One of the first things we normally look at when examining a resource estimate is how much of the resource is classified as Measured or Indicated (“M+I”) compared to the Inferred tonnage. It is important to understand the uncertainty in the estimate and how much the Inferred proportion contributes. Having said that, I think we tend to focus less on the split between the Measured and Indicated tonnages.

Inferred resources have a role

We are all aware of the regulatory limitations imposed by Inferred resources in mining studies. They are speculative in nature and hence cannot be used in the economic models for pre-feasibility and feasibility studies. However Inferred resource can be used for production planing in a Preliminary Economic Assessment (“PEA”).

Inferred resources are so speculative that one cannot legally add them to the Measure and Indicated tonnages in a resource statement (although that is what everyone does). I don’t really understand the concern with a mineral resource statement if it includes a row that adds M+I tonnage with Inferred tonnes, as long as everything is transparent.

When a PEA mining schedule is developed, the three resource classifications can be combined into a single tonnage value. However in the resource statement the M+I+I cannot be totaled. A bit contradictory.

Are Measured resources important?

It appears to me that companies are more interested in what resource tonnage meets the M+I threshold but are not as concerned about the tonnage split between Measured and Indicated. It seems that M+I are largely being viewed the same. Since both Measured and Indicated resources can be used in a feasibility economic analysis, does it matter if the tonnage is 100% Measured (Proven) or 100% Indicated (Probable)?

The NI 43-101 and CIM guidelines provide definitions for Measured and Indicated resources but do not specify any different treatment like they do for the Inferred resources.

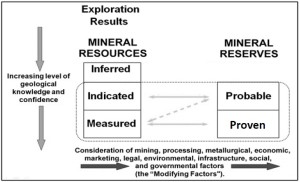

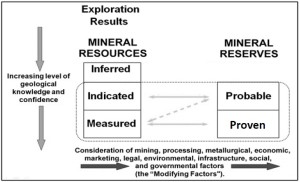

Relationship between Mineral Reserves and Mineral Resources (CIM Definition Standards).

Payback Period and Measured Resource

In my past experience with feasibility studies, some people applied a rule-of-thumb that the majority of the tonnage mined during the payback period must consist of Measure resource (i.e. Proven reserve).

The goal was to reduce project risk by ensuring the production tonnage providing the capital recovery is based on the resource with the highest certainty.

Generally I do not see this requirement used often, although I am not aware of what everyone is doing in every study. I realize there is a cost, and possibly a significant cost, to convert Indicated resource to Measured so there may be some hesitation in this approach. Hence it seems to be simpler for everyone to view the Measured and Indicated tonnages the same way.

Conclusion

NI 43-101 specifies how the Inferred resource can and cannot be utilized. Is it a matter of time before the regulators start specifying how Measured and Indicated resources must be used? There is some potential merit to this idea, however adding more regulation (and cost) to an already burdened industry would not be helpful.

Perhaps in the interest of transparency, feasibility studies should add two new rows to the bottom of the production schedule. These rows would show how the annual processing tonnages are split between Proven and Probable reserves. This enables one to can get a sense of the resource risk in the early years of the project. Given the mining software available today, it isn’t hard to provide this additional detail.

Note: If you would like to get notified when new blogs are posted, then sign up on the KJK mailing list on the website. Otherwise I post notices on LinkedIn, so follow me at: https://www.linkedin.com/in/kenkuchling/.

Tailings dam stability is so important that in some jurisdictions regulators may be requiring that mining companies have third party independent review boards or third party audits done on their tailings dams. The feeling is that, although a reputable consultant may be doing the dam design, there is still a need for some outside oversight.

Tailings dam stability is so important that in some jurisdictions regulators may be requiring that mining companies have third party independent review boards or third party audits done on their tailings dams. The feeling is that, although a reputable consultant may be doing the dam design, there is still a need for some outside oversight. Nowadays most small companies do not develop their own in-house resource estimates. The task is generally awarded to an independent QP.

Nowadays most small companies do not develop their own in-house resource estimates. The task is generally awarded to an independent QP.

One downside to a third party review is the added cost to the owner.

One downside to a third party review is the added cost to the owner.

Their corporate website states that they would pay, for a specified period of time, the claim fees/taxes related to existing mineral properties or related to the staking of new mineral properties.

Their corporate website states that they would pay, for a specified period of time, the claim fees/taxes related to existing mineral properties or related to the staking of new mineral properties.

The term Theory of Constraints may be common to some. However that concept is different than what is being discussed in the book. The TOC essentially relies on managing a constraint or eliminating it, and then addressing the next constraint in sequence.

The term Theory of Constraints may be common to some. However that concept is different than what is being discussed in the book. The TOC essentially relies on managing a constraint or eliminating it, and then addressing the next constraint in sequence.

One specific example that I have seen is related to the 2015 disposition of foreign resource assets by both Barrick and Ivanhoe to Zijin, a Chinese company. I don’t know much about Zijin, other than having heard Norway’s government directed its $790 billion oil fund to sell holdings in some companies because of their environmental performance. Zijin was one of these companies.

One specific example that I have seen is related to the 2015 disposition of foreign resource assets by both Barrick and Ivanhoe to Zijin, a Chinese company. I don’t know much about Zijin, other than having heard Norway’s government directed its $790 billion oil fund to sell holdings in some companies because of their environmental performance. Zijin was one of these companies. It will be interesting to see whether the idea of governments sanctioning the acceptability of acquirers in the mining industry will gain traction.

It will be interesting to see whether the idea of governments sanctioning the acceptability of acquirers in the mining industry will gain traction.

A failure cleanup fund

A failure cleanup fund

Changes in economic parameters would impact the original pit optimization used to define the pit upon which everything is based.

Changes in economic parameters would impact the original pit optimization used to define the pit upon which everything is based.

Once the optimization step is complete, mining engineers will then design the pit inside that shell, introducing benches and ramps. The pit design should mimic the selected optimized shell as closely as possible.

Once the optimization step is complete, mining engineers will then design the pit inside that shell, introducing benches and ramps. The pit design should mimic the selected optimized shell as closely as possible.

One can easily evaluate the potential impact of changing metal prices, changing recoveries, ore tonnages, operating costs, etc. to see what the economic or operational drivers are for this project. This can help you understand what you might need in order to make the project viable.

One can easily evaluate the potential impact of changing metal prices, changing recoveries, ore tonnages, operating costs, etc. to see what the economic or operational drivers are for this project. This can help you understand what you might need in order to make the project viable.

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.