As a mining engineer, I am not usually called in to review a project that is still at the exploration stage. This is normally the domain of the geologist. However from time to time I have an interest in better understanding the potential of an early stage mining project. This could be on behalf of a client, for investing purposes, or just for personal curiosity.

At the exploration stage one only has drill interval data from news releases to examine. A resource estimate may still be unavailable.

At the exploration stage one only has drill interval data from news releases to examine. A resource estimate may still be unavailable.

The drill data can consist of long intervals of low grade or short intervals of high grade and everything in between. What does it all mean and what can it tell you?

The following describes an approach I use for examining early stage gold deposits. The logic can be expanded to other metals but would take more effort.

My focus is on gold because it has been the predominant deposit of interest over the last few years, and it is simpler to analyze quickly.

We All Like Scatter Plots

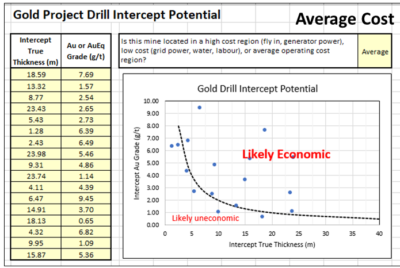

My approach relies on a scatter plot to visual examine the distribution of interval thicknesses and gold grades. Where these data points cluster or how they are distributed can provide some prediction on the overall economic potential of a project. Its not a guarantee, but only an indicator.

I try to group the analysis into potential open pit intervals (0 to 200 metres from surface) and potential underground (deeper than 200m) intervals. This is because a 20m wide interval grading 2.0 g/t is of economic interest when near surface, however of less interest if occurring at a 300m depth.

Using information from a news release, I create a two column Excel table of highlighted intervals and assay grades. The nice thing about using intervals is that the company has provided their view of the mineable widths.

Using information from a news release, I create a two column Excel table of highlighted intervals and assay grades. The nice thing about using intervals is that the company has provided their view of the mineable widths.

If one is provided with raw 1-metre assay data you would have to make that decision, which can be a significant task. The company has already helped make those decisions.

Normally I tend to use the highlighted sub-intervals and not the main intervals since issues with grade smoothing can occur.

A large interval containing multiple high grade sub-intervals may see some grade smoothing.This happens if the grade between sub-intervals is very low grade or even waste. It takes a fair bit of effort to assess this for each drill hole, hence it is easier to work with the sub-intervals.

I have an online calculator (Drill Intercept Calculator) that lets you assess if grade smoothing is occurring.

When inputting the interval thickness, I prefer to use the true thickness and not the interval length. If the assay information does not specify true thicknesses, then I simply multiple the interval length by 0.70 to try to accommodate some possible difference in width. Its all subjective.

The assays can consist of Au (g/t) or AuEq (g/t) if more metals are present. If very high grades are encountered (greater than 10 g/t) I simply input 9.9 g/t into the Excel table so they fit onto my scatter plot. Extremely high grades can be sporadic and localized anyhow.

Finally I need to decide whether the project is located in a region of high operating cost, low cost or about average costs. High costs could be with a fly in/ fly out, camp operation, with diesel power, and seasonal access.

A low cost operation could be in temperate climate, with good access to local infrastructure, water, labour, and grid power. An average operation would be somewhere in between the two. Its just a gut feel.

Results

The following charts describe how it works, using randomly generated dummy assay data in this example.

In the Average cost scenario (left chart) the points are equally scattered both above and below the Likely Economic line. As one moves to a high-cost situation (middle chart) the curve moves upwards and more drill intervals now fall below the economic line.

This would give me an unfavorable impression of the project. The third graph is the Low-Cost scenario and one can see that more assays are now above the line. Hence the same project located in a different region would yield a different economic impression.

The economic boundaries (dashed lines) presented in the plots are based on my personal experience and biases. Other people may have different criteria to define what they would view as economic and uneconomic intervals.

Conclusion

There is not much that a layperson person can do with the multitude of exploration data provided in corporate news releases. However, by aggregating the data one can get a sense of where a gold project positions itself economically. The more data points available, the more that one can gather from the plot.

One should prepare separate plots for shallow and deep mineralization or for different zones and deposits on a property rather than aggregate everything together.

It may be possible to undertake a similar analysis with different commodities if one can summarize the assays into a single equivalent value or NSR dollar value. Unfortunately, exploration news releases don’t often include the poly-metallic interval equivalent grade or NSR value. Calculating these manually would add an extra step in the process, however it can be done.

If you want to try out the concept, I have posted the online spreadsheet to my website at the link Drill Intercept Potential where you can input Au exploration data of interest. Unfortunately, you cannot save your input data so it’s a one time event. Anyone can do this – its not rocket science.

Let me know your thoughts, suggestions, or other ways to play with news release data.

If your project contains metals other than gold, then the rock (or ore) value will be based on the revenue from a combination of metals. How to approach this in discussed in another blog post titled “Ore Value Calculator – What’s My Ore Worth?“

Great Bear Resources Example

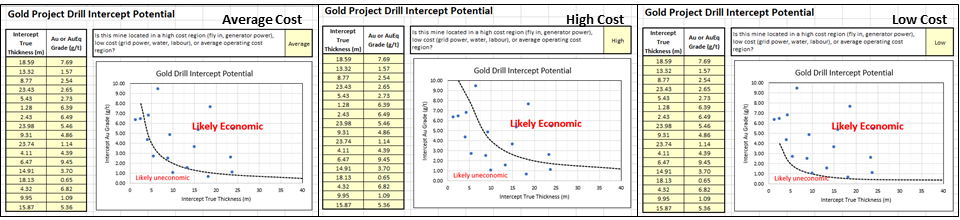

Interesting the Great Bear Resources website allows one to download a data file with all their exploration intervals. I have not seen another company provide this level of transparency. I download their data file of over 1300 intervals and sub-divided them into major intervals and sub-intervals (more ore less). The two plots below show the outcome.

The graph on the left is the sub-intervals showing that many points are above the “economic” line. There are numerous data points along the top axis, indicating many sub-intervals at >10 g/t at widths ranging from 1 to 15 metres. The graph on the right shows the major intervals. While there are still many along the top axis, there are now more along the 40m width but at grades ranging from 1 g.t to 6 g/t.

One would surmise from these plots that overall there are many intervals above the line in the economic zone, showing the potential of the project. It also shows that GBR have encountered many intervals likely sub-economic, but that’s the exploration game.

Great Bear Resources data