We hear a lot about the need for the mining industry to adopt sustainable mining practices. Is everyone certain what that actually means? Ask a group of people for their opinions on this and you’ll probably get a range of answers. It appears to me that there are two general perspectives on the issue.

We hear a lot about the need for the mining industry to adopt sustainable mining practices. Is everyone certain what that actually means? Ask a group of people for their opinions on this and you’ll probably get a range of answers. It appears to me that there are two general perspectives on the issue.

Perspective 1 tends to be more general in nature. It’s about how the mining industry as a whole must become sustainable to remain viable. In other words, can the mining industry continue to meet the current commodity demands and the needs of future generations?

Perspective 2 tends to be a bit more stakeholder focused. It relates to whether a mining project will provide long-term sustainable benefits to local stakeholders. Will the mining project be here and gone leaving little behind, or will it make a real (positive) difference? In other words, “what’s in it for us”?

There are still some other perspectives on what is sustainable mining. For example there are some suggestions that sustainable mining should have a wider scope. It should consider the entire life cycle of a commodity, including manufacturing and recycling. That’s a very broad vision for the industry to try to satisfy.

How might mining be sustainable?

The solutions proposed to foster sustainable mining depend on which perspective is considered.

The solutions proposed to foster sustainable mining depend on which perspective is considered.

With respect to the first perspective, the solutions are board brush. They generally revolve around using best practices in socially and environmentally sound ways. A sustainable mining framework is typically focused on reducing the environmental impacts of mining.

Strategies include measuring, monitoring, and continually improving environmental metrics. These metrics can include minimizing land disturbance, pollution reduction, automation, electrification, renewable energy usage, as well as proper closure and reclamation of mined lands.

Unfortunately if the public hates the concept of mining, the drive towards sustainability will struggle. Trying to fight this, the industry is currently promoting itself by highlighting the ongoing need for its products. Unfortunately some have interpreted this to mean “We make a mess because everyone wants the output from that mess”. I’m not sure how effective and convincing that approach will be in the long run.

Focusing on localized benefits

If one views sustainable mining from the second perspective, i.e. “What’s in it for us”, then one will propose different solutions. Maximizing benefits for the local community requires specific and direct actions. Generalizations won’t work. Stakeholder communities likely don’t care about the sustainability of the mining industry as a whole.

If one views sustainable mining from the second perspective, i.e. “What’s in it for us”, then one will propose different solutions. Maximizing benefits for the local community requires specific and direct actions. Generalizations won’t work. Stakeholder communities likely don’t care about the sustainability of the mining industry as a whole.

They want to know what this project can do for them. Will the local community thrive with development or will they be harmed? Are the economic benefits be short lived or generational in duration? Can the project lead to socio-economic growth opportunities that extend beyond the project lifetime? Will the economic benefits be realized locally or will the benefits be distributed regionally?

One suggestion made to me is that all mining operations be required to have long operating lives. This will develop more regional infrastructure and create longer business relationships. A mine life of ten years or less may be insufficient to teach local entrepreneurship. It maybe too short to ensure the long term continuation of economic impacts. Mine life requirement is an interesting thought but likely difficult to enforce.

Nevertheless the industry needs to convince local communities about the benefits they will see from a well executed mining project. Ideally the fear of a mining project would be replaced by a desire for a mining project. Preferably your stakeholders should become your biggest promoters. Working to make individual mining projects less scary may eventually help sustain the entire industry.

What can the industry do?

We have all heard about the actions the industry is considering when working with local communities. Some of these actions might include:

-

Being transparent and cooperative through the entire development process.

-

Using best practices and not necessarily doing things the “cheapest” way.

-

Focusing on long life projects.

-

Helping communities with more local infrastructure improvements.

-

Promoting business entrepreneurship that will extend beyond the mine life.

-

Transferring of post-closure assets to local communities.

There are teams of smart people representing mining companies working with the local communities. These sustainability teams will ultimately be the key players in making or breaking the sustainability of mining industry. They will build and maintain the perception of the industry.

There are teams of smart people representing mining companies working with the local communities. These sustainability teams will ultimately be the key players in making or breaking the sustainability of mining industry. They will build and maintain the perception of the industry.

While geologists or engineers can develop new technology and operating practices, it will be the sustainability teams that will need to sell the concepts and build the community bridges.

The sustainability effort extends well beyond just developing new technical solutions. It also involves politics, socio-economics, personal relationships, global influences, hidden agendas. It can be a minefield to navigate.

Conclusion

I was at the 2019 Progressive Mine Forum in Toronto and a presentation was given on underground compressed air storage. The company was Hydrostor (

I was at the 2019 Progressive Mine Forum in Toronto and a presentation was given on underground compressed air storage. The company was Hydrostor (

Converting an abandoned mine into a power storage facility will still have its challenges. Cost and economic uncertainty are part of that. In addition, permitting such a facility will still require some environmental study.

Converting an abandoned mine into a power storage facility will still have its challenges. Cost and economic uncertainty are part of that. In addition, permitting such a facility will still require some environmental study.

Process water supply, water storage and treatment, and safe disposal of fine solids (i.e. tailings) are major concerns at most mining projects.

Process water supply, water storage and treatment, and safe disposal of fine solids (i.e. tailings) are major concerns at most mining projects. Electrostatic separation is a dry processing technique in which a mixture of minerals may be separated according to their electrical conductivity. The potash industry has studied this technology for decades.

Electrostatic separation is a dry processing technique in which a mixture of minerals may be separated according to their electrical conductivity. The potash industry has studied this technology for decades. The recovery of non-ferrous metals is the economic basis of every metal recycling system. There is worldwide use of eddy separators.

The recovery of non-ferrous metals is the economic basis of every metal recycling system. There is worldwide use of eddy separators. Given the contentious nature of water supply and slurried solids at many mining operations, industry research into dry processing might be money well spent.

Given the contentious nature of water supply and slurried solids at many mining operations, industry research into dry processing might be money well spent.

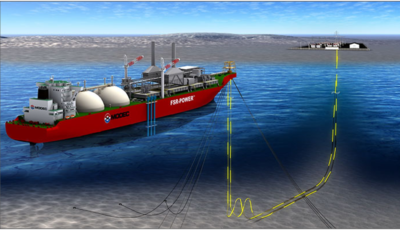

The technology consists of a floating LNG (liquefied natural gas) turbine power plant combined with high capacity seawater desalinization capabilities. MODEC is offering the FSRWP® (Floating Storage Regasification Water-Desalination & Power-Generation) system.

The technology consists of a floating LNG (liquefied natural gas) turbine power plant combined with high capacity seawater desalinization capabilities. MODEC is offering the FSRWP® (Floating Storage Regasification Water-Desalination & Power-Generation) system. From a green mining perspective, the FSRWP produces clean power with the highest thermal efficiency and lowest carbon foot-print.

From a green mining perspective, the FSRWP produces clean power with the highest thermal efficiency and lowest carbon foot-print. Currently there are three mooring options for the floating system that should fit most any tidewater situation.

Currently there are three mooring options for the floating system that should fit most any tidewater situation. The bottom line is that if your mining project is near shore, and has both water supply and power issues, take a look at the FSRWP technology. One might say it is greener technology by using LNG (rather than coal, heavy fuel oil, or diesel) to generate power. At the same time it avoids competition with locals for access to fresh water.

The bottom line is that if your mining project is near shore, and has both water supply and power issues, take a look at the FSRWP technology. One might say it is greener technology by using LNG (rather than coal, heavy fuel oil, or diesel) to generate power. At the same time it avoids competition with locals for access to fresh water.

The mining industry will see positive impacts from digitalization. Unfortunately more reliance on technology also brings with it significant risks. These risks are related to cyber security.

The mining industry will see positive impacts from digitalization. Unfortunately more reliance on technology also brings with it significant risks. These risks are related to cyber security. As your mining company continues to move into the digital world, you must ask:

As your mining company continues to move into the digital world, you must ask: The bottom line is that there is no stopping the digitalization of the mining industry. It is here whether anybody likes it or not. At the same time, there is likely no stopping the growth of cyber crime.

The bottom line is that there is no stopping the digitalization of the mining industry. It is here whether anybody likes it or not. At the same time, there is likely no stopping the growth of cyber crime.

With regards to blockchain, it seems to me the main benefits are being related to supply chains, whether for purchasing or selling activities. Some of the examples given are that one can verify where the cobalt in your phone was mined or where your engagement diamond is from. Oddly though, I don’t recall ever wanting to know where the metal in my phone is from.

With regards to blockchain, it seems to me the main benefits are being related to supply chains, whether for purchasing or selling activities. Some of the examples given are that one can verify where the cobalt in your phone was mined or where your engagement diamond is from. Oddly though, I don’t recall ever wanting to know where the metal in my phone is from. We have seen in manufacturing that robotics will eliminate repetitive type jobs. Will robotic process automation (rPA) be able to do the same by completing repetitive tasks for us?

We have seen in manufacturing that robotics will eliminate repetitive type jobs. Will robotic process automation (rPA) be able to do the same by completing repetitive tasks for us? Collecting hoards of data from a site wide sensor network creates a dilemma in what to do with all the data collected. Smart cities are running into this issue. Who can sort through the data, decide what is important and what is noise, then summarize the data and report on it in real time? A human cannot deal with the amount of data being collected in such networks.

Collecting hoards of data from a site wide sensor network creates a dilemma in what to do with all the data collected. Smart cities are running into this issue. Who can sort through the data, decide what is important and what is noise, then summarize the data and report on it in real time? A human cannot deal with the amount of data being collected in such networks. Regarding the two technologies discussed in this blog, I personally feel robotic process automation will have far greater impact on mining industry future and its profitability.

Regarding the two technologies discussed in this blog, I personally feel robotic process automation will have far greater impact on mining industry future and its profitability.

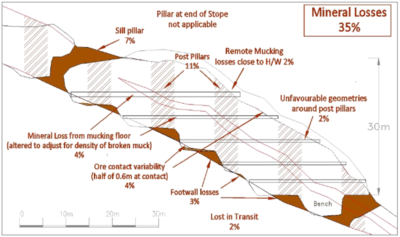

I am not going into detail on Paul’s paper, however some of my key takeaways are as follows. Download the paper to read the rationale behind these ideas.

I am not going into detail on Paul’s paper, however some of my key takeaways are as follows. Download the paper to read the rationale behind these ideas. The bottom line is that not everyone will necessarily agree with all the conclusions of Paul’s paper on underground dilution. However it does raise many issues for technical consideration on your project.

The bottom line is that not everyone will necessarily agree with all the conclusions of Paul’s paper on underground dilution. However it does raise many issues for technical consideration on your project.

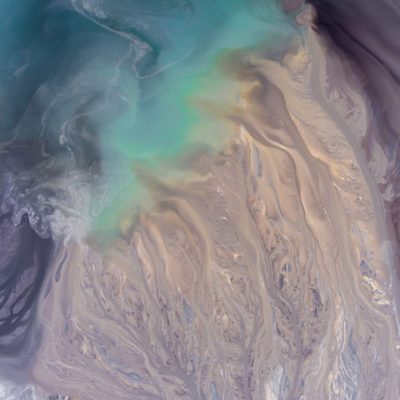

From 1997 to 2000 I was involved in the feasibility study and initial engineering for the Diavik open pit mine in the Northwest Territories. As you can see from the photo on the right, groundwater inflows were going to be a potential mining issue.

From 1997 to 2000 I was involved in the feasibility study and initial engineering for the Diavik open pit mine in the Northwest Territories. As you can see from the photo on the right, groundwater inflows were going to be a potential mining issue.

Groundwater modelling of a fractured rock mass is different than modelling a homogeneous aquifer, like sand or gravel. Discrete structures in the rock mass will be the controlling factor on seepage rates yet such structures can be difficult to detect beforehand.

Groundwater modelling of a fractured rock mass is different than modelling a homogeneous aquifer, like sand or gravel. Discrete structures in the rock mass will be the controlling factor on seepage rates yet such structures can be difficult to detect beforehand. The 2000 paper describes the field investigations, the 1999 modeling assumptions, and results. You can download that

The 2000 paper describes the field investigations, the 1999 modeling assumptions, and results. You can download that

Its the right thing to do

Its the right thing to do The company gets a chance to learn about potential employees and also gets productive service from them.

The company gets a chance to learn about potential employees and also gets productive service from them.