Mine through mill reconciliation, in my view, is an under appreciated topic that could benefit from more conversation amongst industry members. Unfortunately, reconciliation is sometimes viewed as a time consuming frustrating activity, with what some consider less than verifiable results. However given the ongoing innovation that we are seeing in mining, reconciliation may need to play a bigger role than ever.

The mining industry is implementing more and more technology in the mining cycle.

The mining industry is implementing more and more technology in the mining cycle.

For example, this can range from AI assisted resource modelling, down hole logging, blast movement tracking, GPS controlled dig limits, MineSense bucket grade tracking, load scanning, truck dispatch control, smart mining and edge computing, online grade analyzers, belt weightometers, drone surveying of stockpiles, and real time process controls.

Lots of different innovations are continually being adopted by the mining industry, contrary to what some may say.

The question is does all this innovation improve the overall performance of a mining operation, and if so, by how much? It can cost a lot of money to implement the new technology, is there a payoff?

One cannot answer those questions if one doesn’t undertake proper mine reconciliation. A concern might be that mining is innovating faster than the ability to assess the results of that innovation. To monitor it, you need to measure it.

What is Mine Reconciliation

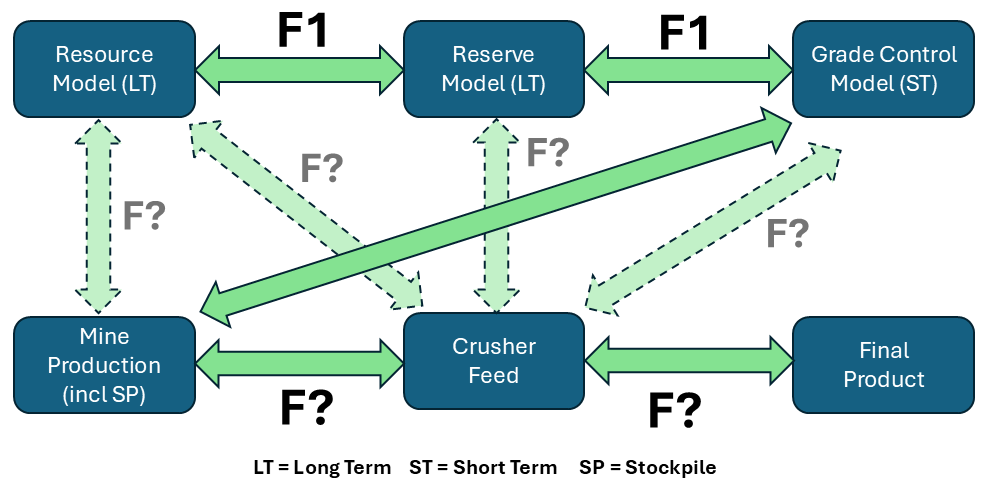

Mine reconciliation is the process of comparing and aligning the estimated production with the actual production from mining and processing. It requires assessing the accuracy of pre-mining predictions against actual results to identify inconsistencies in the system and hopefully improve it, be it resource estimation, mine planning, or process efficiency. Comparisons can be made between multiple stages in the mining system, as shown in the image below.

-

Mine reconciliation requires information such as initial predictions from exploration data and geological models, actual measurement: data from mining sources, such as blast holes, stockpile samples, or mill feed. As well it will need data on the final product being shipped off site. Do the metal quantities balance out throughout the mining operation?

Mine reconciliation requires information such as initial predictions from exploration data and geological models, actual measurement: data from mining sources, such as blast holes, stockpile samples, or mill feed. As well it will need data on the final product being shipped off site. Do the metal quantities balance out throughout the mining operation? -

Mine reconciliation tends to aggregate over longer time periods (monthly, quarterly or annually) due to short term impacts of material handling in stockpiles and plant circuits and the labour time needed to collect the input data.

-

Mine reconciliation ultimately attempts to assess how well the delivery of the final metal product relates to the initial resource model (i.e. what the project decision was originally based on)? It is also tool to evaluate the impact of any innovation implementation on the operation.

-

Reconciliation will help mine operators highlight issues and optimize extraction, manage costs, and ensure compliance with regulatory or investor expectations. Factors such as poor resource estimation, excessive dilution and ore loss, inaccurate sampling, etc. can cause discrepancies, making reconciliation an important part of any operation.

-

The reconciliation process is also used to derive Mine Call Factors. These factors are used to modify the forecasts from long range models, short range models, and grade control models to better represent the actual performance the operation will likely see. Large call factors suggest something is amiss in the “forecast to actual” progression. The first problem is to identify the causes. The list of the common sources of error can be lengthy. Then, once identified, the second problem is how to fix them.

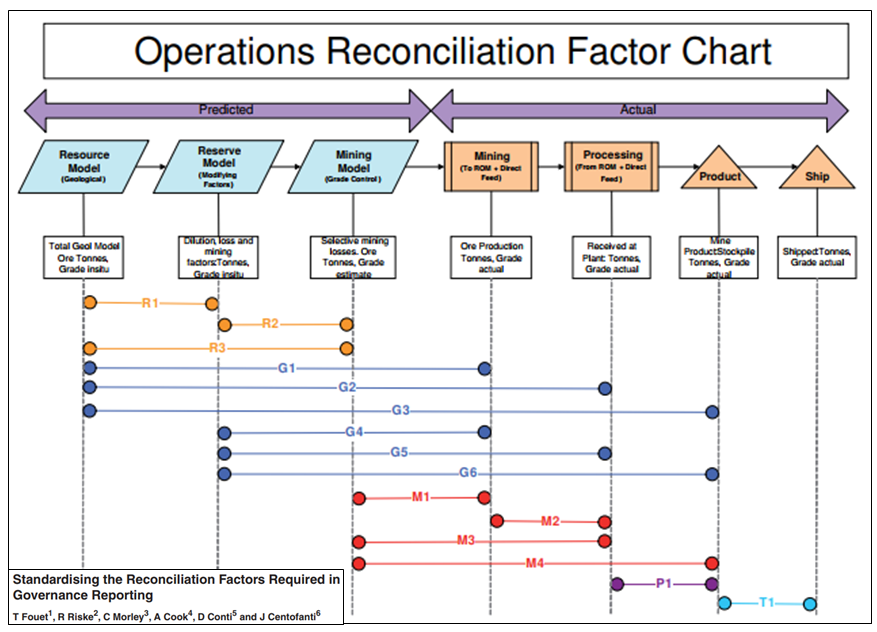

Harry Parker initially suggested various reconciliation parametrics and labelled them F1, F2, F3. In a 2009 paper by Fouet titled “Standardising the Reconciliation Factors Required in Governance Reporting”, indicates that Rio Tinto had decided upon fifteen (15) different possible reconciliation correlations (see image below). Each one provides an insight on the efficiency of the operation in one way or another. I have seen modified versions of the reconciliation relationships, so it appears there may be no industry standard at this time. Fouet was asking about industry standardization in 2009 (an excellent paper to read by the way).

Mining Codes Getting Involved

It appears that the JORC Code may be recognizing the importance of reconciliation. In an August 2024 Exposure Draft JORC is suggesting the following text: “Where an Ore Reserve has been publicly reported for an operating mine, the results of both production reconciliation and any prior estimate comparison must also be included in the annual Mineral Resources and Ore Reserves statement. Refer to Clause 2.36. The relationships and variables being reconciled must be described in plain language or depicted graphically and must include reconciliations of both the Mineral Resources and Ore Reserves.”

Interestingly, it appears that NI43-101 has not yet jumped on the bandwagon about the importance of disclosing reconciliation results. However, it may just be a matter of time before it becomes one of their disclosure requirements.

If more regulatory focus will be put on mine reconciliation disclosure, then perhaps more industry standardization is warranted. This would help better define some of the terminology and “F factors” shown in the diagrams above to ensure consistency and help avoid each mine doing reconciliation in their own way.

Excel versus Cloud Based Reconciliation

Each mine site may be unique with respect to; ore sources; terminology; ore types; mining methods; stockpiling philosophy; processing methods; technology availability; and personnel capability. So often the easiest approach for mine reconciliation is based on the Excel spreadsheet. (Reconciliation is generally not an easy undertaking).

Each mine site may be unique with respect to; ore sources; terminology; ore types; mining methods; stockpiling philosophy; processing methods; technology availability; and personnel capability. So often the easiest approach for mine reconciliation is based on the Excel spreadsheet. (Reconciliation is generally not an easy undertaking).

Spreadsheets can be built site specific, based on an operation’s unique characteristics.

Spreadsheets are often built by a user for that user. They are tailored for the tailor. In my experience, typically the modeler is the only one comfortable with an Excel model’s logic, since all of us may think differently. Unfortunately, with the spreadsheet approach, it becomes more difficult to standardize an industry wide reconciliation process.

An alternate solution to spreadsheets is to use a cloud based standardized software package. Toronto based Minebright has one option, called Pit Info (see link for more info). There are a few other reconciliation software applications available. They tend to be cloud based, hence multiple people can have access to the input modules or output modules. (I would like to thank the Minebright people for steering me towards some of the technical papers on this subject).

The cloud based approach may help make reconciliation a group effort instead of a tightly controlled internal function. It may also help standardize reporting from a company’s multiple operations, reporting from the mining industry globally, or simply for consistent JORC reporting.

The downside to the cloud approach is the mine site teams must learn the software and tailor it to their operation. However, once that hurdle is passed, personnel changes become less onerous due to the model consistency. I have seen cases where a person doing the Excel reconciliation task has left their job, and hence forward the reconciliation effort came to a halt. The people remaining may be too busy or simply don’t want to have to figure out the Excel logic of someone else.

The other nice thing about a cloud software approach is that when improvements are rolled out, every user gets the same update. The “wisdom of crowds” will result in learnings and suggestions that will tend to improve the application functionality over time. There are a lot of smart people out there, and it would be nice to see them working together rather than individually, as the open source software community has demonstrated.

With AI, we also may get to the point where cloud based mine reconciliation platforms can use learnings from other projects, and help identify where the likely technical shortfalls are at a mine site and why production is not reconciling. Let’s ask AI do some of the thinking for us to get to the bottom of a problem.

Conclusion

On YouTube, there are also a lot of educational videos related to mining. Some of the same audio podcast episodes are also available on the YouTube platform. Given an option, I prefer the audio-only podcast format over YouTube.

On YouTube, there are also a lot of educational videos related to mining. Some of the same audio podcast episodes are also available on the YouTube platform. Given an option, I prefer the audio-only podcast format over YouTube. Pick and choose. One can’t listen to all the podcast episodes available or else you wouldn’t have time to do anything else in life. You would also become bored since much of it can be repetitive.

Pick and choose. One can’t listen to all the podcast episodes available or else you wouldn’t have time to do anything else in life. You would also become bored since much of it can be repetitive. Mining Stock Education (680 episodes)

Mining Stock Education (680 episodes)  Fresh Thinking by Optiro-Snowden (53 episodes) This podcast is hosted by Snowdon – Optiro consultants. They typically focus on resource modelling and grade reconciliation aspects. The episodes are fairly short (15 mins), which is nice. Although I am not a resource modeller, I can always learn more about the black art of resource modelling.

Fresh Thinking by Optiro-Snowden (53 episodes) This podcast is hosted by Snowdon – Optiro consultants. They typically focus on resource modelling and grade reconciliation aspects. The episodes are fairly short (15 mins), which is nice. Although I am not a resource modeller, I can always learn more about the black art of resource modelling. To the best of my knowledge, there are a lack of podcasts related to mine engineering, for topics such as pit optimization, mine design, scheduling, equipment selection, and costing.

To the best of my knowledge, there are a lack of podcasts related to mine engineering, for topics such as pit optimization, mine design, scheduling, equipment selection, and costing. There is no shortage of material in the podcast world about the mining industry. It all depends on what interests you the most. There is even more mining information available on YouTube, if you have the time to sit and watch videos. Nevertheless the audio-only platform is great, although you don’t get to see the charts being discussed. That’s fine with me, particularly if they take a few seconds to describe the chart.

There is no shortage of material in the podcast world about the mining industry. It all depends on what interests you the most. There is even more mining information available on YouTube, if you have the time to sit and watch videos. Nevertheless the audio-only platform is great, although you don’t get to see the charts being discussed. That’s fine with me, particularly if they take a few seconds to describe the chart.

NPV One is targeting to replace the typical Excel based cashflow model with an online cloud model. It reminds me of personal income tax software, where one simply inputs the income and expense information, and then the software takes over doing all the calculations and outputting the result.

NPV One is targeting to replace the typical Excel based cashflow model with an online cloud model. It reminds me of personal income tax software, where one simply inputs the income and expense information, and then the software takes over doing all the calculations and outputting the result. Pros

Pros Like anything, nothing is perfect and NPV may have a few issues for me.

Like anything, nothing is perfect and NPV may have a few issues for me. The NPV One software is an option for those wishing to standardize or simplify their financial modelling.

The NPV One software is an option for those wishing to standardize or simplify their financial modelling.

This game is part of a coal-mining game trilogy created by Thomas Spitzer in Germany. The players take the role of farmers with opportunities to exploit the presence of coal in the Ruhr region of Germany. During the game, players acquire knowledge about coal, extend their farms, and dig deeper in the ground to extract more coal.

This game is part of a coal-mining game trilogy created by Thomas Spitzer in Germany. The players take the role of farmers with opportunities to exploit the presence of coal in the Ruhr region of Germany. During the game, players acquire knowledge about coal, extend their farms, and dig deeper in the ground to extract more coal. In the second game of Spitzer’s trilogy, you are still in the Ruhr region in the 18th century, at the beginning of the industrial revolution. The Ruhr river presented a transportation route from the coal mines. However, the Ruhr was filled with obstacles and large dams, making it incredibly difficult to navigate.

In the second game of Spitzer’s trilogy, you are still in the Ruhr region in the 18th century, at the beginning of the industrial revolution. The Ruhr river presented a transportation route from the coal mines. However, the Ruhr was filled with obstacles and large dams, making it incredibly difficult to navigate. This game may still be in German text only. Players are the administrator of a coal mine, and experience competition while living through a piece of Ruhr Valley history.

This game may still be in German text only. Players are the administrator of a coal mine, and experience competition while living through a piece of Ruhr Valley history. This game takes on a more negative view of the mining industry. It is described as “A bold take on the economics in the brutal industry that is asbestos.” The game players assume the role of a global asbestos company.

This game takes on a more negative view of the mining industry. It is described as “A bold take on the economics in the brutal industry that is asbestos.” The game players assume the role of a global asbestos company. In 1983 my brother, at the age of 10, got his Commodore 64 computer and was eagerly learning to program in BASIC. He was always looking for ideas on what he could write programs about. I had graduated from McGill in Mining Engineering a few years earlier, so I suggested he write a simple computer game about mining as his project.

In 1983 my brother, at the age of 10, got his Commodore 64 computer and was eagerly learning to program in BASIC. He was always looking for ideas on what he could write programs about. I had graduated from McGill in Mining Engineering a few years earlier, so I suggested he write a simple computer game about mining as his project. Over the last few months I decided to learn VBA (Visual Basic for Applications). VBA is a programming language the works with Microsoft Office products, mainly Excel.

Over the last few months I decided to learn VBA (Visual Basic for Applications). VBA is a programming language the works with Microsoft Office products, mainly Excel.

Mining has been a part of my life for as long as I can remember. Being born in Sudbury, many of my family members have been, or are currently involved, in mining through a variety of occupations, including my father who I idolized. However, I never knew my true interest in the industry until my 11th-grade technology class. I had a teacher who was passionate about the mining industry, and he created a project that involved developing a very basic mine design.

Mining has been a part of my life for as long as I can remember. Being born in Sudbury, many of my family members have been, or are currently involved, in mining through a variety of occupations, including my father who I idolized. However, I never knew my true interest in the industry until my 11th-grade technology class. I had a teacher who was passionate about the mining industry, and he created a project that involved developing a very basic mine design. Before my first year of university, I had a summer job tramming at Macassa Mine in Kirkland Lake Ontario, which has been in production since 1933. My mentality was to get the boots on the ground and get the job done, whatever it took (with proper safety precautions of course). Using rail systems, dumping ore cars manually, jackleg drilling, etc. gave me the perspective that mining was archaic, mining was rough, and mining was only about the ounces.

Before my first year of university, I had a summer job tramming at Macassa Mine in Kirkland Lake Ontario, which has been in production since 1933. My mentality was to get the boots on the ground and get the job done, whatever it took (with proper safety precautions of course). Using rail systems, dumping ore cars manually, jackleg drilling, etc. gave me the perspective that mining was archaic, mining was rough, and mining was only about the ounces. To change the negative view around mining, I believe the main focal point should be electric equipment and the ability for remote operation/work. With all this newly developed technology at our fingertips, I know that future operations will be safer and more sustainable, which should be better portrayed.

To change the negative view around mining, I believe the main focal point should be electric equipment and the ability for remote operation/work. With all this newly developed technology at our fingertips, I know that future operations will be safer and more sustainable, which should be better portrayed. Even creating a mining simulation video game where you can run through a story of being a manager, excavator/scoop operator, truck driver, etc. would get the thought of mining brought into the coming generations at a younger age. This would increase the talent pool from the more typical operator because more and more youth are getting skilled at remote operation through video games due to their increased screen time.

Even creating a mining simulation video game where you can run through a story of being a manager, excavator/scoop operator, truck driver, etc. would get the thought of mining brought into the coming generations at a younger age. This would increase the talent pool from the more typical operator because more and more youth are getting skilled at remote operation through video games due to their increased screen time. People get comfortable and people are afraid to leave home, so selling a career that allows for boundless flexibility in job tasks and constant stimulation while living wherever you desire could allow a shrinkage in the current technical gap.

People get comfortable and people are afraid to leave home, so selling a career that allows for boundless flexibility in job tasks and constant stimulation while living wherever you desire could allow a shrinkage in the current technical gap. So do I think the mining industry is archaic…. not anymore.

So do I think the mining industry is archaic…. not anymore. Firstly, I would like to thank this engineer for taking time to write out his well formed thoughts, and for allowing me to share them.

Firstly, I would like to thank this engineer for taking time to write out his well formed thoughts, and for allowing me to share them.

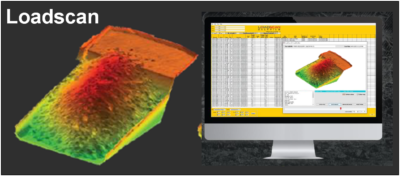

Loadscan has been around for a few years, but I only became aware of it recently. It is a technology that allows the rapid assessment of the load being carried in truck. It does not rely on the use of load cells or weigh scales to measure the payload.

Loadscan has been around for a few years, but I only became aware of it recently. It is a technology that allows the rapid assessment of the load being carried in truck. It does not rely on the use of load cells or weigh scales to measure the payload. What is interesting about this technology is that it is simple to install in an operation. It does not require retrofitting of a truck.

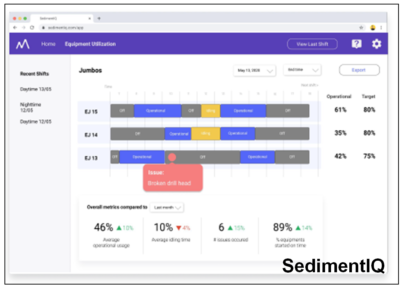

What is interesting about this technology is that it is simple to install in an operation. It does not require retrofitting of a truck. SedimentIQ is a new smartphone vehicle tracking platform that is trying to establish itself. Their proposed technology makes use of a phone’s built-in GPS, Bluetooth, and accelerometer to track vehicle operation. The phone’s sensor can measure vibrations produced by an operating truck or loader.

SedimentIQ is a new smartphone vehicle tracking platform that is trying to establish itself. Their proposed technology makes use of a phone’s built-in GPS, Bluetooth, and accelerometer to track vehicle operation. The phone’s sensor can measure vibrations produced by an operating truck or loader. The SedimentIQ software will aggregate the cycle time and delay information and upload it in real time to a cloud based database. A web-based dashboard allows anyone with access to view the real time production data graphically or export it to Excel.

The SedimentIQ software will aggregate the cycle time and delay information and upload it in real time to a cloud based database. A web-based dashboard allows anyone with access to view the real time production data graphically or export it to Excel.

I was at the 2019 Progressive Mine Forum in Toronto and a presentation was given on underground compressed air storage. The company was Hydrostor (

I was at the 2019 Progressive Mine Forum in Toronto and a presentation was given on underground compressed air storage. The company was Hydrostor (

Converting an abandoned mine into a power storage facility will still have its challenges. Cost and economic uncertainty are part of that. In addition, permitting such a facility will still require some environmental study.

Converting an abandoned mine into a power storage facility will still have its challenges. Cost and economic uncertainty are part of that. In addition, permitting such a facility will still require some environmental study.

The mining industry will see positive impacts from digitalization. Unfortunately more reliance on technology also brings with it significant risks. These risks are related to cyber security.

The mining industry will see positive impacts from digitalization. Unfortunately more reliance on technology also brings with it significant risks. These risks are related to cyber security. As your mining company continues to move into the digital world, you must ask:

As your mining company continues to move into the digital world, you must ask: The bottom line is that there is no stopping the digitalization of the mining industry. It is here whether anybody likes it or not. At the same time, there is likely no stopping the growth of cyber crime.

The bottom line is that there is no stopping the digitalization of the mining industry. It is here whether anybody likes it or not. At the same time, there is likely no stopping the growth of cyber crime.