One of the interesting aspects of being an engineer in the mining industry is travelling around the globe (or even) around your own country. I have been to over a dozen countries as part of my career and this only makes me a small-time traveller compared to other engineers I know. Travelling and experiencing the world is often part of the job, whether working for a junior miner, a major, a financial house, a consulting firm, or an equipment vendor. It is actually quite difficult to avoid travel if you work in mining.

Diavik Project

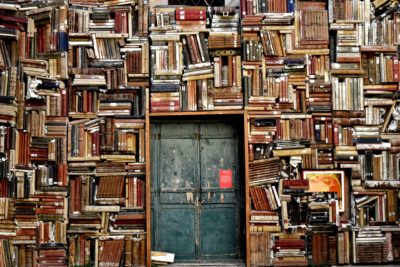

Recently a former colleague of mine on the Diavik Diamond Diavik project has published book that describes his life as an engineer. The book is titled Roseway: a Life of Adventure and is available on Amazon.

Its the story of John Wonnacott, a Canadian professional engineer who was involved in the construction of several projects, including the Diavik Diamond mine in Canada, a nickel smelter in China, a gold mine in Brazil, and a titanium mine in Madagascar to list a few.

John has a broad background, having conducted engineering studies in the jungles of Indonesia, the cold of Greenland, the sands of the desert, the heat of Australia, the altitude of the Andes. He has documented his engineering career in his new book.

Disclaimer: I have not yet read the book since it has only recently been published. However John has kindly sent me some excerpts that I have reprinted below to provide everyone with a sense for the content and style.

Some Excerpts

Introduction

At one time or another, I have been a professional paper-boy, forest worker, tree planter, market gardener, food processing equipment operator, lobster fisherman’s helper, commercial dragger deckhand, short-order cook, military engineering officer, computer system installer, greenhouse worker, permafrost researcher, marine oil spill cleanup specialist, pyrometallurgy researcher, garbage landfill operator, project manager, construction company general manager, regional director, open pit diamond miner, underground gold miner, corporate vice-president, design consultant, company owner, private corporation president and for 50 years, a damn good engineer. I have also been happily married to my wonderful wife Carole Anne for more than 52 years and we have 2 outstanding children. So I can add “husband”, “father” and “grandfather” to the list – but making lists like this is boring. Let me tell you my story.

Newfoundland

I remember in the late fall of that year, the company had a chance to bid on a larger project in Gros Morne National Park, Newfoundland. So our President, Frank Nolan (he was a brother to Fred Nolan, the infamous land-owner at Oak Island, by the way), decided he wanted to see the site and he chartered a Bell 106 helicopter to fly us there from Deer Lake. It was December (they say “December month” in that province) and when we got close to the Park, we ran into a sudden snow squall.

I remember in the late fall of that year, the company had a chance to bid on a larger project in Gros Morne National Park, Newfoundland. So our President, Frank Nolan (he was a brother to Fred Nolan, the infamous land-owner at Oak Island, by the way), decided he wanted to see the site and he chartered a Bell 106 helicopter to fly us there from Deer Lake. It was December (they say “December month” in that province) and when we got close to the Park, we ran into a sudden snow squall.

From bright sunny weather we were suddenly flying in heavy wet snow. I was sitting in the back of the chopper, with Frank sitting in the left front passenger seat. We were chatting with the pilot, via the radio headsets, when suddenly there was a loud “BEEP BEEP BEEP” sound coming from the front of the aircraft, and a number of the instrument lights started flashing. The engine had cut out – we learned later that wet snow had blocked the air intake and the engine had stalled – and we started descending pretty fast. Most people don’t realize that a helicopter will glide (quite steeply, at a glide angle of about 10 to 1) provided the pilot gets the torque off the rotor and he makes the correct feathering adjustments.

Our pilot did that instinctively and when we passed through the squall he calmly explained to us what was happening as he looked around for an open, flat spot to land. We didn’t have many options as we were flying over a densely wooded forest, with the mountains of Gros Morne and a deep fiord up ahead. But the pilot spotted a snow-covered frozen bog that was not a lot bigger than the helicopter and he put us down there as smoothly as if the engine hadn’t stopped. Maybe the deep snow cushioned our impact, because I felt nothing. But the instant we landed, Frank Nolan wrenched his door open, and he bolted out of the machine, straight ahead, in front of us.

The rotor was still spinning rapidly, and just as Frank ran ahead, the chopper settled further into the snow, tilting the machine forward in the process. With the chopper blades almost skimming the top of the snow, both the pilot and I expected Frank to be cut into pieces by the rotor, but he was just past their reach and he ran on, unaware of his narrow escape. When the spinning parts stopped, the pilot and I climbed out of the chopper to catch up with Frank. Examination of the machine showed us how the snow had plugged the air intake. The pilot cleared away the snow, and walked around the chopper once and then we took off again. We continued our aerial inspection of the National Park project and later that afternoon we flew back to Deer Lake.

Madagascar

The QMM field office In Port Dauphin, Madagascar was located near the edge of town, and I typically walked from my lodging to the office each morning when I was there, about the time when school started for the children. Typically I passed dozens and dozens of tiny bamboo huts with corrugated metal roofs, and dirt floors each about 2 meters square.

The QMM field office In Port Dauphin, Madagascar was located near the edge of town, and I typically walked from my lodging to the office each morning when I was there, about the time when school started for the children. Typically I passed dozens and dozens of tiny bamboo huts with corrugated metal roofs, and dirt floors each about 2 meters square.

I was constantly amazed by the flocks of young boys and girls walking to school – each child aged from 6 to 15 years old, I suppose – dressed in immaculate white shirt or blouse and blue shorts or skirts. I never saw a dirty child, and how they could have kept clean clothes while living in those small crude huts was something I never could figure out. Even more amazing, were the genuine, wide smiles and frequent greeting as we passed the children: “bonjour monsieur, bonjour monsieur”.

It brings tears to my eyes even now, thinking about those children. If they were girls, they could look forward to a life expectancy of 48 years, according to the town officials we talked to. If they were boys, they could expect to live to an age of only 40 years. The perils of fishing in the ocean in dugout canoes made life even harder for the men.

The next morning, we arrived at the Astana international airport, to find that the check-in arrangements were quite different from what we were used to. Instead of checking our luggage at a desk and then walking through Security to get to our departure gate, everyone was expected to wheel their luggage and handbags through security, as the airline check-in desks were located inside.

The mechanics of rustling our luggage weren’t difficult, but as I passed through the check-point, suddenly a strange-sounding alarm went off. As the alarm rang and rang, my mind raced – what did I have in my bag that would trigger the alarm, I wondered? It didn’t help that the Security guards only spoke Russian, and they were dressed in military uniforms with ridiculously large military caps, which made them look imposing (and silly). But what began to worry me more, was that the look on the Security guards’ faces was not the usual one that happens when a piece of metal sets off an alarm. The guards looked frightened and angry, at the same time.

Fortunately for us, the commotion caught the attention of the clerks at the Turkish Airlines desk inside the terminal building, and one English-speaking fellow approached, speaking to the security guards in Russian first, then saying to us: “I speak English, may I help”? Well, he helped, but it took a while, because it turned out that a rarely used hidden nuclear radiation detector had been triggered when I came through the gate, and the guards were concerned that I had some kind of radioactive material in my suitcase.

For a moment my mind went blank, and then I remembered a card that I was carrying in my wallet. I had had a bout of prostate cancer the previous fall, and my brachytherapy treatment had involved inserting over a hundred tiny radioactive pellets in and around my prostate – designed to kill the cancer. The pellets decay naturally in a fairly short time, and by now, 9 or 10 months after my operation, I would have bet that the radioactive material had all decayed to an undetectable level. But my doctor had given me a card to carry, which explained the medical procedure, just for circumstances like this. When I pulled out the card, it was like a “Get out of Jail Free Card” from the Monopoly game. Instantly the guards’ attitudes changed from fear and suspicion, to sympathy and smiles. One of the big fellows wheeled my luggage over to the Turkish Airlines desk where the Good Samaritan clerk reverted back to his normal job of checking us in.

**** end of excerpt ****

Conclusion

It is one thing to briefly visit a remote project as part of a review team. It is another thing to be there as part of a design team trying to solve a problem and engineer a solution. I know of many engineers and geologists that would have similar work life experiences as part of their careers. However John has taken the initiative to write it all down.

It is one thing to briefly visit a remote project as part of a review team. It is another thing to be there as part of a design team trying to solve a problem and engineer a solution. I know of many engineers and geologists that would have similar work life experiences as part of their careers. However John has taken the initiative to write it all down.

The tech start-up model is similar to the junior mining business model as it relates to early stage funding followed by additional financing rounds. One obvious difference is that mining mainly uses the public financing route (IPO’s) while the tech industry relies on private equity venture capital (VC’s).

The tech start-up model is similar to the junior mining business model as it relates to early stage funding followed by additional financing rounds. One obvious difference is that mining mainly uses the public financing route (IPO’s) while the tech industry relies on private equity venture capital (VC’s). My first experience with the tech industry was associated with the many after-hours networking meetings called “meetups”. They are held weeknights from 6 to 9 pm and consist of guest speakers, expert panels, and for general networking purposes. Often guest speakers will describe their learnings in starting new companies and failures they had along the way.

My first experience with the tech industry was associated with the many after-hours networking meetings called “meetups”. They are held weeknights from 6 to 9 pm and consist of guest speakers, expert panels, and for general networking purposes. Often guest speakers will describe their learnings in starting new companies and failures they had along the way. Most of the tech meetups are held in local tech offices. These offices are great. They have an open concept, pool tables, ping pong, video games, fully stocked kitchen. Who wouldn’t want to work there?

Most of the tech meetups are held in local tech offices. These offices are great. They have an open concept, pool tables, ping pong, video games, fully stocked kitchen. Who wouldn’t want to work there? In the late 1990’s I was working in the Diavik engineering office in Calgary. They provided a unique office layout whereby everyone had an “office” but no front wall on the office so you couldn’t shut yourself in. There were numerous map layout tables scattered throughout the office to purposely foster discussion among the team.

In the late 1990’s I was working in the Diavik engineering office in Calgary. They provided a unique office layout whereby everyone had an “office” but no front wall on the office so you couldn’t shut yourself in. There were numerous map layout tables scattered throughout the office to purposely foster discussion among the team.

So there likely is a significant network of experienced people out there. It’s just a matter of being able to tap into that network when someone needs specific expertise.

So there likely is a significant network of experienced people out there. It’s just a matter of being able to tap into that network when someone needs specific expertise.

The WBS can provide the following information to the team:

The WBS can provide the following information to the team: Typically a WBS is developed for pre-feasibility and feasibility mining studies but is often ignored at the PEA stage. Some feel it is too detailed for that level of study. I don’t feel this is the case.

Typically a WBS is developed for pre-feasibility and feasibility mining studies but is often ignored at the PEA stage. Some feel it is too detailed for that level of study. I don’t feel this is the case. The bottom line is that regardless of the level of study, a WBS should always be created.

The bottom line is that regardless of the level of study, a WBS should always be created.

There are numerous factors that will influence the successful completion of a study. They can be related to the quality of the technical team, the budget, the time window, and direction from the Owner. However the key factor that I observed is the competency of the Study Manager (or Project Manager).

There are numerous factors that will influence the successful completion of a study. They can be related to the quality of the technical team, the budget, the time window, and direction from the Owner. However the key factor that I observed is the competency of the Study Manager (or Project Manager). The Study Manager also needs to understand the objectives of the Owner and ensure the team is working towards those objectives.

The Study Manager also needs to understand the objectives of the Owner and ensure the team is working towards those objectives. Often the Environmental Impact Assessment is being conducted concurrently with an engineering study. The level of internal and external communication now becomes even more critical due to the large number of new technical disciplines involved.

Often the Environmental Impact Assessment is being conducted concurrently with an engineering study. The level of internal and external communication now becomes even more critical due to the large number of new technical disciplines involved. The bottom line is that when a project Owner has received proposals for a study and is in the process of awarding that job, the most important consideration is who will be the Study Manager. If possible meet or chat about how they will manage the study and what their experience is. Check references if possible.

The bottom line is that when a project Owner has received proposals for a study and is in the process of awarding that job, the most important consideration is who will be the Study Manager. If possible meet or chat about how they will manage the study and what their experience is. Check references if possible.

Data rooms are typically created for due diligence exercises, or during advanced an engineering stage. Regardless of the purpose, it is helpful for all involved to have a document control person who understands what is in the data room, what is important, and what is non-essential.

Data rooms are typically created for due diligence exercises, or during advanced an engineering stage. Regardless of the purpose, it is helpful for all involved to have a document control person who understands what is in the data room, what is important, and what is non-essential.

Independent consultants will differentiate themselves from large engineering firms in several ways.

Independent consultants will differentiate themselves from large engineering firms in several ways.

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

The bottom line is that in order for a project (and the management team) to get serious attention from potential investors is to make sure there is a realistic view of the project itself and have a realistic path forward.

In my personal experience I find that larger consultants are best suited for managing the large scale feasibility studies. This isn’t because they necessarily provide better technical expertise. Its because they generally have the internal project management and costing systems to manage the complexities of such larger studies.

In my personal experience I find that larger consultants are best suited for managing the large scale feasibility studies. This isn’t because they necessarily provide better technical expertise. Its because they generally have the internal project management and costing systems to manage the complexities of such larger studies. One of the purposes of an early stage study is to see if the project has economic merit and would therefore warrant further expenditures in the future. An early stage study is (hopefully) not used to defend a production decision. The objective of an early stage study is not necessarily to terminate a project (unless it is obviously highly uneconomic).

One of the purposes of an early stage study is to see if the project has economic merit and would therefore warrant further expenditures in the future. An early stage study is (hopefully) not used to defend a production decision. The objective of an early stage study is not necessarily to terminate a project (unless it is obviously highly uneconomic).

My recollection is that many years ago larger consulting firms would offer to do an entire study in-house. They would have the in-house team to cover almost the entire study. That approach seems to have changed and now the multi-company path is the norm.

My recollection is that many years ago larger consulting firms would offer to do an entire study in-house. They would have the in-house team to cover almost the entire study. That approach seems to have changed and now the multi-company path is the norm.