Update: This blog was initially written in May 2015, however not much as changed to the end of 2018.

Let me say the obvious; the state of the junior mining market is not great these days. The number of financings is down and it seems there are a lot of companies struggling to get their piece of the financing pie. People mention to me that there actually is a fair bit of private equity funding available but only for the right projects.

I have heard from geologist colleagues that financing grass-roots exploration is still extremely difficult. That is unless company management has had past successes or is well connected to the money scene.

I have heard from geologist colleagues that financing grass-roots exploration is still extremely difficult. That is unless company management has had past successes or is well connected to the money scene.

I’m told that 43-101 resource estimates alone no longer generate much excitement. For projects to be “on the radar” they need to be advanced to at least the PEA stage. It seems that investors want some vision of what the project might eventually look like.

I have be made aware of more junior mining companies that are struggling for cash while others seemed to have no problem in getting at least some funding to continue their operations. To me, the biggest differences between these two situations are;

-

If there is top notch management in place,

-

The type of project they had,

-

If their path forward and development plan made sense.

You don’t want to always change management

Management is what it is. Companies attempt to bring on experienced people to the executive level or to the Board level. Experienced management can hopefully establish if their project will have a high probability of success or if the project is going to be a hard sell. This will provide guidance on whether to continue spending money on the project or look for a new project.

From my experience in undertaking due diligence, when a company is looking for financing it is important that management have the capability to present an orderly, practical, and realistic path forward. It is important to demonstrate where they will spend the money.

I have participated in due diligence meetings listening to management teams explain that they will have a resource estimate this year and be in production in two years. Those around the table glance at one another, knowing that they will be lucky to have a feasibility study completed by that time and even more lucky to have their environmental permits in place. This makes investors nervous.

Keep plans realistic and achievable

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

Gather your team around their computers and fire up screen sharing software like Teams, GoToMeeting, Skype, or Zoom. Give control of the mouse to someone who knows the site well. Here are some of the things you can do on your group tour.

Gather your team around their computers and fire up screen sharing software like Teams, GoToMeeting, Skype, or Zoom. Give control of the mouse to someone who knows the site well. Here are some of the things you can do on your group tour.

In my personal experience I find that larger consultants are best suited for managing the large scale feasibility studies. This isn’t because they necessarily provide better technical expertise. Its because they generally have the internal project management and costing systems to manage the complexities of such larger studies.

In my personal experience I find that larger consultants are best suited for managing the large scale feasibility studies. This isn’t because they necessarily provide better technical expertise. Its because they generally have the internal project management and costing systems to manage the complexities of such larger studies. For certain aspects of a feasibility study, one may get better technical expertise by subcontracting to smaller highly specialized engineering firms. However too much subcontracting may become an onerous task. Often the larger firms may be better positioned to do this.

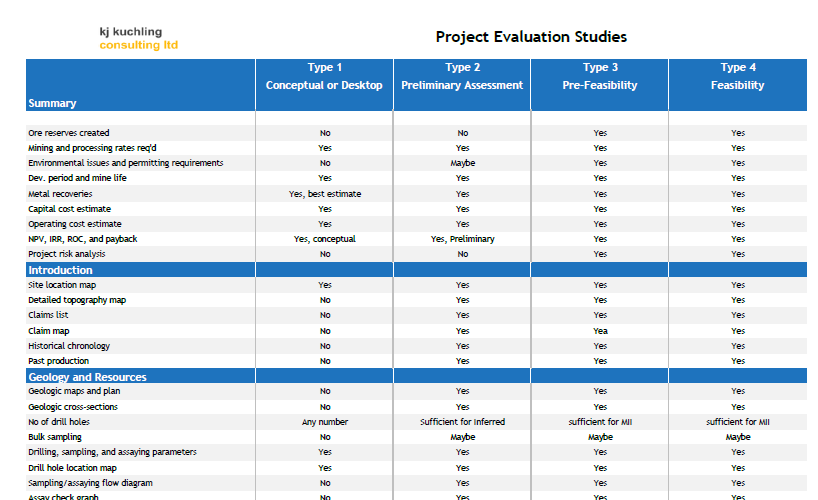

For certain aspects of a feasibility study, one may get better technical expertise by subcontracting to smaller highly specialized engineering firms. However too much subcontracting may become an onerous task. Often the larger firms may be better positioned to do this. One of the purposes of an early stage study is to see if the project has economic merit and would therefore warrant further expenditures in the future. An early stage study is (hopefully) not used to defend a production decision. The objective of an early stage study is not necessarily to terminate a project (unless it is obviously highly uneconomic).

One of the purposes of an early stage study is to see if the project has economic merit and would therefore warrant further expenditures in the future. An early stage study is (hopefully) not used to defend a production decision. The objective of an early stage study is not necessarily to terminate a project (unless it is obviously highly uneconomic).

The bottom line is that it is important for the Study Manager and project Owner to ensure the entire technical team is on the same page and understands the type of information they are working with. The technical detail in the final study should be consistent throughout.

The bottom line is that it is important for the Study Manager and project Owner to ensure the entire technical team is on the same page and understands the type of information they are working with. The technical detail in the final study should be consistent throughout.

My recollection is that many years ago larger consulting firms would offer to do an entire study in-house. They would have the in-house team to cover almost the entire study. That approach seems to have changed and now the multi-company path is the norm.

My recollection is that many years ago larger consulting firms would offer to do an entire study in-house. They would have the in-house team to cover almost the entire study. That approach seems to have changed and now the multi-company path is the norm. The Study Manager must ensure that everyone understands what their deliverables are. Generally this is done using a “Responsibility Matrix”, but these can sometimes be too general.

The Study Manager must ensure that everyone understands what their deliverables are. Generally this is done using a “Responsibility Matrix”, but these can sometimes be too general.

Some PEA’s might be based on a large database of test work and site information while others may rely on very preliminary data and require design projections based on that data.

Some PEA’s might be based on a large database of test work and site information while others may rely on very preliminary data and require design projections based on that data. The securities commissions consider that the cautionary language an important component of the PEA Technical Report and may red-flag it if it’s not in all the right places. However this cautionary language is generally focused on the resource.

The securities commissions consider that the cautionary language an important component of the PEA Technical Report and may red-flag it if it’s not in all the right places. However this cautionary language is generally focused on the resource.

In my opinion the more advanced the study the more important the site visit becomes. However, given the cost, this requires that one maximizes the scope of the trip.

In my opinion the more advanced the study the more important the site visit becomes. However, given the cost, this requires that one maximizes the scope of the trip.