Access to a fresh water supply and a power supply are issues that must be addressed by many mining projects. Mining operations may be in competition with local water users for the available clean water resources. In addition, the greenhouse gas emissions from mine site power plants are also an industry concern. If your project has both water and power supply issues and it is close to tidewater, then there might be a new solution available.

I recently attended a presentation for an oil & gas related technology that is now being introduced to the mining industry. It is an innovative approach that addresses both water and power issues at the same time.

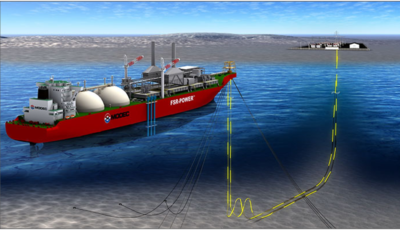

The technology consists of a floating LNG (liquefied natural gas) turbine power plant combined with high capacity seawater desalinization capabilities. MODEC is offering the FSRWP® (Floating Storage Regasification Water-Desalination & Power-Generation) system.

The technology consists of a floating LNG (liquefied natural gas) turbine power plant combined with high capacity seawater desalinization capabilities. MODEC is offering the FSRWP® (Floating Storage Regasification Water-Desalination & Power-Generation) system.

MODEC also has associated systems for power only (FSR-Power®) and water only (FSR-Water®)

FSRWP capabilities

The technology is geared towards large capacity operations that have access to tidewater. It provides many tangible and intangible operational and environmental benefits. It can:

-

Generate fresh water supply (10,000 – 600,000 m3 /day)

-

Generate electrical power (80 to 1000 MW) using LNG

-

Can provide power inland (>100 km) from a tidewater based floating power plant

-

Can provide natural gas distribution on land via on-board re-gasification systems

-

Has LNG storage capacity of 135,000 cu.m

-

Has a refueling autonomy of 20 to 150 days

-

Allows low cost marine delivery of bulk LNG supply

Procurement & Application

The equipment can be procured in several ways. For instance it can be contracted as an IPP (Independent Power Producer), purchased as an EPCI (Engineering, Procurement, Construction and Installation), BOO (Build, Own and Operate) or BOOT (Build, Own, Operate and Transfer).

Typically it takes 18-24 months of contract award to deliver to the project site, although temporary power solutions can be provided within 60-90 days.

From a green mining perspective, the FSRWP produces clean power with the highest thermal efficiency and lowest carbon foot-print.

From a green mining perspective, the FSRWP produces clean power with the highest thermal efficiency and lowest carbon foot-print.

See the table for a comparison of different power generation efficiencies and carbon emissions per kW.

Gas turbines are not new technology to MODEC. They currently own & operate 42 such generators, which can produce roughly 43 MW (each) in combined-cycle mode.

Mooring options

Currently there are three mooring options for the floating system that should fit most any tidewater situation.

Currently there are three mooring options for the floating system that should fit most any tidewater situation.

Jetty or Dolphin mooring is suitable for protected areas or near-shore applications where the water depth is in the range of 7 to 20 meters.

Tower Yoke mooring is ideal for relatively calm waters where the water depth is between 20 to 50 meters.

External Turret mooring is similar to a Tower-Yoke and is ideal for water depths exceeding 50 meters or where the seabed drops off steeply into the ocean.

Power transmission

Twenty years ago it was impractical to transmit AC power long-distances and subsea power cable technology was not as advanced as it is today. Hence an offshore power plant like a FSRWP was not technically viable. Due to R&D efforts over the last 15 years it is now possible to economically transmit AC. For example it is possible to transmit up to 100 MW over 100 miles through a single subsea cable. In addition, it is also viable to transit 200 MW at 145 kV from a vessel to shore.

Water treatment

Modern FSRWP’s use reverse osmosis membrane technology to produce industrial or potable water. This is similar to most conventional onshore desalination plants.

The main benefits of floating offshore desalination are increased overall thermal efficiency if both power and water production are combined on a single vessel. In addition, seawater sourced offshore and rejected brine discharged offshore minimizes risk to coastal marine life.

Conclusion

The bottom line is that if your mining project is near shore, and has both water supply and power issues, take a look at the FSRWP technology. One might say it is greener technology by using LNG (rather than coal, heavy fuel oil, or diesel) to generate power. At the same time it avoids competition with locals for access to fresh water.

The bottom line is that if your mining project is near shore, and has both water supply and power issues, take a look at the FSRWP technology. One might say it is greener technology by using LNG (rather than coal, heavy fuel oil, or diesel) to generate power. At the same time it avoids competition with locals for access to fresh water.

Each year business leaders are queried about what they view as their major risks. The survey results are summarized in the Global Risk Report.

Each year business leaders are queried about what they view as their major risks. The survey results are summarized in the Global Risk Report.

It is also interesting to look at the detailed 10 year table in the report to see how the risk perceptions have changed over the last decade.

It is also interesting to look at the detailed 10 year table in the report to see how the risk perceptions have changed over the last decade.

Mining companies are always on the hunt for new projects to grow their cashflows. They would all like to find the “perfect” project; one with ideal conditions and great attributes.

Mining companies are always on the hunt for new projects to grow their cashflows. They would all like to find the “perfect” project; one with ideal conditions and great attributes. Now take an honest look at some recent (or past) projects that you have been involved with. How many of the perfect attributes listed above would be represented? It would be surprising to see them all checked off. Unfortunately that means certain flaws (risks) must be accepted when developing a project.

Now take an honest look at some recent (or past) projects that you have been involved with. How many of the perfect attributes listed above would be represented? It would be surprising to see them all checked off. Unfortunately that means certain flaws (risks) must be accepted when developing a project. The bottom line is that management understandably have a difficult task in making go/no-go decisions. Financial institutions have similar dilemmas when deciding on whether or not to finance a project.

The bottom line is that management understandably have a difficult task in making go/no-go decisions. Financial institutions have similar dilemmas when deciding on whether or not to finance a project.

The study concluded that accessing potential deposits at depths of around 1000 m is economically feasible only if curved wells are used. The most relevant operational parameters are sufficient permeability in the ore zone and an adequate contact surface between the ore and leaching solution. The depth of the deposit is indirectly relevant, but more importantly the well installation cost per volume of deposit is critical. Hence curved wells are optimal.

The study concluded that accessing potential deposits at depths of around 1000 m is economically feasible only if curved wells are used. The most relevant operational parameters are sufficient permeability in the ore zone and an adequate contact surface between the ore and leaching solution. The depth of the deposit is indirectly relevant, but more importantly the well installation cost per volume of deposit is critical. Hence curved wells are optimal. I am also curious about the ability to finance such projects, given the caution associated with any novel technology. Many financiers prefer projects that rely on proven and conventional operating methods.

I am also curious about the ability to finance such projects, given the caution associated with any novel technology. Many financiers prefer projects that rely on proven and conventional operating methods.

At a booth at the 2019 PDAC I had a chance to speak with a publicly traded company called

At a booth at the 2019 PDAC I had a chance to speak with a publicly traded company called  The algorithm then examines the cell data to teach itself which attributes correlate to known mineralization and which attributes correlate with barren areas. It essentially determines a geological “signature” for each mineralization type. There could be millions of data points and combinations of attributes. Correlation patterns may be invisible to the naked eye, but not to the computer algorithm.

The algorithm then examines the cell data to teach itself which attributes correlate to known mineralization and which attributes correlate with barren areas. It essentially determines a geological “signature” for each mineralization type. There could be millions of data points and combinations of attributes. Correlation patterns may be invisible to the naked eye, but not to the computer algorithm. I was told that many in the geological community tend to discount the AI approach. Either they don’t think it will work or they are fearing for their jobs. Personally I don’t understand these fears nor can I really see how geologists can ever be eliminated. Someone still has to collect and prepare the data as well as ultimately make the final decision on the proposed targets. I don’t see the downside in using AI as another tool in the geologist’s toolbox.

I was told that many in the geological community tend to discount the AI approach. Either they don’t think it will work or they are fearing for their jobs. Personally I don’t understand these fears nor can I really see how geologists can ever be eliminated. Someone still has to collect and prepare the data as well as ultimately make the final decision on the proposed targets. I don’t see the downside in using AI as another tool in the geologist’s toolbox.

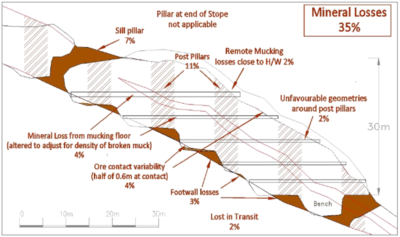

I am not going into detail on Paul’s paper, however some of my key takeaways are as follows. Download the paper to read the rationale behind these ideas.

I am not going into detail on Paul’s paper, however some of my key takeaways are as follows. Download the paper to read the rationale behind these ideas. The bottom line is that not everyone will necessarily agree with all the conclusions of Paul’s paper on underground dilution. However it does raise many issues for technical consideration on your project.

The bottom line is that not everyone will necessarily agree with all the conclusions of Paul’s paper on underground dilution. However it does raise many issues for technical consideration on your project.

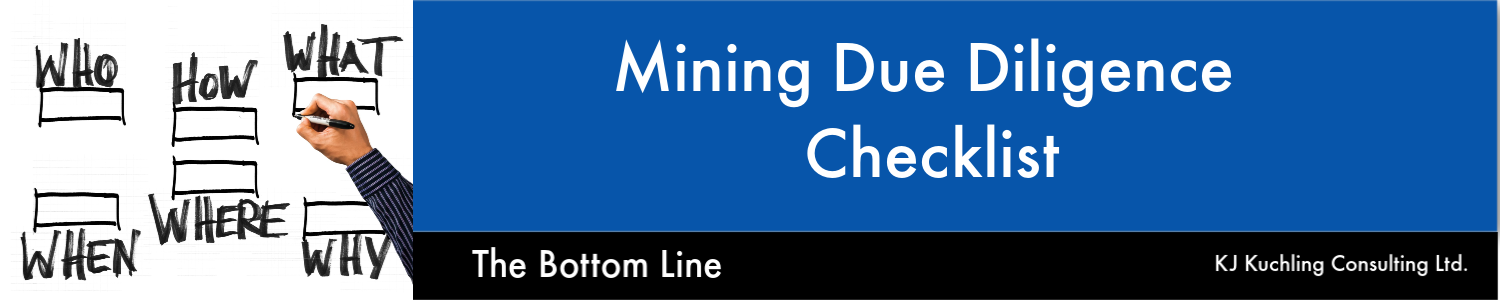

You a create your own checklist but if you would like a copy of mine just email me at KJKLTD@rogers.com and let me know a bit about how you plan to use it (for my own curiosity). Specify if you would prefer the Excel or PDF versions.

You a create your own checklist but if you would like a copy of mine just email me at KJKLTD@rogers.com and let me know a bit about how you plan to use it (for my own curiosity). Specify if you would prefer the Excel or PDF versions. Mining due diligence exercises can be interesting and great learning experiences, even for senior people that have seen it all. However they can also be mentally taxing due to the volumes of information that one must find, review, and comprehend, all in a short period of time.

Mining due diligence exercises can be interesting and great learning experiences, even for senior people that have seen it all. However they can also be mentally taxing due to the volumes of information that one must find, review, and comprehend, all in a short period of time.

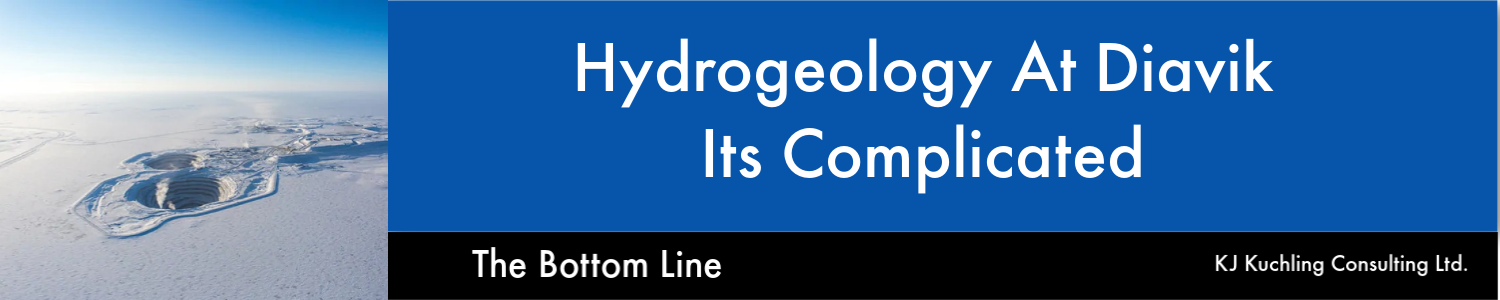

From 1997 to 2000 I was involved in the feasibility study and initial engineering for the Diavik open pit mine in the Northwest Territories. As you can see from the photo on the right, groundwater inflows were going to be a potential mining issue.

From 1997 to 2000 I was involved in the feasibility study and initial engineering for the Diavik open pit mine in the Northwest Territories. As you can see from the photo on the right, groundwater inflows were going to be a potential mining issue.

Groundwater modelling of a fractured rock mass is different than modelling a homogeneous aquifer, like sand or gravel. Discrete structures in the rock mass will be the controlling factor on seepage rates yet such structures can be difficult to detect beforehand.

Groundwater modelling of a fractured rock mass is different than modelling a homogeneous aquifer, like sand or gravel. Discrete structures in the rock mass will be the controlling factor on seepage rates yet such structures can be difficult to detect beforehand. The 2000 paper describes the field investigations, the 1999 modeling assumptions, and results. You can download that

The 2000 paper describes the field investigations, the 1999 modeling assumptions, and results. You can download that

I like the concept that Globex are promoting. I like the idea of having a one-stop shop that acquires and options out exploration properties to mining companies looking for new projects.

I like the concept that Globex are promoting. I like the idea of having a one-stop shop that acquires and options out exploration properties to mining companies looking for new projects.