Over the years I have been involved in numerous mining tradeoff studies. These could involve throughput rate selection, site selection, processing options, tailings disposal methods, and equipment sizing. These are all relatively straightforward analyses. However, in my view, one of the more technically interesting tradeoffs is the optimization of the open pit to underground crossover point.

The majority of mining projects tend to consist of either open pit only or underground only operations. However there are instances where the orebody is such that eventually the mine must transition from open pit to underground. Open pit stripping ratios can reach uneconomic levels hence the need for the change in direction.

The majority of mining projects tend to consist of either open pit only or underground only operations. However there are instances where the orebody is such that eventually the mine must transition from open pit to underground. Open pit stripping ratios can reach uneconomic levels hence the need for the change in direction.

The evaluation of the cross-over point is interesting because one is essentially trying to fit two different mining projects together.

Transitioning isn’t easy

There are several reasons why open pit and underground can be considered as two different projects within the same project.

There are several reasons why open pit and underground can be considered as two different projects within the same project.

There is a tug of war between conflicting factors that can pull the cross-over point in one direction or the other. The following discussion will describe some of these factors.

The operating cut-off grade in an open pit mine (e.g. ~0.5 g/t Au) will be lower than that for the underground mine (~2-3 g/t Au). Hence the mineable ore zone configuration and continuity can be different for each. The mined head grades will be different, as well as the dilution and ore loss assumptions. The ore that the process plant will see can differ significantly between the two.

When ore tonnes are reallocated from open pit to underground, one will normally see an increased head grade, increased mining cost, and possibly a reduction in total metal recovered. How much these factors change for the reallocated ore will impact on the economics of the overall project and the decision being made.

A process plant designed for an open pit project may be too large for the subsequent underground project. For example a “small” 5,000 tpd open pit mill may have difficulty being kept at capacity by an underground mine. Ideally one would like to have some satellite open pits to help keep the plant at capacity. If these satellite deposits don’t exist, then a restricted plant throughput can occur. Perhaps there is a large ore stockpile created during the open pit phase that can be used to supplement underground ore feed. When in a restricted ore situation, it is possible to reduce plant operating hours or campaign the underground ore but that normally doesn’t help the overall economics.

Some investors (and companies) will view underground mines as having riskier tonnes from the perspective of defining mineable zones, dilution control, operating cost, and potential ore abandonment due to ground control issues. These risks must be considered when deciding whether to shift ore tonnes from the open pit to underground.

An underground mine that uses a backfilling method will be able to dispose of some tailings underground. Conversely moving towards a larger open pit will require a larger tailings pond, larger waste dumps and overall larger footprint. This helps make the case for underground mining, particularly where surface area is restricted or local communities are anti-open pit.

An underground mine that uses a backfilling method will be able to dispose of some tailings underground. Conversely moving towards a larger open pit will require a larger tailings pond, larger waste dumps and overall larger footprint. This helps make the case for underground mining, particularly where surface area is restricted or local communities are anti-open pit.

Another issue is whether the open pit and underground mines should operate sequentially or concurrently. There will need to be some degree of production overlap during the underground ramp up period. However the duration of this overlap is a subject of discussion. There are some safety issues in trying to mine beneath an operating open pit. Underground mine access could either be part way down the open pit or require an entirely separate access away from the pit.

Concurrent open pit and underground operations may impact upon the ability to backfill the open pit with either waste rock or tailings. Underground mining operations beneath a backfilled open pit may be a concern with respect to safety of the workers and ore lost in crown pillars used to separate the workings.

Open pit and underground operations will require different skill sets from the perspective of supervision, technical, and operations. Underground mining can be a highly specialized skill while open pit mining is similar to earthworks construction where skilled labour is more readily available globally. Do local people want to learn underground mining skills? Do management teams have the capability and desire to manage both these mining approaches at the same time?

Open pit and underground operations will require different skill sets from the perspective of supervision, technical, and operations. Underground mining can be a highly specialized skill while open pit mining is similar to earthworks construction where skilled labour is more readily available globally. Do local people want to learn underground mining skills? Do management teams have the capability and desire to manage both these mining approaches at the same time?

In some instances if the open pit is pushed deep, the amount of underground resource remaining beneath the pit is limited. This could make the economics of the capital investment for underground development look unfavorable, resulting in the possible loss of that ore. Perhaps had the open pit been kept shallower, the investment in underground infrastructure may have been justifiable, leading to more total life-of-mine ore recovery.

The timing of the cross-over will also create another significant capital investment period. By selecting a smaller this underground investment is seen earlier in the project life. This would recreate some of the financing and execution risks the project just went through. Conversely increasing the open pit size would delay the underground mine and defer this investment and its mining risk.

Conclusion

As you can see from the foregoing discussion, there are a multitude of factors playing off one another when examining the open pit to underground cross-over point. It can be like trying to mesh two different projects together.

As you can see from the foregoing discussion, there are a multitude of factors playing off one another when examining the open pit to underground cross-over point. It can be like trying to mesh two different projects together.

The general consensus seems to be to push the underground mine as far off into the future as possible. Maximize initial production based on the low risk open open pit before transitioning.

One way some groups will simplify the transition is to declare that the underground operation will be a block cave. That way they can maintain an open pit style low cutoff grade and high production rate. Unfortunately not many deposits are amenable to block caving. Extensive geotechnical investigations are required to determine if block caving is even applicable.

Optimization studies in general are often not well documented in 43-101 Technical Reports. In most mining studies some tradeoffs will have been done (or should have been done). There might be only brief mention of them in the 43-101 report. I don’t see a real problem with this since a Technical Report is to describe a project study, not provide all the technical data that went into it. The downside of not presenting these tradeoffs is that they cannot be scrutinized (without having data room access).

One of the features of any optimization study is that one never really knows if you got it wrong. Once the decision is made and the project moves forward, rarely will someone ever remember or question basic design decisions made years earlier. The project is now what it is.

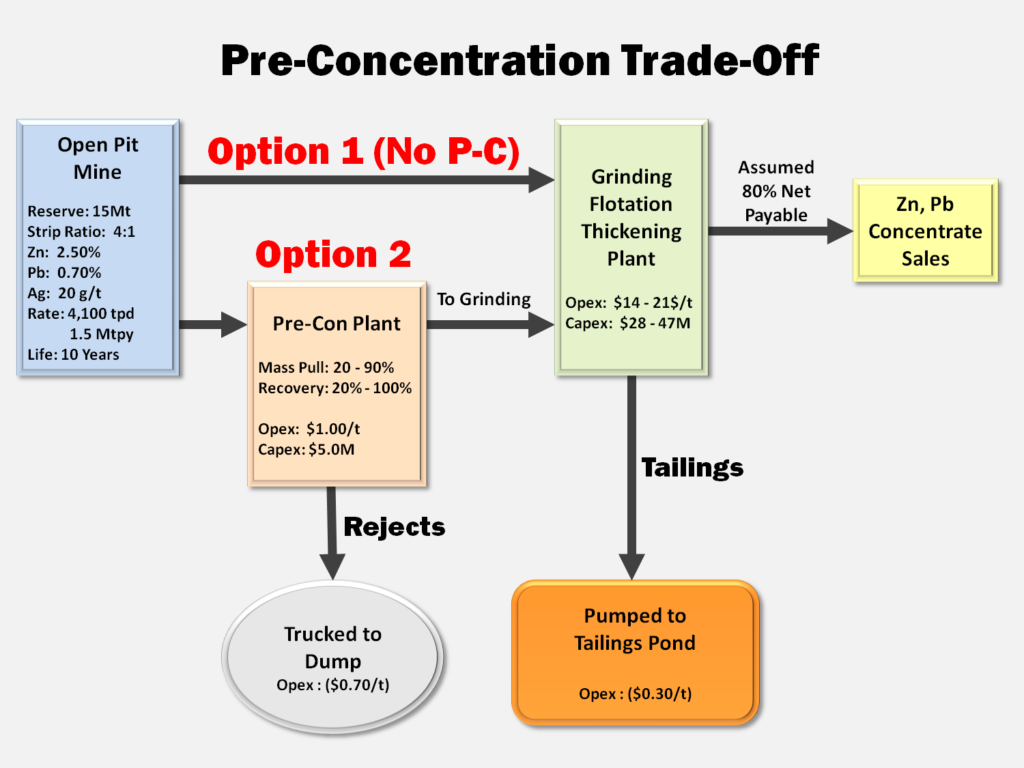

Concentrate handling systems may not differ much between model options since roughly the same amount of final concentrate is (hopefully) generated.

Concentrate handling systems may not differ much between model options since roughly the same amount of final concentrate is (hopefully) generated.

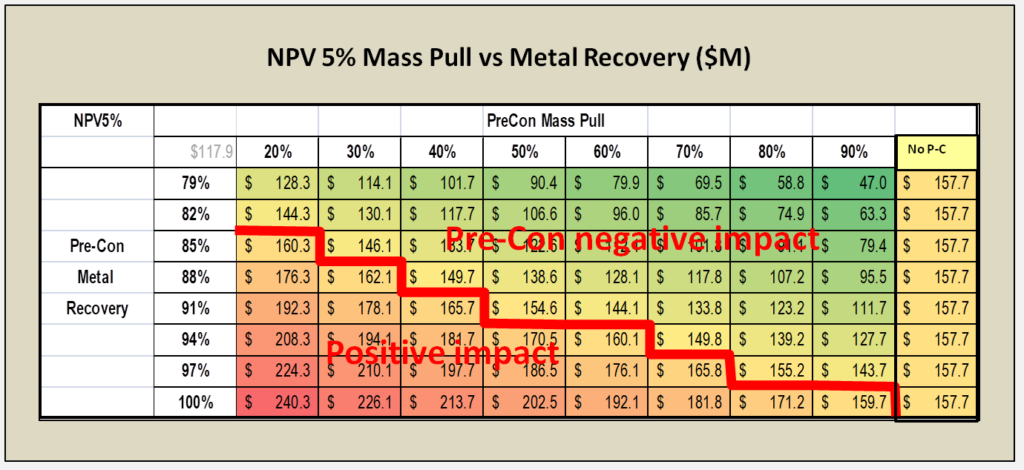

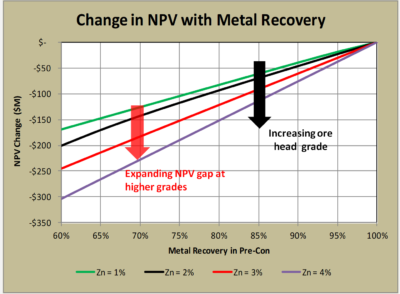

4. The head grade of the deposit also determines how economically risky pre-concentration might be. In higher grade ore bodies, the negative impact of any metal loss in pre-concentration may be offset by accepting higher cost for grinding (see chart on the right).

4. The head grade of the deposit also determines how economically risky pre-concentration might be. In higher grade ore bodies, the negative impact of any metal loss in pre-concentration may be offset by accepting higher cost for grinding (see chart on the right).

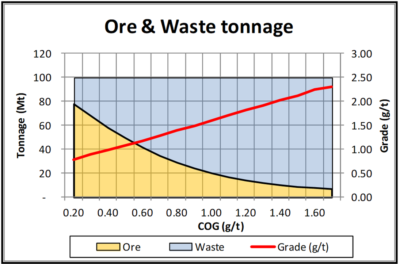

I had a grade tonnage curve, including the tonnes of ore and waste, for a designed pit. This data is shown graphically on the right. Essentially the mineable reserve is 62 Mt @ 0.94 g/t Pd with a strip ratio of 0.6 at a breakeven cutoff grade of 0.35 g/t. It’s a large tonnage, low strip ratio, and low grade deposit. The total pit tonnage is 100 Mt of combined ore and waste.

I had a grade tonnage curve, including the tonnes of ore and waste, for a designed pit. This data is shown graphically on the right. Essentially the mineable reserve is 62 Mt @ 0.94 g/t Pd with a strip ratio of 0.6 at a breakeven cutoff grade of 0.35 g/t. It’s a large tonnage, low strip ratio, and low grade deposit. The total pit tonnage is 100 Mt of combined ore and waste.

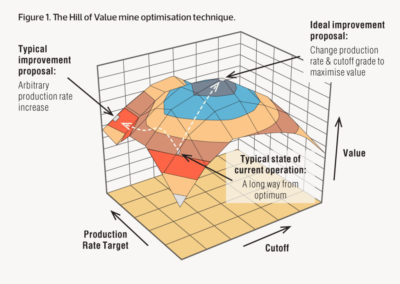

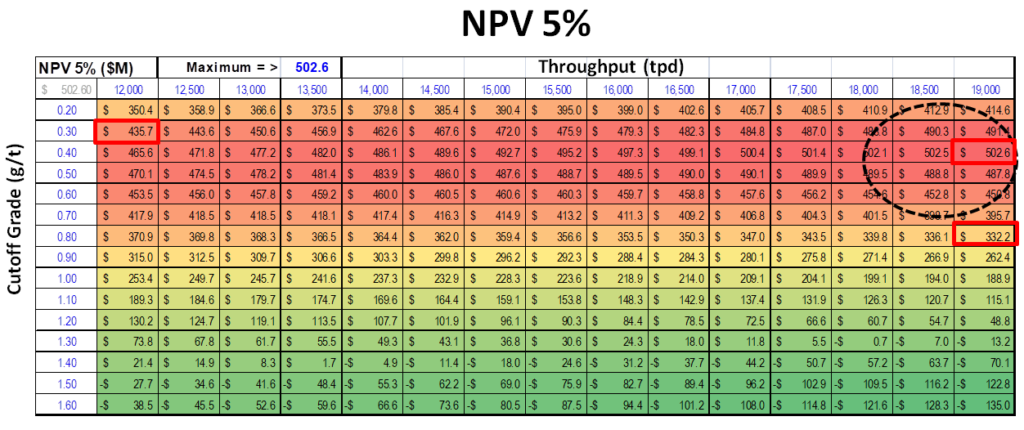

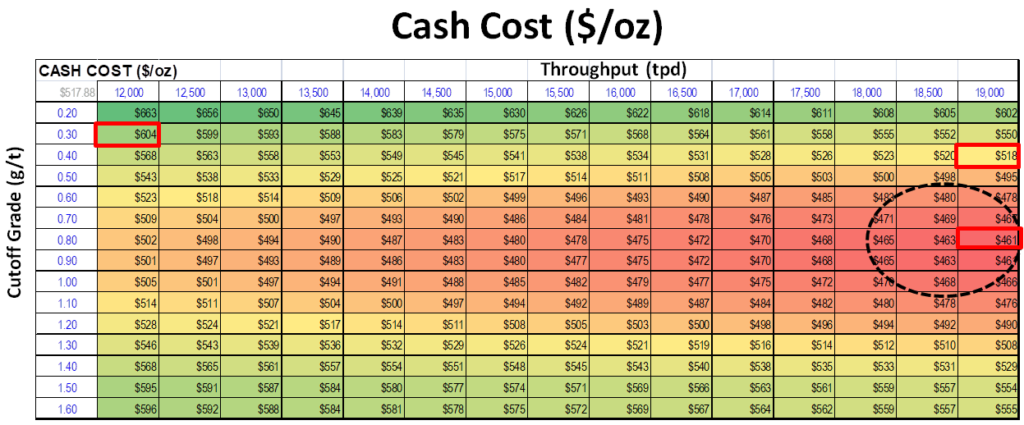

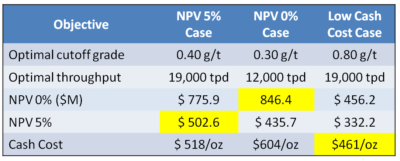

The Hill of Value is an interesting optimization concept to apply to a project. In the example I have provided, the optimal project varies depending on what the financial objective is. I don’t know if this would be the case with all projects, however I suspect so.

The Hill of Value is an interesting optimization concept to apply to a project. In the example I have provided, the optimal project varies depending on what the financial objective is. I don’t know if this would be the case with all projects, however I suspect so.

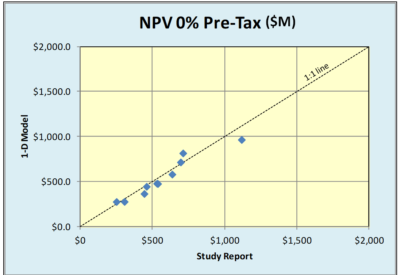

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model.

One of the questions I have been asked is how valid is the 1D approach compared to the standard 2D cashflow model. In order to examine that, I have randomly selected several recent 43-101 studies and plugged their reserve and cost parameters into the 1D model. There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

There is surprisingly good agreement on both the discounted and undiscounted cases. Even the before and after tax cases look reasonably close.

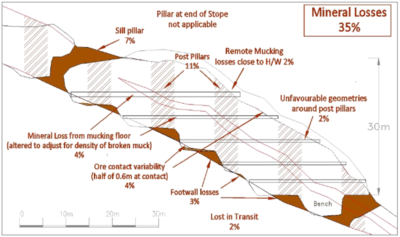

I am not going into detail on Paul’s paper, however some of my key takeaways are as follows. Download the paper to read the rationale behind these ideas.

I am not going into detail on Paul’s paper, however some of my key takeaways are as follows. Download the paper to read the rationale behind these ideas. The bottom line is that not everyone will necessarily agree with all the conclusions of Paul’s paper on underground dilution. However it does raise many issues for technical consideration on your project.

The bottom line is that not everyone will necessarily agree with all the conclusions of Paul’s paper on underground dilution. However it does raise many issues for technical consideration on your project.

From 1997 to 2000 I was involved in the feasibility study and initial engineering for the Diavik open pit mine in the Northwest Territories. As you can see from the photo on the right, groundwater inflows were going to be a potential mining issue.

From 1997 to 2000 I was involved in the feasibility study and initial engineering for the Diavik open pit mine in the Northwest Territories. As you can see from the photo on the right, groundwater inflows were going to be a potential mining issue.

Groundwater modelling of a fractured rock mass is different than modelling a homogeneous aquifer, like sand or gravel. Discrete structures in the rock mass will be the controlling factor on seepage rates yet such structures can be difficult to detect beforehand.

Groundwater modelling of a fractured rock mass is different than modelling a homogeneous aquifer, like sand or gravel. Discrete structures in the rock mass will be the controlling factor on seepage rates yet such structures can be difficult to detect beforehand. The 2000 paper describes the field investigations, the 1999 modeling assumptions, and results. You can download that

The 2000 paper describes the field investigations, the 1999 modeling assumptions, and results. You can download that

Tailings dam stability is so important that in some jurisdictions regulators may be requiring that mining companies have third party independent review boards or third party audits done on their tailings dams. The feeling is that, although a reputable consultant may be doing the dam design, there is still a need for some outside oversight.

Tailings dam stability is so important that in some jurisdictions regulators may be requiring that mining companies have third party independent review boards or third party audits done on their tailings dams. The feeling is that, although a reputable consultant may be doing the dam design, there is still a need for some outside oversight. Nowadays most small companies do not develop their own in-house resource estimates. The task is generally awarded to an independent QP.

Nowadays most small companies do not develop their own in-house resource estimates. The task is generally awarded to an independent QP.

One downside to a third party review is the added cost to the owner.

One downside to a third party review is the added cost to the owner.