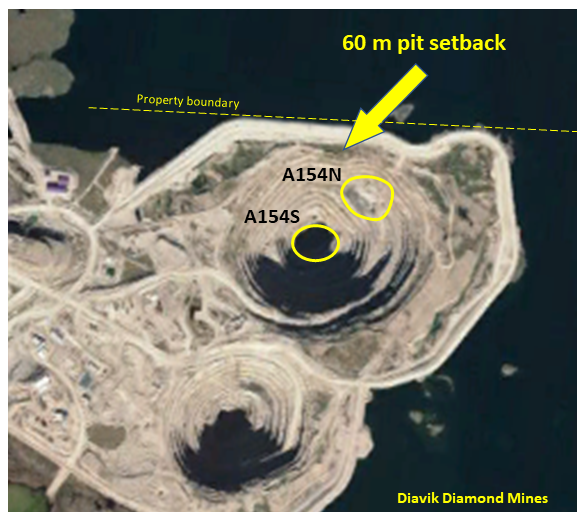

Lake Turbidity: Dike construction will need to be done through the water column. Works such as dredging or dumping rock fill will create sediment plumes that can extend far beyond the dike. Is the area particularly sensitive to such turbidity disturbances, is there water current flow to carry away sediments? Pit wall setback: Given the size and depth of the open pit, how far must the dike be from the pit crest? Its nice to have 200 metre setback distance, but that may push the dike out into deeper water.

Pit wall setback: Given the size and depth of the open pit, how far must the dike be from the pit crest? Its nice to have 200 metre setback distance, but that may push the dike out into deeper water. Once the approximate location of the dike has been identified, the next step is to examine the design of the dike itself. Most of the issues to be considered relate to the geotechnical site conditions.

Once the approximate location of the dike has been identified, the next step is to examine the design of the dike itself. Most of the issues to be considered relate to the geotechnical site conditions. Each mine site is different, and that is what makes mining into water bodies a unique challenge. However many mine operators have done this successfully using various approaches to tackle the challenge.

Each mine site is different, and that is what makes mining into water bodies a unique challenge. However many mine operators have done this successfully using various approaches to tackle the challenge.

NPV One is targeting to replace the typical Excel based cashflow model with an online cloud model. It reminds me of personal income tax software, where one simply inputs the income and expense information, and then the software takes over doing all the calculations and outputting the result.

NPV One is targeting to replace the typical Excel based cashflow model with an online cloud model. It reminds me of personal income tax software, where one simply inputs the income and expense information, and then the software takes over doing all the calculations and outputting the result. Pros

Pros Like anything, nothing is perfect and NPV may have a few issues for me.

Like anything, nothing is perfect and NPV may have a few issues for me. The NPV One software is an option for those wishing to standardize or simplify their financial modelling.

The NPV One software is an option for those wishing to standardize or simplify their financial modelling.

We likely have all heard the statement that increasing pit wall angles will result in significant cost savings to the mining operation.

We likely have all heard the statement that increasing pit wall angles will result in significant cost savings to the mining operation. The results of applying the increased inter-ramp angle to each of the four pits is shown in the Bar Chart. Note that the waste reduction is not necessarily the same for each pit. It depends on the specific topography around each pit.

The results of applying the increased inter-ramp angle to each of the four pits is shown in the Bar Chart. Note that the waste reduction is not necessarily the same for each pit. It depends on the specific topography around each pit. In general one can typically see four positive outcomes from adopting steeper pit walls. They are as follows:

In general one can typically see four positive outcomes from adopting steeper pit walls. They are as follows: 4. Pit Crest Location: The steeper wall angles result in a shift in the final pit crest location. The Image shows the impact that the 5 degree steepening had on the crest location for one of the pits in this scenario.

4. Pit Crest Location: The steeper wall angles result in a shift in the final pit crest location. The Image shows the impact that the 5 degree steepening had on the crest location for one of the pits in this scenario. It is relatively easy to justify spending additional time and money on proper geotechnical investigations and geotechnical monitoring given the potential slope steepening benefits.

It is relatively easy to justify spending additional time and money on proper geotechnical investigations and geotechnical monitoring given the potential slope steepening benefits.

I remember in the late fall of that year, the company had a chance to bid on a larger project in Gros Morne National Park, Newfoundland. So our President, Frank Nolan (he was a brother to Fred Nolan, the infamous land-owner at Oak Island, by the way), decided he wanted to see the site and he chartered a Bell 106 helicopter to fly us there from Deer Lake. It was December (they say “December month” in that province) and when we got close to the Park, we ran into a sudden snow squall.

I remember in the late fall of that year, the company had a chance to bid on a larger project in Gros Morne National Park, Newfoundland. So our President, Frank Nolan (he was a brother to Fred Nolan, the infamous land-owner at Oak Island, by the way), decided he wanted to see the site and he chartered a Bell 106 helicopter to fly us there from Deer Lake. It was December (they say “December month” in that province) and when we got close to the Park, we ran into a sudden snow squall. The QMM field office In Port Dauphin, Madagascar was located near the edge of town, and I typically walked from my lodging to the office each morning when I was there, about the time when school started for the children. Typically I passed dozens and dozens of tiny bamboo huts with corrugated metal roofs, and dirt floors each about 2 meters square.

The QMM field office In Port Dauphin, Madagascar was located near the edge of town, and I typically walked from my lodging to the office each morning when I was there, about the time when school started for the children. Typically I passed dozens and dozens of tiny bamboo huts with corrugated metal roofs, and dirt floors each about 2 meters square. It is one thing to briefly visit a remote project as part of a review team. It is another thing to be there as part of a design team trying to solve a problem and engineer a solution. I know of many engineers and geologists that would have similar work life experiences as part of their careers. However John has taken the initiative to write it all down.

It is one thing to briefly visit a remote project as part of a review team. It is another thing to be there as part of a design team trying to solve a problem and engineer a solution. I know of many engineers and geologists that would have similar work life experiences as part of their careers. However John has taken the initiative to write it all down.

This game is part of a coal-mining game trilogy created by Thomas Spitzer in Germany. The players take the role of farmers with opportunities to exploit the presence of coal in the Ruhr region of Germany. During the game, players acquire knowledge about coal, extend their farms, and dig deeper in the ground to extract more coal.

This game is part of a coal-mining game trilogy created by Thomas Spitzer in Germany. The players take the role of farmers with opportunities to exploit the presence of coal in the Ruhr region of Germany. During the game, players acquire knowledge about coal, extend their farms, and dig deeper in the ground to extract more coal. In the second game of Spitzer’s trilogy, you are still in the Ruhr region in the 18th century, at the beginning of the industrial revolution. The Ruhr river presented a transportation route from the coal mines. However, the Ruhr was filled with obstacles and large dams, making it incredibly difficult to navigate.

In the second game of Spitzer’s trilogy, you are still in the Ruhr region in the 18th century, at the beginning of the industrial revolution. The Ruhr river presented a transportation route from the coal mines. However, the Ruhr was filled with obstacles and large dams, making it incredibly difficult to navigate. This game may still be in German text only. Players are the administrator of a coal mine, and experience competition while living through a piece of Ruhr Valley history.

This game may still be in German text only. Players are the administrator of a coal mine, and experience competition while living through a piece of Ruhr Valley history. This game takes on a more negative view of the mining industry. It is described as “A bold take on the economics in the brutal industry that is asbestos.” The game players assume the role of a global asbestos company.

This game takes on a more negative view of the mining industry. It is described as “A bold take on the economics in the brutal industry that is asbestos.” The game players assume the role of a global asbestos company. In 1983 my brother, at the age of 10, got his Commodore 64 computer and was eagerly learning to program in BASIC. He was always looking for ideas on what he could write programs about. I had graduated from McGill in Mining Engineering a few years earlier, so I suggested he write a simple computer game about mining as his project.

In 1983 my brother, at the age of 10, got his Commodore 64 computer and was eagerly learning to program in BASIC. He was always looking for ideas on what he could write programs about. I had graduated from McGill in Mining Engineering a few years earlier, so I suggested he write a simple computer game about mining as his project. Over the last few months I decided to learn VBA (Visual Basic for Applications). VBA is a programming language the works with Microsoft Office products, mainly Excel.

Over the last few months I decided to learn VBA (Visual Basic for Applications). VBA is a programming language the works with Microsoft Office products, mainly Excel.

Overburden is a generalized termed used to describe unconsolidated material encountered at a mine. It can consist of gravels, sands, silts, and clays and combinations of each. Usually overburden is not given much focus in many mining studies. Very often, the overburden as a unit, is not adequately characterized.

Overburden is a generalized termed used to describe unconsolidated material encountered at a mine. It can consist of gravels, sands, silts, and clays and combinations of each. Usually overburden is not given much focus in many mining studies. Very often, the overburden as a unit, is not adequately characterized. These are the clays most people are familiar with, i.e. a sedimentary deposit of very fine particles that have settled in a calm body of water. Normally consolidated clays are generally not a problem, other than having a high moisture content. As such, they can be very sticky in loader buckets, truck boxes, and when feeding crushers.

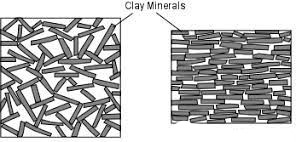

These are the clays most people are familiar with, i.e. a sedimentary deposit of very fine particles that have settled in a calm body of water. Normally consolidated clays are generally not a problem, other than having a high moisture content. As such, they can be very sticky in loader buckets, truck boxes, and when feeding crushers. Clays in general consist of very fine plate like particles, as shown in this sketch. In over-consolidated clays, these particles have been flattened and tightly compressed as in the right image. The result is that the clay may be dense, have a good cross bedding shear strength, but very low shear strength along the plates. This characteristic is analogous to the lubricating properties of graphite, which is facilitated by sliding along graphite plates.

Clays in general consist of very fine plate like particles, as shown in this sketch. In over-consolidated clays, these particles have been flattened and tightly compressed as in the right image. The result is that the clay may be dense, have a good cross bedding shear strength, but very low shear strength along the plates. This characteristic is analogous to the lubricating properties of graphite, which is facilitated by sliding along graphite plates. My experience with sensitive clays was at the former BHP bauxite mining operations along the northern coast of Suriname. There were Demerara clay channels up to 20m thick over top of many of their open pits. The bucketwheel excavators used for waste stripping would trigger the quick clay slope failures, sometimes resulting in the crawler tracks being buried and unfortunately also causing some worker fatalities.

My experience with sensitive clays was at the former BHP bauxite mining operations along the northern coast of Suriname. There were Demerara clay channels up to 20m thick over top of many of their open pits. The bucketwheel excavators used for waste stripping would trigger the quick clay slope failures, sometimes resulting in the crawler tracks being buried and unfortunately also causing some worker fatalities. I recall walking up towards a bucketwheel digging face as the machine quietly churned away. About 70 metres from the machine, we would see cracks quietly opening all around us as the ground mass was starting to initiate its flow towards the machine. Most times the bucketwheel could just sit there and dig. Instead of the machine having to advance toward the face, the face would advance towards the machine.

I recall walking up towards a bucketwheel digging face as the machine quietly churned away. About 70 metres from the machine, we would see cracks quietly opening all around us as the ground mass was starting to initiate its flow towards the machine. Most times the bucketwheel could just sit there and dig. Instead of the machine having to advance toward the face, the face would advance towards the machine. The formation of the diamond deposits in northern Canada often involved the explosive eruption of kimberlite pipes under bodies of water. The lakebed muds and expelled kimberlite by the eruption would collapse back into the crater, resulting in a mix of mud and kimberlite (yellow zones in the image). This muddy kimberlite could be soft, weak, and difficult to mine with underground methods.

The formation of the diamond deposits in northern Canada often involved the explosive eruption of kimberlite pipes under bodies of water. The lakebed muds and expelled kimberlite by the eruption would collapse back into the crater, resulting in a mix of mud and kimberlite (yellow zones in the image). This muddy kimberlite could be soft, weak, and difficult to mine with underground methods. At many tropical mining operations (west African gold projects for example) the upper bedrock has undergone weathering, resulting in the fresh rock being decomposed into saprolite. This clay-rich material can exceed 50 metres in thickness, can be fairly soft and diggable without blasting. This is an obvious mining cost benefit.

At many tropical mining operations (west African gold projects for example) the upper bedrock has undergone weathering, resulting in the fresh rock being decomposed into saprolite. This clay-rich material can exceed 50 metres in thickness, can be fairly soft and diggable without blasting. This is an obvious mining cost benefit. Compacted clay fill can also be used as a pond liner material for water retention ponds.

Compacted clay fill can also be used as a pond liner material for water retention ponds.

Mining has been a part of my life for as long as I can remember. Being born in Sudbury, many of my family members have been, or are currently involved, in mining through a variety of occupations, including my father who I idolized. However, I never knew my true interest in the industry until my 11th-grade technology class. I had a teacher who was passionate about the mining industry, and he created a project that involved developing a very basic mine design.

Mining has been a part of my life for as long as I can remember. Being born in Sudbury, many of my family members have been, or are currently involved, in mining through a variety of occupations, including my father who I idolized. However, I never knew my true interest in the industry until my 11th-grade technology class. I had a teacher who was passionate about the mining industry, and he created a project that involved developing a very basic mine design. Before my first year of university, I had a summer job tramming at Macassa Mine in Kirkland Lake Ontario, which has been in production since 1933. My mentality was to get the boots on the ground and get the job done, whatever it took (with proper safety precautions of course). Using rail systems, dumping ore cars manually, jackleg drilling, etc. gave me the perspective that mining was archaic, mining was rough, and mining was only about the ounces.

Before my first year of university, I had a summer job tramming at Macassa Mine in Kirkland Lake Ontario, which has been in production since 1933. My mentality was to get the boots on the ground and get the job done, whatever it took (with proper safety precautions of course). Using rail systems, dumping ore cars manually, jackleg drilling, etc. gave me the perspective that mining was archaic, mining was rough, and mining was only about the ounces. To change the negative view around mining, I believe the main focal point should be electric equipment and the ability for remote operation/work. With all this newly developed technology at our fingertips, I know that future operations will be safer and more sustainable, which should be better portrayed.

To change the negative view around mining, I believe the main focal point should be electric equipment and the ability for remote operation/work. With all this newly developed technology at our fingertips, I know that future operations will be safer and more sustainable, which should be better portrayed. Even creating a mining simulation video game where you can run through a story of being a manager, excavator/scoop operator, truck driver, etc. would get the thought of mining brought into the coming generations at a younger age. This would increase the talent pool from the more typical operator because more and more youth are getting skilled at remote operation through video games due to their increased screen time.

Even creating a mining simulation video game where you can run through a story of being a manager, excavator/scoop operator, truck driver, etc. would get the thought of mining brought into the coming generations at a younger age. This would increase the talent pool from the more typical operator because more and more youth are getting skilled at remote operation through video games due to their increased screen time. People get comfortable and people are afraid to leave home, so selling a career that allows for boundless flexibility in job tasks and constant stimulation while living wherever you desire could allow a shrinkage in the current technical gap.

People get comfortable and people are afraid to leave home, so selling a career that allows for boundless flexibility in job tasks and constant stimulation while living wherever you desire could allow a shrinkage in the current technical gap. So do I think the mining industry is archaic…. not anymore.

So do I think the mining industry is archaic…. not anymore. Firstly, I would like to thank this engineer for taking time to write out his well formed thoughts, and for allowing me to share them.

Firstly, I would like to thank this engineer for taking time to write out his well formed thoughts, and for allowing me to share them.

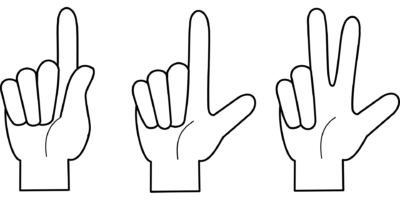

I would suggest that the three reporting categories be used instead of two, described as follows:

I would suggest that the three reporting categories be used instead of two, described as follows: