As a mining engineer, I am not usually called in to review a project that is still at the exploration stage. This is normally the domain of the geologist. However from time to time I have an interest in better understanding the potential of an early stage mining project. This could be on behalf of a client, for investing purposes, or just for personal curiosity.

At the exploration stage one only has drill interval data from news releases to examine. A resource estimate may still be unavailable.

At the exploration stage one only has drill interval data from news releases to examine. A resource estimate may still be unavailable.

The drill data can consist of long intervals of low grade or short intervals of high grade and everything in between. What does it all mean and what can it tell you?

The following describes an approach I use for examining early stage gold deposits. The logic can be expanded to other metals but would take more effort.

My focus is on gold because it has been the predominant deposit of interest over the last few years, and it is simpler to analyze quickly.

We All Like Scatter Plots

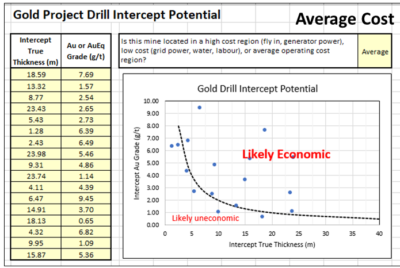

My approach relies on a scatter plot to visual examine the distribution of interval thicknesses and gold grades. Where these data points cluster or how they are distributed can provide some prediction on the overall economic potential of a project. Its not a guarantee, but only an indicator.

I try to group the analysis into potential open pit intervals (0 to 200 metres from surface) and potential underground (deeper than 200m) intervals. This is because a 20m wide interval grading 2.0 g/t is of economic interest when near surface, however of less interest if occurring at a 300m depth.

Using information from a news release, I create a two column Excel table of highlighted intervals and assay grades. The nice thing about using intervals is that the company has provided their view of the mineable widths.

Using information from a news release, I create a two column Excel table of highlighted intervals and assay grades. The nice thing about using intervals is that the company has provided their view of the mineable widths.

If one is provided with raw 1-metre assay data you would have to make that decision, which can be a significant task. The company has already helped make those decisions.

Normally I tend to use the highlighted sub-intervals and not the main intervals since issues with grade smoothing can occur.

A large interval containing multiple high grade sub-intervals may see some grade smoothing.This happens if the grade between sub-intervals is very low grade or even waste. It takes a fair bit of effort to assess this for each drill hole, hence it is easier to work with the sub-intervals.

I have an online calculator (Drill Intercept Calculator) that lets you assess if grade smoothing is occurring.

When inputting the interval thickness, I prefer to use the true thickness and not the interval length. If the assay information does not specify true thicknesses, then I simply multiple the interval length by 0.70 to try to accommodate some possible difference in width. Its all subjective.

The assays can consist of Au (g/t) or AuEq (g/t) if more metals are present. If very high grades are encountered (greater than 10 g/t) I simply input 9.9 g/t into the Excel table so they fit onto my scatter plot. Extremely high grades can be sporadic and localized anyhow.

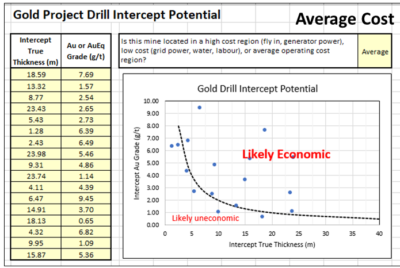

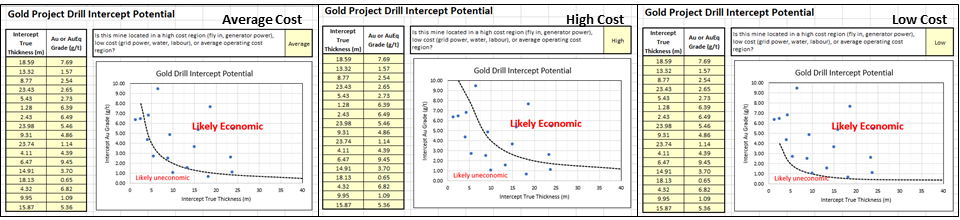

Finally I need to decide whether the project is located in a region of high operating cost, low cost or about average costs. High costs could be with a fly in/ fly out, camp operation, with diesel power, and seasonal access.

A low cost operation could be in temperate climate, with good access to local infrastructure, water, labour, and grid power. An average operation would be somewhere in between the two. Its just a gut feel.

Results

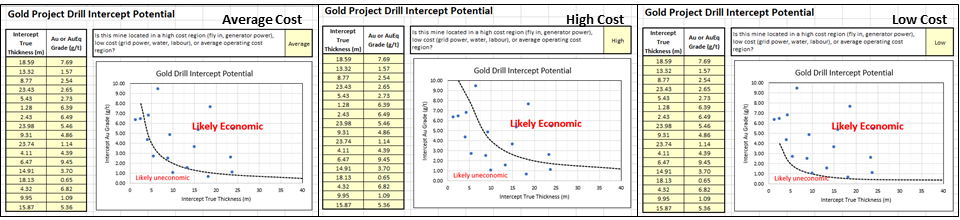

The following charts describe how it works, using randomly generated dummy assay data in this example.

In the Average cost scenario (left chart) the points are equally scattered both above and below the Likely Economic line. As one moves to a high-cost situation (middle chart) the curve moves upwards and more drill intervals now fall below the economic line.

This would give me an unfavorable impression of the project. The third graph is the Low-Cost scenario and one can see that more assays are now above the line. Hence the same project located in a different region would yield a different economic impression.

The economic boundaries (dashed lines) presented in the plots are based on my personal experience and biases. Other people may have different criteria to define what they would view as economic and uneconomic intervals.

Conclusion

There is not much that a layperson person can do with the multitude of exploration data provided in corporate news releases. However, by aggregating the data one can get a sense of where a gold project positions itself economically. The more data points available, the more that one can gather from the plot.

One should prepare separate plots for shallow and deep mineralization or for different zones and deposits on a property rather than aggregate everything together.

It may be possible to undertake a similar analysis with different commodities if one can summarize the assays into a single equivalent value or NSR dollar value. Unfortunately, exploration news releases don’t often include the poly-metallic interval equivalent grade or NSR value. Calculating these manually would add an extra step in the process, however it can be done.

If you want to try out the concept, I have posted the online spreadsheet to my website at the link Drill Intercept Potential where you can input Au exploration data of interest. Unfortunately, you cannot save your input data so it’s a one time event. Anyone can do this – its not rocket science.

Let me know your thoughts, suggestions, or other ways to play with news release data.

If your project contains metals other than gold, then the rock (or ore) value will be based on the revenue from a combination of metals. How to approach this in discussed in another blog post titled “Ore Value Calculator – What’s My Ore Worth?“

Great Bear Resources Example

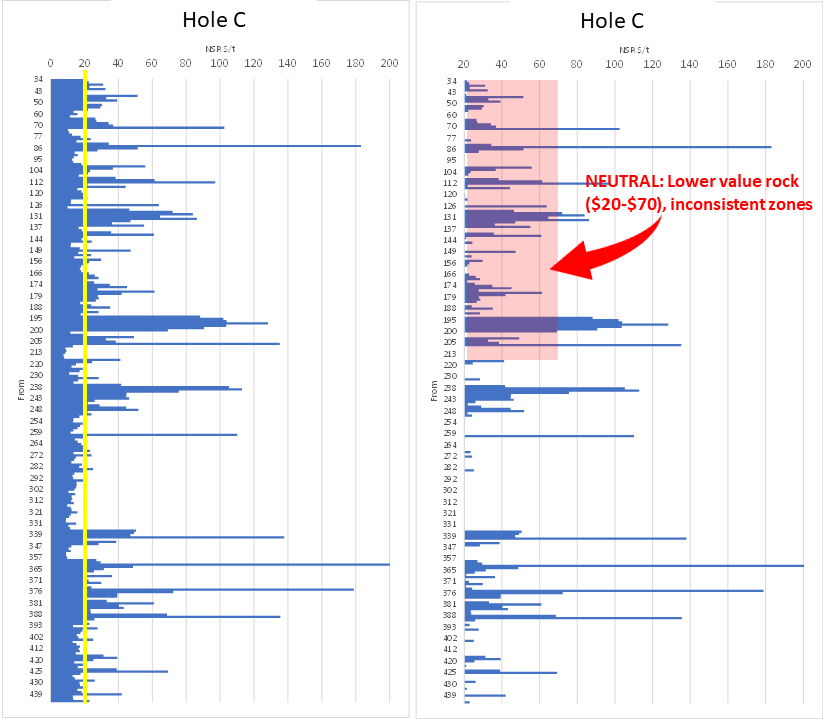

Interesting the Great Bear Resources website allows one to download a data file with all their exploration intervals. I have not seen another company provide this level of transparency. I download their data file of over 1300 intervals and sub-divided them into major intervals and sub-intervals (more ore less). The two plots below show the outcome.

The graph on the left is the sub-intervals showing that many points are above the “economic” line. There are numerous data points along the top axis, indicating many sub-intervals at >10 g/t at widths ranging from 1 to 15 metres. The graph on the right shows the major intervals. While there are still many along the top axis, there are now more along the 40m width but at grades ranging from 1 g.t to 6 g/t.

One would surmise from these plots that overall there are many intervals above the line in the economic zone, showing the potential of the project. It also shows that GBR have encountered many intervals likely sub-economic, but that’s the exploration game.

Great Bear Resources data

Examining polymetallic drill results in a similar manner isn’t as simple as this. The mutiple metals of interest make the calaculations a bit more complex. Another blog post discusses the approach I use for polymetallic, at this this link “Polymetallic Drill Results – Interesting or Not?“

Note: You can sign up for the KJK mailing list to get notified when new blogs are posted. Follow me on Twitter at @KJKLtd for updates and insights.

The lesson is that QP’s signing off on technical information for clients should be proficient in the nature of their work and need to know the reporting rules very well. Some of these incidents involve error and poor judgment, not outright fraud.

The lesson is that QP’s signing off on technical information for clients should be proficient in the nature of their work and need to know the reporting rules very well. Some of these incidents involve error and poor judgment, not outright fraud. 43-101 regulations state that “An issuer must not file a technical report that contains a disclaimer by any qualified person responsible for preparing or supervising the preparation of all or part of the report that

43-101 regulations state that “An issuer must not file a technical report that contains a disclaimer by any qualified person responsible for preparing or supervising the preparation of all or part of the report that

This ends Part 2 of this blog post. It hopefully highlights the importance of QP’s being knowledgably on the disclosure rules and the technical aspects of what they are hired to do.

This ends Part 2 of this blog post. It hopefully highlights the importance of QP’s being knowledgably on the disclosure rules and the technical aspects of what they are hired to do. The focus of this blog is on the types of activities that raised the red flags in the past. I am less interested in naming the people responsible, although the associated web links do provide more detail on the events.

The focus of this blog is on the types of activities that raised the red flags in the past. I am less interested in naming the people responsible, although the associated web links do provide more detail on the events. This ends Part 1 of this blog post. Part 2 will continue with a few more examples, specifically involving Qualified Persons, and can be found at this link

This ends Part 1 of this blog post. Part 2 will continue with a few more examples, specifically involving Qualified Persons, and can be found at this link

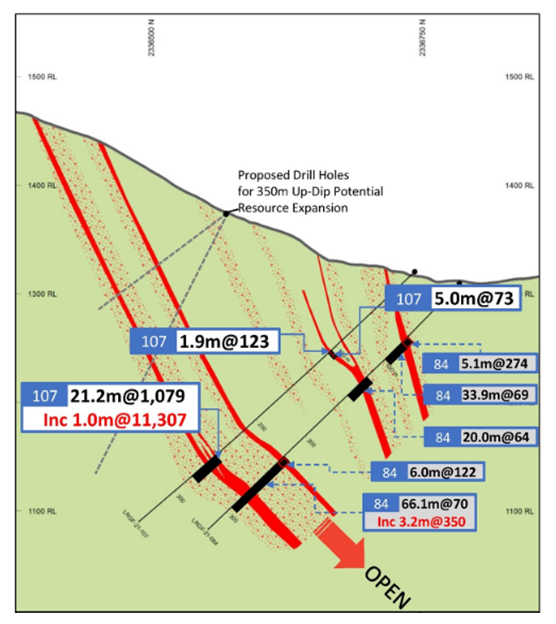

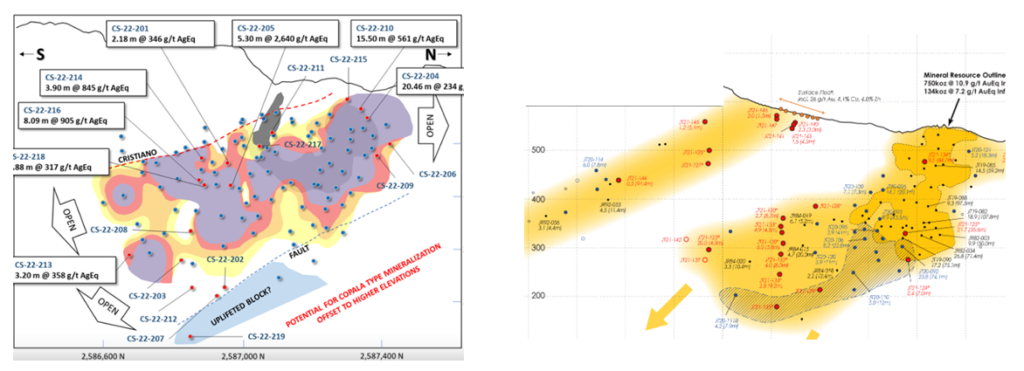

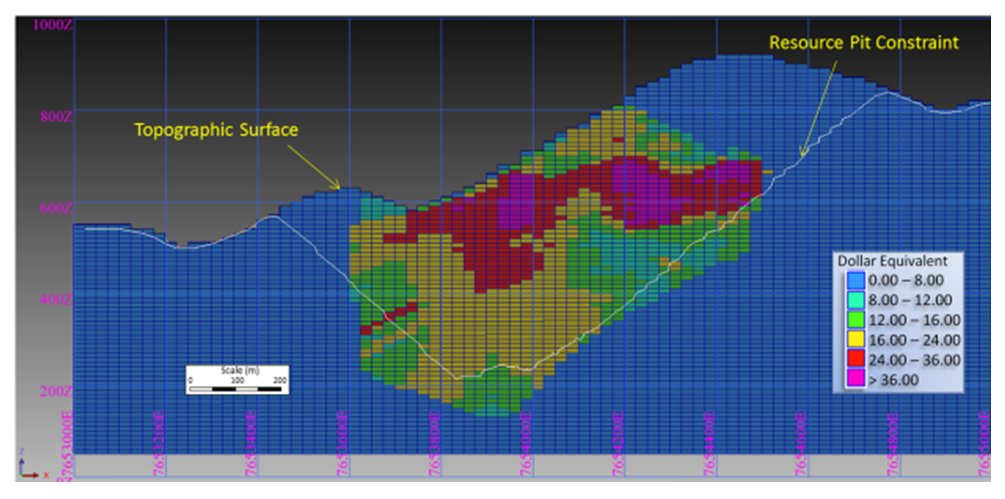

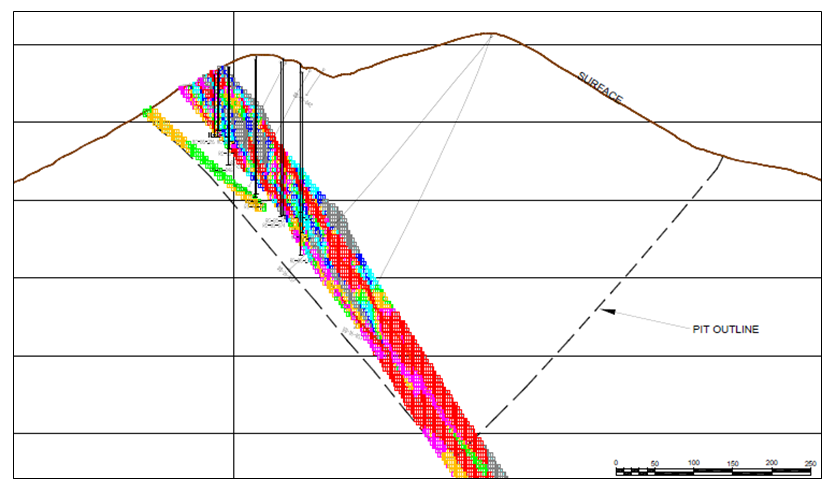

This article is about the benefit of preparing (cutting) more geological cross-sections and the value they bring.

This article is about the benefit of preparing (cutting) more geological cross-sections and the value they bring. Long sections are aligned along the long axis of the deposit. They can be vertically oriented, although sometimes they may be tilted to follow the dip angle of an ore zone.

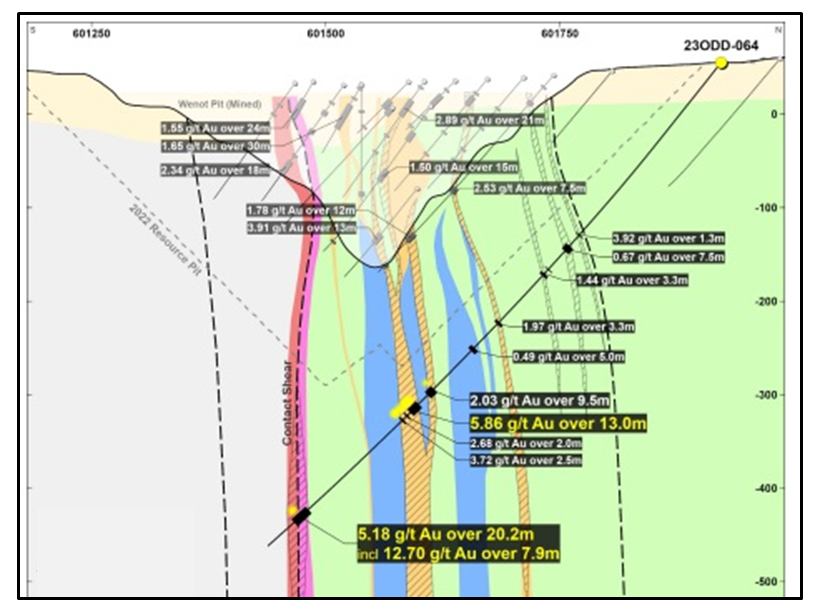

Long sections are aligned along the long axis of the deposit. They can be vertically oriented, although sometimes they may be tilted to follow the dip angle of an ore zone. Cross-sections are generally the most popular geological sections seen in presentations. These are vertical slices aligned perpendicular to the strike of the orebody. They can show the ore zone interpretation, drill holes traces, assays, rock types, and/or color-coded resource block grades.

Cross-sections are generally the most popular geological sections seen in presentations. These are vertical slices aligned perpendicular to the strike of the orebody. They can show the ore zone interpretation, drill holes traces, assays, rock types, and/or color-coded resource block grades. When looking at cross-sections, it is always important to look at multiple cross-sections across the orebody. Too often in reports one may be presented with the widest and juiciest ore zone, as if that was typical for the entire orebody. It likely is not typical.

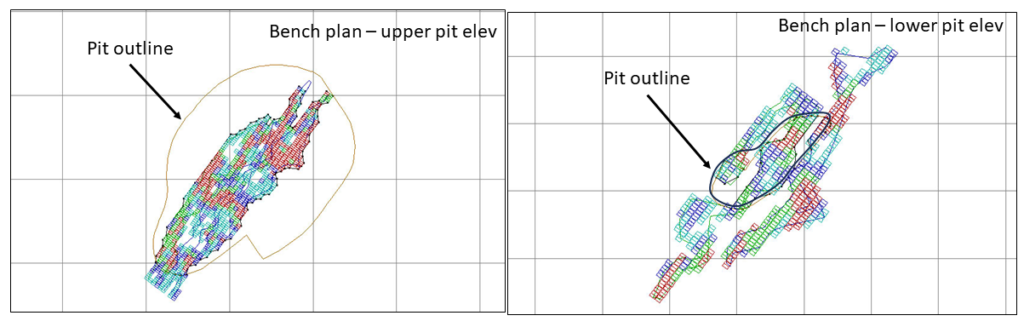

When looking at cross-sections, it is always important to look at multiple cross-sections across the orebody. Too often in reports one may be presented with the widest and juiciest ore zone, as if that was typical for the entire orebody. It likely is not typical. Bench plans (or level plans) are horizontal slices across the ore body at various elevations. In these sections one is looking down on the orebody from above.

Bench plans (or level plans) are horizontal slices across the ore body at various elevations. In these sections one is looking down on the orebody from above. 3D PDF files can be created by some of the geological software packages. They can export specific data of interest; for example topography, ore zone wireframes, underground workings, and block model information. These 3D files allows anyone to rotate an image, zoom in as needed and turn layers off and on.

3D PDF files can be created by some of the geological software packages. They can export specific data of interest; for example topography, ore zone wireframes, underground workings, and block model information. These 3D files allows anyone to rotate an image, zoom in as needed and turn layers off and on. The different types of geological sections all provide useful information. Don’t focus only on cross-sections, and don’t focus only on one typical section. Create more sections at different orientations to help everyone understand better.

The different types of geological sections all provide useful information. Don’t focus only on cross-sections, and don’t focus only on one typical section. Create more sections at different orientations to help everyone understand better.

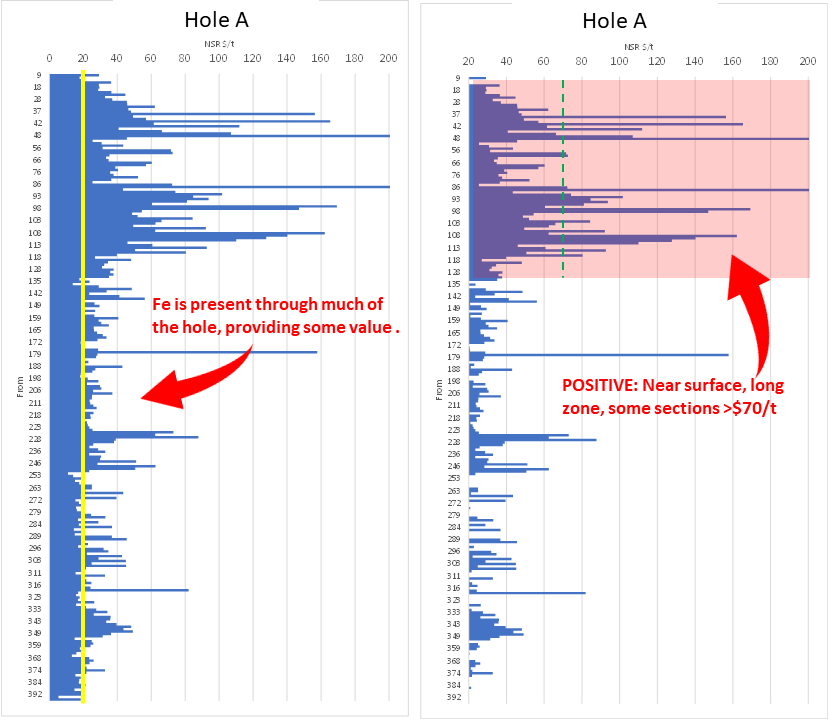

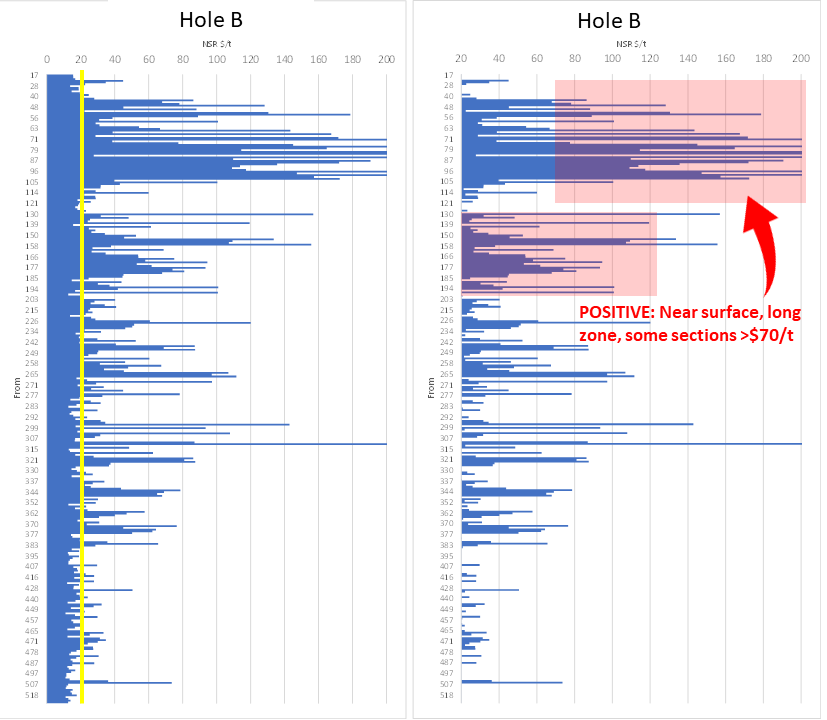

When disclosing polymetallic drill results, many companies will convert the multiple metal grades into a single equivalent grade. I am not a big proponent of that approach.

When disclosing polymetallic drill results, many companies will convert the multiple metal grades into a single equivalent grade. I am not a big proponent of that approach. The three aspects that interest me the most when looking at early-stage drill results are:

The three aspects that interest me the most when looking at early-stage drill results are:

The “NSR factor” would now be 85% x 85% or 75%. Therefore, if the breakeven cost is $14/t, then one should target to mine rock with an insitu value greater than $20/tonne (i.e. $14 / 0.75). This would be the approximate ore vs waste cutoff. It is still only ballpark estimate at this early stage, but good enough for this type of review.

The “NSR factor” would now be 85% x 85% or 75%. Therefore, if the breakeven cost is $14/t, then one should target to mine rock with an insitu value greater than $20/tonne (i.e. $14 / 0.75). This would be the approximate ore vs waste cutoff. It is still only ballpark estimate at this early stage, but good enough for this type of review.

This might be better than each company applying their own unique equivalent grade calculation to their exploration results.

This might be better than each company applying their own unique equivalent grade calculation to their exploration results.

The DRX Drill Hole and Reporting algorithm developed by

The DRX Drill Hole and Reporting algorithm developed by

At the exploration stage one only has drill interval data from news releases to examine. A resource estimate may still be unavailable.

At the exploration stage one only has drill interval data from news releases to examine. A resource estimate may still be unavailable. Using information from a news release, I create a two column Excel table of highlighted intervals and assay grades. The nice thing about using intervals is that the company has provided their view of the mineable widths.

Using information from a news release, I create a two column Excel table of highlighted intervals and assay grades. The nice thing about using intervals is that the company has provided their view of the mineable widths.

Based on my own career, mining has definitely provided me with a chance to travel the world. It will also help anyone overcome their fear of travel. One will also learn that both international and domestic travel can be as equally rewarding. There is nothing wrong with learning more about your own country.

Based on my own career, mining has definitely provided me with a chance to travel the world. It will also help anyone overcome their fear of travel. One will also learn that both international and domestic travel can be as equally rewarding. There is nothing wrong with learning more about your own country.

Business travel has always been one of the best parts of my mining career. I can remember the details about a lot of the travel that I did. Unfortunately the project details themselves will blur with those of other projects.

Business travel has always been one of the best parts of my mining career. I can remember the details about a lot of the travel that I did. Unfortunately the project details themselves will blur with those of other projects.

It’s always open to debate who these 43-101 technical reports are intended for. Generally we can assume correctly that they are not being written mainly for geologists. However if they are intended for a wider audience of future investors, shareholders, engineers, and C-suite management, then (in my view) greater focus needs to be put on the physical orebody description.

It’s always open to debate who these 43-101 technical reports are intended for. Generally we can assume correctly that they are not being written mainly for geologists. However if they are intended for a wider audience of future investors, shareholders, engineers, and C-suite management, then (in my view) greater focus needs to be put on the physical orebody description. I would like to suggest that every technical report includes more focus on the operational aspects of the orebody.

I would like to suggest that every technical report includes more focus on the operational aspects of the orebody. Improving the quality of information presented to investors is one key way of maintaining trust with investors. Accordingly we should look to improve the description of the mineable ore body for everyone. In many cases it is the key to the entire project.

Improving the quality of information presented to investors is one key way of maintaining trust with investors. Accordingly we should look to improve the description of the mineable ore body for everyone. In many cases it is the key to the entire project.

The study concluded that accessing potential deposits at depths of around 1000 m is economically feasible only if curved wells are used. The most relevant operational parameters are sufficient permeability in the ore zone and an adequate contact surface between the ore and leaching solution. The depth of the deposit is indirectly relevant, but more importantly the well installation cost per volume of deposit is critical. Hence curved wells are optimal.

The study concluded that accessing potential deposits at depths of around 1000 m is economically feasible only if curved wells are used. The most relevant operational parameters are sufficient permeability in the ore zone and an adequate contact surface between the ore and leaching solution. The depth of the deposit is indirectly relevant, but more importantly the well installation cost per volume of deposit is critical. Hence curved wells are optimal. I am also curious about the ability to finance such projects, given the caution associated with any novel technology. Many financiers prefer projects that rely on proven and conventional operating methods.

I am also curious about the ability to finance such projects, given the caution associated with any novel technology. Many financiers prefer projects that rely on proven and conventional operating methods.